What was the general market movement in Q1?

Like Dubai, Abu Dhabi has experienced a fall that has now been in motion for the past couple of years - and the first quarter was no different.

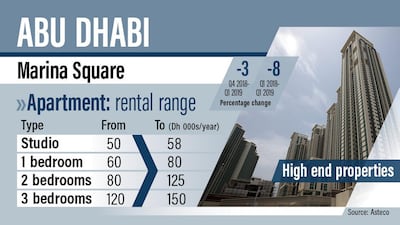

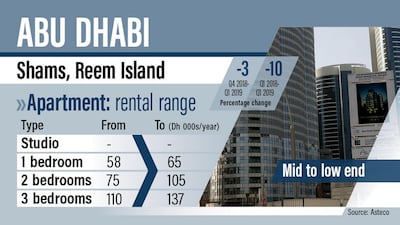

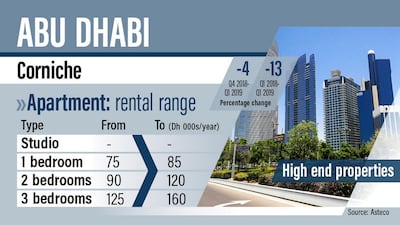

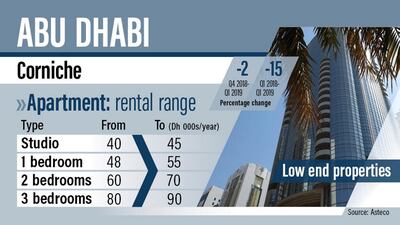

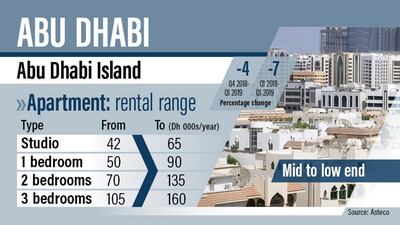

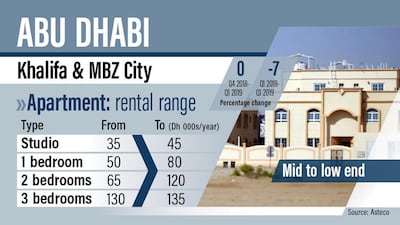

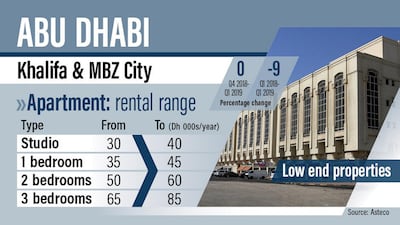

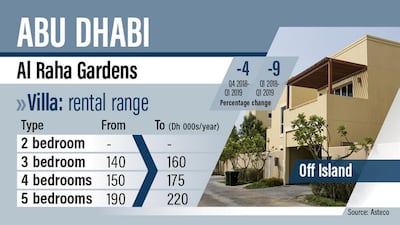

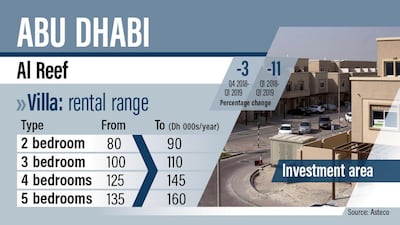

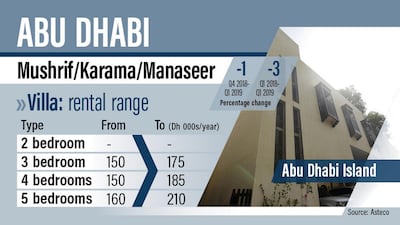

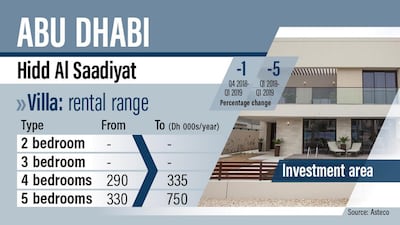

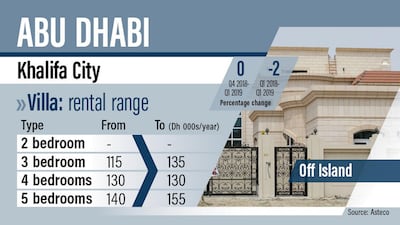

Apartment rents declined 2 per cent on average while villa rents were down 1 per cent, according to property services company Asteco, which noted that the declines were 7 per cent and 5 per cent, respectively, year-on-year.

JLL Mena said apartments were down 3 per cent quarter on quarter and 12 per cent year-on-year, while it reported villa rents fell 4 per cent in the first quarter and 17 per cent year on year.

The downward adjustment was backed up by Chestertons, which said apartments were down 3 per cent in the first quarter and villa rents dropped 2 per cent.

Completed projects included United Square in Khalidiya, Meera on Reem Island, Al Reef 2 and other buildings in Al Raha Beach, Rawdhat and the Danet area near Muroor Road.

What else did the property companies have to say?

The general gist was simple - new supply entered the market and demand was subdued making it very much a tenants' market.

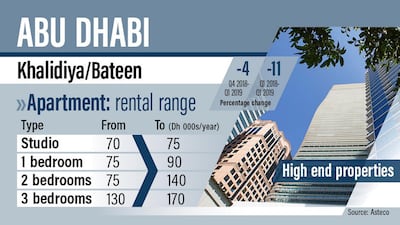

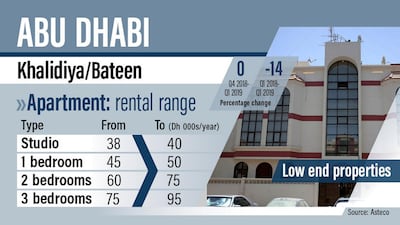

The bigger declines were seen in the older parts of the capital such as Khalidiya and Muroor, according to Chestertons, with a two-bedroom property in the former falling from Dh96,000 per annum to Dh85,000. It saw residents making the most of the lower rates to move to more popular areas with bigger units.

JLL said it expects "further downward pressure" on rents as more supply materialises throughout the year, a view shared by Asteco, which noted tenants seeking "more affordable opportunities" resulting in higher declines in the mid and high end sector.

It added that multiple cheque payments and rent-free periods are "now the norm in the lower to mid-end market", and vacancies in prime buildings increased significantly "as discounts and incentives offered were insufficient to ensure tenant retention in a highly competitive market".

Any big announcements at Cityscape in April?

There was nothing major for the rental market in the short-term, although Aldar Properties sold out its latest residential project, Lea, on Yas Island.

This is the second project Aldar has launched with plots for sale amid demand from buyers who want to build their own home in a waterfront community.

Just prior to Cityscape, there was the unveiling of development plans for Jubail Island, which sits between Saadiyat Island and Yas Island.

Within four years, it is planned for there to be up to 6,000 residents living in low-rise buildings

How does the supply situation look for the rest of the year?

In a word, plentiful.

JLL saw 1,700 units delivered in the first quarter and expects a further 8,000 by the end of the year with absorbtion rates "unlikely to be significant".

The delivery number from Asteco was much higher - 2,800 apartments and 800 villas, although it expects 6,000 to come through during the remainder of the year, subject to delays.

Reem Island, Al Raha Beach and Saadiyat Island are set to contribute the majority of the new supply.