Jeff Bezos

The world's second-richest person made the single-largest charitable contribution in 2020, according to The Chronicle of Philanthropy's annual list of top donations, a $10 billion gift that is intended to help fight climate change.

Amazon's founder and chief executive, Jeff Bezos, whose "real-time" worth Forbes estimates at roughly $188bn, used the contribution to launch his Bezos Earth Fund. The fund, which supports non-profits involved in the climate crisis, has paid out $790 million to 16 groups so far, according to the Chronicle.

Setting aside Mr Bezos’ whopping gift, though, the sum total of the top 10 donations last year – $2.6 billion – was the lowest since 2011, even as many billionaires vastly increased their wealth in the stock market rally that catapulted technology shares, in particular, last year.

Nike co-founder and chairman Phil Knight, who with his wife, Penny, made the second- and third-largest donations last year according to the Chronicle, increased his wealth by about 77 per cent from March 18 through December 7, 2020. Mr Knight and his wife gave more than $900m to the Knight Foundation and $300m to the University of Oregon.

Fred Kummer, founder of construction company HBE Corporation, and his wife, June, gave $300m to establish a foundation to support programmes at the Missouri University of Science and Technology.

Facebook's founder Mark Zuckerberg and his wife, Priscilla Chan, delivered the fourth-largest donation on the Chronicle's list: A $250m gift to the Centre for Tech and Civic Life, which worked on voting security issues in the 2020 election.

Two billionaires who donated heavily to charity last year – MacKenzie Scott, Mr Bezos' former wife, and Jack Dorsey, co-founder of Twitter – did not make the Chronicle's list because no single donation of theirs was large enough to qualify.

Jian Jun & Zhao Yan

Fiona Cai is an internet host from Nanchang, China, who livestreams the nation’s pop songs to several thousand social media followers. She’s 28 but spends about 1,000 yuan ($155) each month for a skin booster injection.

The industry is big business in China’s fast-growing beauty market – 13.7 million people use the treatments, and this could just be the start. It’s forecast to reach 25.5 million by 2023, boosting the market to 311.5bn yuan ($48.2bn), according to a report by iResearch. Globally, the business generated $86.2bn in revenue last year and is expected to increase at an annual pace of almost 10 per cent through 2028, Grand View Research estimates.

Two of the biggest beneficiaries are Chinese women.

Jian Jun, the chairwoman of IMeik Technology Development, last year amassed money faster than any Asian female entrepreneur in the Bloomberg Billionaires Index. She’s worth $5.2bn after shares of her company surged more than 500 per cent since listing in September. Bloomage Biotechnology’s Zhao Yan, meanwhile, added more than $3bn to her fortune in 2020 as the stock rallied 76 per cent.

Their firms are top makers of sodium hyaluronate, a moisturising substance used in skin fillers. Unlike botox, which freezes muscles to stop wrinkles and tends to cater to older customers, fillers are tiny injections of vitamins, minerals and amino acids that help improve the skin’s appearance, appealing to the younger crowds.

“As an entry-level project, sodium hyaluronate often becomes the first choice of consumers,” said Neil Wang, president of Frost & Sullivan China, adding that the country’s idol-entertainment culture and growing internet influence is lifting people’s beauty standards.

Ms Jun became interested in cosmetology while working abroad, after discovering injection treatments with nicknames such as “beauty lunch”, which only take one or two hours. After working at a US trade company and a textile firm in Panama, she moved back to China in 2004 and joined IMeik the same year as a director, gradually becoming its biggest owner. The 57-year-old became the company’s chairwoman in 2016.

While only about 3.6 per cent of the Chinese population had tried medical cosmetology by 2019 – compared with 21 per cent in South Korea and 17 per cent in the US – that number is poised to grow, according to Kenneth Law, financial advisory director at Deloitte China.

“Female consumers in the age bucket between 30 and 40 are seen as the major spending group with high disposable income,” Mr Law said. “With stronger awareness and general emphasis towards a culture of personal well-being, rising demand for sodium-hyaluronate products was seen and is expected to continue.”

Even Covid-19 proved temporary. After a drop in business during lockdowns at the start of 2020, activity picked up. IMeik revenue surged 17 per cent in the three quarters through September, with profit jumping 32 per cent to 290m yuan. Bloomage sales climbed 24 per cent in the same period as earnings rose 5 per cent to 438m yuan.

Bill Ackman

Bill Ackman’s Pershing Square Capital Management reported a second straight record performance in 2020, as a bet in the early days of the pandemic helped the fund return 70 per cent on investments.

The billionaire investor said Pershing Square had a net return of 4.6 per cent in December alone. The annual results eclipsed the 16 per cent gain in the S&P 500, and surpassed Mr Ackman’s 2019 record of about 58 per cent.

Back-to-back wins mark an impressive return for Mr Ackman, whose hedge fund previously racked up three consecutive years of losses after a disastrous bet on Valeant Pharmaceuticals and an ill-fated short-selling campaign at Herbalife Nutrition, among other challenges.

Pershing Square’s 2020 performance was driven by a lucrative credit hedge Mr Ackman put in place in the lead-up to the coronavirus crisis and the subsequent market sell-off. Mr Ackman said in April that he had been so concerned about the potential impact of the coronavirus that he had considered liquidating Pershing Square’s entire portfolio before opting for a credit-hedge strategy.

The bet paid off, returning about $2.6bn to Pershing Square by the time it was sold in March, or roughly 100 times the size of the original investment. Mr Ackman used the proceeds to make what he called a “recovery bet” on the economy, increasing stakes in portfolio companies and reinvesting in others including Starbucks.

Mr Ackman’s attention later turned to his blank-check company, Pershing Square Tontine Holdings. In July, the special purpose acquisition company raised $4bn in an initial public offering, plus a $1bn commitment from Pershing Square, and is now seeking a private company to take public. Mr Ackman has held talks with Airbnb, Stripe and others.

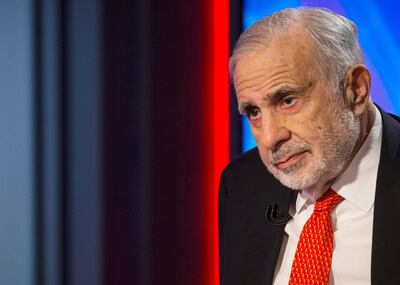

Carl Icahn

Billionaire investor Carl Icahn will sell about $600m worth of his stake in Herbalife Nutrition, further winding down his holdings in the nutritional supplements company after a tumultuous eight-year investment.

Herbalife has agreed to repurchase the shares from Mr Icahn at $48.05 each. The billionaire is also giving up his five seats on the board of the company, while Icahn Enterprises LP will trim its holdings to about 6 per cent.

The 84-year-old investor will no longer be Herbalife’s biggest shareholder after the transaction, according to data compiled by Bloomberg.

Herbalife has been a part of Mr Icahn’s portfolio since 2013, when he bought into the stock months after fellow activist investor Bill Ackman took a short position in the company and labelled it a pyramid scheme. Mr Icahn and Mr Ackman publicly clashed over their investments multiple times, with the former defending Herbalife’s marketing model and even suggesting he might take the company private.

In 2018, after Mr Ackman almost completely exited his own stake, Mr Icahn said he’d enjoyed “a good fight” and that his investment had yielded a $1bn return on paper.

Mr Icahn sold $679.3m of Herbalife shares in the third quarter of 2020, according to an earlier filing, the first time he’d cut his stake in the company in two years. He was left with a 16 per cent stake worth about $946m at the time, the filing showed.

“The time for activism has passed as the company has grown, and I don’t typically invest billions of dollars in companies where our role as activist is not needed,” Mr Icahn said. “That being said, Herbalife Nutrition’s products and business opportunity are needed now more than ever, and I look forward to remaining a shareholder of the company.”