The UAE's property market registered a strong performance across all sectors in the first half of the year amid robust growth in its non-oil economy despite global macroeconomic headwinds, a report has said.

On the residential side, Abu Dhabi's market recorded 4,737 in sales transactions in the first half of the year, up 88.6 per cent annually, while average prices in Dubai's market rose by 16.9 per cent in the year to June 2023, consultancy CBRE said in its latest market report.

Meanwhile, UAE hotels recorded a rise of 4.1 percentage points in average occupancy rates over the first six months of the year, supporting the hospitality segment.

The outlook remains relatively strong on the whole, “despite … seemingly dissipating global macroeconomic headwinds”, the UAE Real Estate Market Review Q2 2023 report said.

“The key downside risks that we are monitoring include the impact of higher interest rates, the impact on consumers on the back of higher housing costs, namely in Dubai, and finally, the net impact of a weakening US dollar.”

The UAE economy, the second largest in the Arab world, grew 7.9 per cent last year, the highest in 11 years, after expanding 4.4 per cent in 2021, supported by its non-oil sector at a time when the country is advancing its diversification strategy.

This year, its economy is expected to expand by 3.3 per cent, with the non-oil sector growing by 4.5 per cent, according to the UAE Central Bank.

Business activity in the non-oil private sector strengthened as new order growth hit a four-year high in June, marking the most pronounced improvement since June 2019.

The seasonally adjusted S&P Global purchasing managers’ index reading climbed to 56.9 in June, from 55.5 in May. This was well above the neutral 50-point mark that separates growth from contraction.

The health of the non-oil private sector has now improved in each of the past 31 survey periods.

The country's property market has made a strong rebound from the coronavirus-induced slowdown, buoyed by government initiatives such as residency permits for retirees and remote workers.

The move to expand the 10-year golden visa programme, the economic gains generated by Expo 2020 Dubai and higher oil prices also supported the sector's growth momentum.

Residential market growth

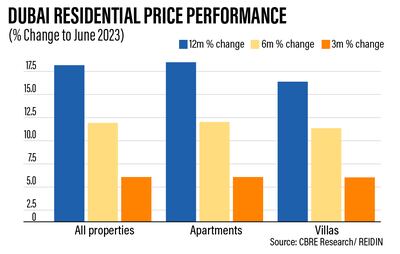

Average prices in Dubai's residential market increased by 16.9 per cent in the year to June, with apartment prices up 17.2 per cent and average villa prices rising by 15.1 per cent, CBRE said.

As of June, average apartment prices stood at Dh1,294 per square foot while average villa prices were at Dh1,525 per square foot, it said.

While the average apartment sales rates are still 13.1 per cent below the highs records of 2014, average villa prices currently sit at 5.5 per cent above this peak and a number of districts have long surpassed 2014 levels, the report showed.

Meanwhile, the number of transactions in the first six months stood at 57,738, the “highest total on record over this period”, marking an increase of 43.2 per cent annually, the report said.

In terms of residential supply, a total of 16,499 units have been completed and delivered in the first two quarters of 2023, with new stock in Downtown Dubai, Dubai Creek Harbour, and Business Bay accounting for 44.6 per cent of this recent supply.

By the end of this year, an additional 45,380 units are expected to be completed, although some of the stock may not be delivered as planned, CBRE said.

Meanwhile, rents continued to moderate for the fifth straight in June as tenants preferred to renew existing contracts.

“Moving forward, we expect that rental rates will continue to moderate. This is due to a reduction in asking rents in a number of key residential areas, particularly in the apartment segment of the market, where rents in several prime communities are now heading towards a single-digit growth,” CBRE said.

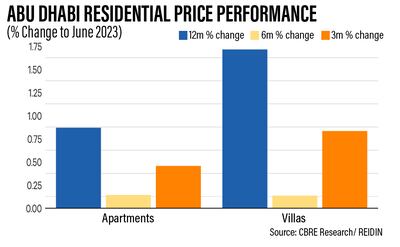

In Abu Dhabi's residential market, average apartment and villa prices in the second quarter registered year-on-year increases of 0.9 per cent and 1.7 per cent, respectively, CBRE said.

Considering only transactions undertaken during the second quarter, average apartment prices stood at Dh14,873 a square metre while average villa prices were at Dh11,232 a square metre.

The market recorded 4,737 in sales transactions in the first half of the year, up 88.6 per cent annually, underpinned by a 151.1 per cent rise in off-plan market sales and a 10.5 per cent increase in secondary market sales, the report said.

In terms of supply, midway through the year, 1,265 units have been completed in Abu Dhabi, with 65.8 per cent of this supply delivered in Al Raha Beach and Najmat Abu Dhabi.

A further 4,538 units are expected to be completed over the last two quarters of the year, with 49 per cent of this coming stock scheduled to be delivered in Al Maryah Island.

On the rental side, average apartment rents in Abu Dhabi marginally increased by 0.1 per cent while and average villa rents were up 1 per cent in the second quarter.

Based on rental registrations in the second quarter, the average apartment rent stood at Dh66,259 while the average for villas was Dh166,248.

Hospitality supported by tourism boom

Currently, the UAE's hospitality industry is benefitting from the reopening of the European tourism market, the report said.

Visitors are being attracted to book a stopover in the country, which is helping to drive demand and profitability in the typically low summer season, CBRE said.

In the year to June, the average hotel occupancy rate in the UAE rose by 4.1 percentage points while the average revenue per available room, a key gauge of performance for the hotel industry, increased 3.6 per cent on an annual basis, CBRE said.

The sector is expected to continue growing during the year on the back of several key coming events, including the Abu Dhabi F1 Grand Prix, the Cop 28 summit and the gradual return of key source markets that reopened after the pandemic, it said.

The country's retail, industrial and office property sectors also recorded growth during the first half of the year, according to CBRE.