Private sector activity in the UAE and Saudi Arabia remained robust last month, data released yesterday by HSBC showed.

However, the headline score eased from 55.4 points in February to 54.3 last month in the UAE in the bank's purchasing managers' index, which covers non-oil companies. A reading above the 50 mark represents an expansion in activity.

"I'm not concerned by the slight moderation in the headline score," said Simon Williams, the chief economist for the Middle East and North Africa at HSBC. "Output and new order growth are still robust and employment has continued to pick up, so far without generating any material inflationary pressures. 2013 continues to look like a good year for the UAE."

Output growth in the UAE eased from the previous month but remained above the series average. The rate of new order growth dipped for the third month in a row but remained solid, said HSBC. New export business rose for the 34th consecutive survey period but at the slowest pace since last July.

Workforce numbers rose in the Emirates for the 15th consecutive month in line with the series average. About 9 per cent of firms reported a rise in staff levels, compared to 3 per cent reporting a decline.

The survey also suggested fears of a pick-up in economic activity and a recovery in property prices leading to a rapid rise in inflation may be premature. It showed a fall in output prices last month from the previous month, despite modest gains in input prices.

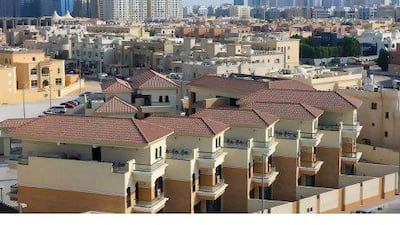

Economic activity has remained solid this year and is forecast by the IMF to reach 2.6 per cent. Apartment prices rose by an average 12 per cent in the UAE during the first three months of the year, according to data released this week by the property broker Asteco.

Rising public spending and an upturn in domestic financing helped underpin the momentum of Saudi Arabia's private sector last month. The headline index reached 59, its highest level since October 2012.

"All of the underlying scores are strong and rose month on month in March," wrote Mr Williams in a research note. "Output printed at 61, for example, while new orders gained more than a point to 68 - an exceptional level for a PMI score - boosted by an unexpectedly strong recovery in export orders."

The strength of the private sector in the UAE and Saudi Arabia, however, is in contrast to the troubles still afflicting Egypt's economy. The headline score of the country's PMI data was 45, suggesting the private sector slumped for a fourth month in a row. Output and new orders both dipped to 41, while cost pressures, reflected in output prices, jumped to 54.