The global payments industry posted its first contraction in 11 years in 2020 but is poised to quickly return to its long-term growth trajectory, according to management consultant company McKinsey & Company's annual sector report.

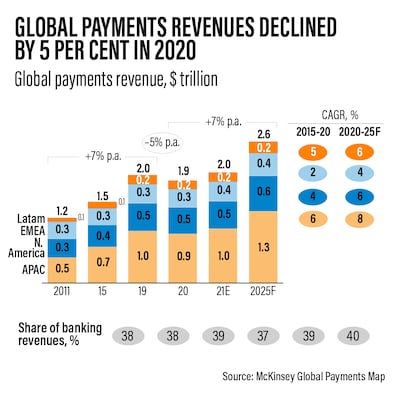

The sector's revenue fell 5 per cent annually last year to $1.9 trillion, as the pandemic-induced global economic slowdown weighed heavily on the industry.

However, 2020's losses will be recouped this year, bringing revenue back into the range of 2019's record high, McKinsey said in the report. Revenues are expected to hit about $2.5tn by 2025, helped by the digitisation of consumer and commercial transactions, it added.

"The relatively muted 2020 top-line numbers mask some important countervailing effects, however, which are poised to re-set the scale of opportunity for payments players for years to come. The pandemic accelerated ongoing declines in cash usage and adoption of electronic and e-commerce transaction methods," McKinsey said.

The global payments industry was among the sectors that witnessed fast-paced changes amid the pandemic, as consumers increasingly adopted digital platforms to shop, study and work online.

The digital shift created new opportunities for payments players. However, it is unclear which changes are permanent and which ones are likely to revert, at least partially, to prior trajectories as economies re-open, McKinsey said.

Nonetheless, continued cash displacement and the global economy's return to growth will be among the primary drivers accelerating the existing upward trends in electronic transactions, the consultancy said.

However, Interest margins are likely to remain muted and this will create a greater incentive for players in the payments sector to pursue new fee-driven revenue sources and to expand beyond their traditional focus areas.

Latin America posted the biggest decline in payments revenues, down 8 per cent. Meanwhile, the Asia-Pacific, North America and Europe, the Middle East and North Africa dropped 6 per cent, 5 per cent and 3 per cent, respectively.

The Asia-Pacific region – which has been the largest and fastest-growing payments region for the past several years – presents a major opportunity for service providers, McKinsey said. The region had a total revenue of $210 billion, about 35 per cent higher than Latin America's, and this is expected to grow further because of rapidly expanding business-to-business activities and an explosion in digital wallets.

The pandemic also significantly reduced the use of cash payments in Asia-Pacific, most notably in key markets such as Thailand and Indonesia. Although some transactions will return as storefronts reopen, a "solid majority" are likely to have permanently moved on to digital platforms.

"The pandemic has pushed businesses to reorient their payments operations and customer interactions. Small and medium-sized enterprises are increasingly aware of the payment solutions available to them and are motivated to encourage the use of those that best serve their needs and those of their customers," McKinsey said.

Stabilising the cryptocurrency market

Meanwhile, the rise of stablecoins, a type of cryptocurrency that attempts to offer price stability and are backed by a reserve asset such as gold, and central bank digital currencies, the online form of a particular country or region's fiat currency, is expected to provide some middle ground for the highly volatile cryptocurrency market. However, their co-existence and implementations are raising questions.

"Cryptocurrency has been touted for its potential to usher in a new era of financial inclusion and simplified financial services infrastructure globally. To date, however, its high profile has derived more from its status as a potential store of value than as a means of financial exchange," McKinsey said.

"That disconnect is now evolving rapidly, with both monetary authorities and private institutions issuing stabilised cryptocurrencies as viable, mainstream payments vehicles."

The price volatility of traditional cryptocurrencies – which has a market capitalisation of more than $2.34tn as of Sunday – have hindered their utility as a practical means of value exchange. Bitcoin, the biggest and most popular cryptocurrency, has a market capitalisation of about $1.04tn alone.

Stablecoins aim to address cryptocurrencies' shortcomings by pegging their value to a unit of an underlying asset. They are also often issued on faster blockchains and backed by state-issued tender such as the dollar, pound, euro and highly liquid reserves including government treasuries or commodities such as precious metals.

In the first half of 2021 alone, around $3tn in stablecoins were transacted, including in USD Coin and gold-backed Tether, which is currently the biggest stablecoin.

"Many see the current development of CBDCs as a response to the challenge private-sector stablecoins could pose to central bank prerogatives and as evidence of the desire of institutions to address long-term goals such as payment systems efficiency and financial inclusion," McKinsey said.

The most notable examples of CBDCs include China's digital yuan, which is in pilot phase, and the European Central Bank's digital euro project that is currently under development.

However, a number of major central banks – including the ECB – have said that government-backed digital currencies could take a major bite out of commercial deposits and jeopardise the industry’s funding.

The Bank for International Settlements has called for more adequate regulation to avoid issues such as fraud, noting that the market cap of stablecoins has more than doubled since the start of the pandemic.