Iran and Russia may look to strengthen strategic ties with a bartering arrangement of oil for goods as both countries seek to overcome sanctions imposed by the West.

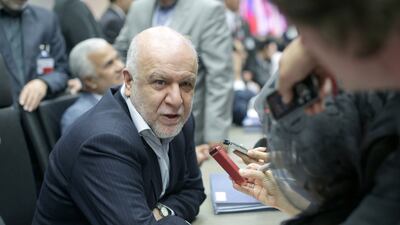

Iranian energy minister Bijan Namdar Zanganeh said Russia could start importing crude oil from Iran as early as next week.

“Much of this will be for cash and we will be using this money to buy commodities from the Russians,” he said on Friday.

Mr Zanganeh said Russia would buy fewer than 500,000 barrels a day (bpd) in exchange for cash that Iran would use to buy Russian goods such as steel, wheat and oil by-products.

Iran is hoping to reach a final accord with world powers by the end of this month to lift international economic sanctions. Mohsen Qamsari, director for international affairs at the National Iranian Oil Company, denies that Russia and Iran have reached such a deal, according to local Iranian media.

He said both sides were hoping to establish a joint fund that would house capital from Iranian crude sales. The money in the fund could be used for various purchases from suppliers around the world, not just Russian products.

A deal between Iran and Russia over Iranian crude had been discussed for a while, said Alexander Kornilov, an oil and gas analyst at Alpha Bank in Moscow.

“In terms of the scale of crude [that Russia would import], it is not a big deal as per the share on the market,” he said, adding that Iran was currently exporting 1 million bpd of crude oil and the deal with Russia would be for half of that amount.

However, the identity of the ultimate buyers of the Iranian crude remains unclear.

Mr Kornilov said Moscow had not announced how the arrangement would work. “If [the buyers] are Russian oil companies, perhaps Iranian pricing could be beneficial for some companies operating in Russia,” he said.

The decision of Russia, the second-largest oil-producing country, to buy crude oil from Iran was a strategic move, he said.

“It isn’t about crude, but a general scope of geopolitical factors where the two countries could collaborate down the road,” said Mr Kornilov.

US and European allies imposed sanctions on Russia after the country invaded eastern Ukraine to back separatist groups more than a year ago.

The effects of the sanctions on Russia have been mixed despite the high probability that the restrictions would be extended at the European Union summit held at the end of this month.

Russia's oil output remained at a post-Soviet high of 10.71 million bpd ahead of the Opec meeting in Vienna last week, according to data from Russia's energy ministry. Even so, Russian firms are suffering financially. The economic strains weighing on Rosneft, the oil company majority owned by the Russian government, have been attributed to the economic sanctions coupled with the slump in oil prices.

Last September, Rosneft said it would slash staff numbers and production, and re-evaluate its stakes in various fields.

“Since Russia is suffering from sanctions, the country is moving forward in search of partners in different parts of the world,” said Mr Kornilov.

In April, Russian officials said they were already sending grain, equipment and construction materials to Iran in the barter deal and that it was ready to supply an advanced S-300 anti-missile system to Tehran.

While trying to diversify its revenue sources, Russia last year signed a long-term gas deal with China said to be worth $400bn.

lgraves@thenational.ae

Follow The National's Business section on Twitter