The office space market in major cities is at risk of losing about $800 billion by 2030 as vacancies rise amid people opting for remote or flexible working arrangements, a study from McKinsey & Co has shown.

While office attendance has stabilised and recovered slightly following the Covid-19 pandemic, it is still 30 per cent below pre-pandemic levels, the global consultancy said in its latest report on Thursday.

The estimate for those losses translates into a decline of more than a quarter compared to pre-pandemic levels in 2019, with a worst-case scenario showing that it could spiral to as much as 43 per cent.

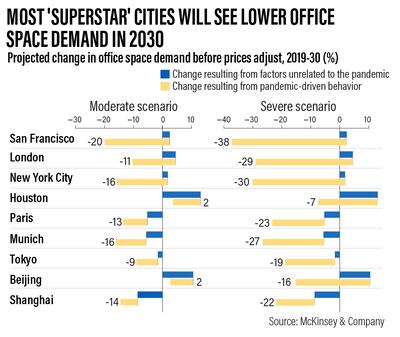

Demand for office space, in a moderate scenario, is projected to be about 13 per cent lower by 2030 compared to 2019 levels, and predicted to balloon to 38 per cent in a severe scenario, the study said.

In any case, the amount of office space demanded in most cities will not return to pre-pandemic levels for decades, McKinsey said.

The survey focused on nine “superstar” cities – Beijing, Houston, London, New York City, Paris, Munich, San Francisco, Shanghai and Tokyo.

“What is certain is that urban real estate in superstar cities around the world faces substantial challenges. And those challenges could imperil the fiscal health of cities,” analysts at McKinsey wrote in the report.

This poses a challenge for landlords as companies reconsider leasing out office space amid low attendance, which in turn will dampen occupancy and, consequently, rents, it said.

While office attendance varies by industry and neighbourhood, one trend has persisted: the vacancy percentage in office spaces has grown sharply since 2019, McKinsey said.

Fewer people going to the office has also affected the retail sector, as more consumers have increasingly begun to do their shopping online.

“Because of reduced foot traffic near urban stores during the pandemic, vacancy in retail space has increased and rents have declined, particularly in office-dense locations,” McKinsey said.

“Foot traffic plummeted near stores in the cities we studied, and online spending as a share of retail spending spiked.”

Remote work rose to prominence during the Covid-19 pandemic and was part of the frantic change companies had to adapt to in order to keep their operations afloat.

And with work-related technologies – most notably videoconferencing – improving and more widely available, the situation has highlighted that work and other activities can be done remotely.

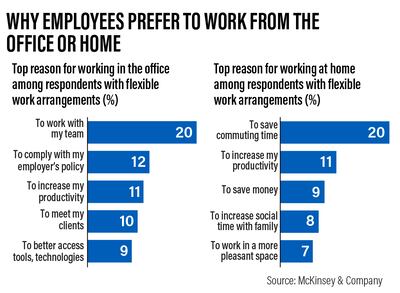

In the McKinsey report's expanded global survey of 24 countries, employees have cited a variety of reasons for choosing to work remotely, with the top ones being that it saves them time and money, increases productivity, and allows them to spend more time with their families, the report said.

Analysts also said that the decline of big city centres could also add to local government budgets, some of which heavily rely on tax revenue from commercial real estate, according to the Council of Foreign Relations, a US think tank.

“The ripple effects will be complex … certain kinds of cities and neighbourhoods will be more heavily affected than others,” McKinsey said.

“The impact could be stronger if troubled financial institutions decide to more quickly reduce the price of property they finance or own.”

Another factor that has contributed to declining demand for office and retail space is out-migration, or the movement of people from urban areas to the suburbs.

The rise is again attributed to hybrid work, according to McKinsey.

“The behavioural changes caused by the pandemic – lower office attendance, accelerated out-migration from cities and less shopping in office-heavy neighbourhoods – will push down demand for real estate in most superstar cities,” it said.

“Real estate has not kept up with shifts in behaviour caused by the pandemic. The cities’ vibrancy is at risk, and they will have to adapt.”