Dubai's residential property market posted strong growth in August, with total sales up 37 per cent annually to Dh31.2 billion ($8.5 billion), boosted by rising demand for off-plan units.

The value of off-plan sales doubled on a yearly basis to Dh16.79 billion last month, the latest market report by EFG Hermes said.

Robust activity in the Dubai Land and Business Bay areas drove off-plan sales, the report found.

Average selling prices continued their upward trend last month, increasing 20 per cent year-on-year to Dh2,230 per square foot on average.

Rates in the luxury segment posted strong annual growth of 37.7 per cent, with average prices at Dh3,870 per sq ft.

The top five areas by transaction value were Dubai Harbour (Dh2.7 billion), The Palm Jumeirah (Dh2.49 billion), Downtown Dubai (Dh778 million), Jumeirah (Dh393 million) and Dubai Healthcare City (Dh349 million).

In the affordable segment, prices rose 8.5 per cent yearly in August, with average rates at Dh1,815 per sq ft, EFG Hermes said.

Total transaction value stood at about Dh13 billion, with the top five areas including MBR City (Dh3.7 billion), Business Bay (Dh2.3 billion), Dubai Marina (Dh1.07 billion), Arabian Ranches (Dh1.01 billion) and The Lagoons (Dh837 million).

Meanwhile, in the budget segment, prices dropped by 4.5 per cent year-on-year, although they were up 4.4 per cent on a monthly basis averaging Dh990 per sq ft.

Looking at transaction values, the top five areas were Dubai Land (Dh4.9 billion), Dubai South (Dh1.28 billion), Jumeirah Village Circle (Dh915 million), Al Furjan (Dh 713 million) and Jumeirah Golf Estates (Dh544 million).

Dubai's property market has bounced back strongly from the coronavirus-induced slowdown, helped by government initiatives such as residency permits for retired and remote workers.

The emirate's move to expand the 10-year golden visa programme and higher oil prices also supported property market growth momentum.

Dubai’s residential real estate prices rose 17 per cent in the second quarter on an annual basis, marking the 10th consecutive quarter of expansion, amid strong demand and robust economic growth, a report by consultancy Knight Frank last month found.

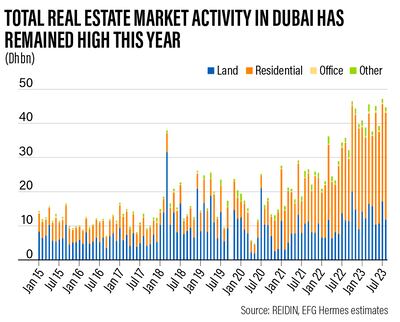

Overall, total transactions in Dubai's real estate market rose nearly 25 per cent annually to Dh44.67 billion in August, the EFG report said.

While residential and office activity posted strong gains, land transactions recorded the least growth on a yearly basis.

Rental market mixed

On the rental side, the market recorded mixed performance in August, the EFG report found.

Areas such as Motor City, Downtown Dubai (affordable) and Dubai Sports City saw strong annual growth of 37.5 per cent, 29 per cent and 28 per cent, respectively, for two-bedroom apartments.

However, in Downtown Dubai (luxury) rents were down 17.6 per cent year-on-year, and in Emirates Living (The Greens) and International City, they nudged up 11 per cent and about 14 per cent, respectively, for two-bedroom units.