The cycles of greed and fear we've seen over the past decade - the dot-com collapse that rang in the 2000s, followed by a five-year upsurge and the financial crisis - have done little to change perceptions of what stocks and investing are all about. Curiously, perhaps, many people still conceive of markets as middle-class lotteries in which people with modest fortunes can make big ones. If you'd like evidence of this, look no further than the shelves of the nearest Borders. Nestled in the business section among finance classics and bestselling fluff are sure to be a few tomes that promise can't-fail investment formulas that will make you rich if only you adhere slavishly to their tenets.

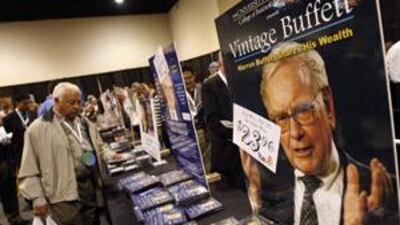

Some recommend particular stocks, while others promote novel valuation methods or technical analysis, which despite its fancy sounding name essentially means reading patterns in stock price charts. The investing-as-avenue-to-riches meme has existed at least since the invention of the modern economy gave rise to a few examples of people who actually did strike it rich through investing. Even today, wealthy exemplars of the same ilk thrive as the guiding lights of the get-rich-quick crowd. Their success seemingly vindicates the strategies they employ, crowning them as modern-day shamans with profitmaking secrets to tell.

This is all bunk, as any halfway-discerning person can easily tell. If any genius really had a foolproof method for beating the market and getting rich quick, he wouldn't be sharing it. No rational person would. He'd be too busy making money to write a book and tend to a flock of disciples. And yet many people - even those who don't necessarily expect to get rich quickly - go into investing mainly because they see it as a sure path to wealth.

While I have nothing against the pure pursuit of wealth, that is flawed thinking. Markets, after all, aren't massive raffles; they serve a much larger social and economic purpose. In the broadest view, they function both as a way for companies to raise capital and grow by offering shares to the public and as a means of allocating capital. The best companies get investment. The worst don't. Seeing investing narrowly, as merely a means of getting rich, completely ignores the fundamental function of markets in society.

The bigger problem with seeing investing as merely a quest for riches, though, is that from the individual investor's standpoint putting money in markets has to be a means to an end. Many of us have open-ended dreams that are fed by the prospect of booking big gains in the markets - starting a yachting business on the French riviera, perhaps, or retiring early and travelling the world over. Or maybe it's simply enjoying a life of wealth and privilege.

But those dreams aren't practical. They're full of hope but bereft of a clearly defined purpose. And without a clear purpose behind an investing plan, you are likely never to accomplish anything so vague as "becoming rich" or "living well". Before you can accomplish anything close to that, you'll need to define exactly what that means, how much it will cost and what sacrifices you will have to make to achieve it.

That is why planning is crucial to investing, whether that means scratching out what you want to do on a piece of paper or going to a professional financial planner to help put all the pieces together. Once you know what you want to do, you can set it against what you think you can reasonably save and invest over the next decade, during the rest of your working years or whatever period you decide to allot yourself to get what you want.

Planning, in short, makes investing practical. It's one thing to say you want to buy a house and will put as much money as you can into a portfolio of investments over the next few years to try to come up with a deposit on a mortgage. It's quite another thing to do all the maths. If, for example, you figure you want to buy a house in the French countryside that you estimate will cost about Dh2 million, and you have Dh100,000 saved, you might concoct a plan whereby you'll steadily build up another Dh300,000 over six years to use as a deposit.

Assuming investment returns of six per cent a year on a diversified portfolio, you can calculate fairly precisely what you will need to set aside every month to reach your goal. In doing the maths, you may discover that your goal is out of reach, or that you need to adjust your time horizons. Either way, you'll have learnt something useful about your goals - something that goes far beyond investing and hoping for a major market upswing.

As this scenario shows, markets are best conceived as tools for individual investors that can help them reach clear financial goals. Investing may make you rich, but that is at best an outside chance that is likely to take many years of careful work. Given all the financial mayhem of recent years, it's a wonder that more people haven't discovered the real purpose of investing and that those get-rich-quick books are still on the shelves. Yet in some ways it's not too surprising. It's in our nature to dream. If you're going to dream, though, you might as well dream about something you can actually do - with the help of a sane investment plan, of course.

afitch@thenational.ae