For the last decade, analysts have warned we are on the brink of another stock market crash. So far they've been wrong every time.

The latest doomsayer merits a hearing, though, because he is Wall Street guru Michael Burry, who made a winning $1 billion (Dh3.67bn) bet by accurately predicting the 2008 market collapse.

You may not recognise the name but if you saw the 2015 Hollywood movie The Big Short, he was the character played by Christian Bale, who spotted the dangers lurking in subprime collateralised debt obligations, which triggered the financial crisis.

Few had heard of these esoteric investments, and even fewer understood them, but Mr Burry’s latest warning focuses on something millions of ordinary investors now have in their portfolios — exchange traded funds (ETFs).

These are low-cost, passive investment funds that dispense with active managers and simply track their chosen stock market indices, such as the S&P 500, FTSE 100 and the FTSE All World, plus a heap of smaller exchanges and commodities.

Mr Burry isn't the first to warn against the dangers of passive investing, and he won’t be the last. Given his track record, his words carry weight. So should we be worried?

The first ETF was launched back in 1993 but they only really became a big deal after the financial crisis, when investors woke up to how much they were paying active fund managers to look after their money.

ETFs are cheap and this means investors get to keep more of their money. While an active fund may charge 5 per cent upfront then another 1.5 per cent a year, ETFs have zero initial charges and annual fees from as low as 0.07 per cent.

If an investor puts $100,000 in two funds with these charging profiles and both grew at an average 7 per cent a year, the costlier active fund would give them $473,475 after 30 years while the cheaper ETF would deliver a whopping $746,246. The only difference is charges.

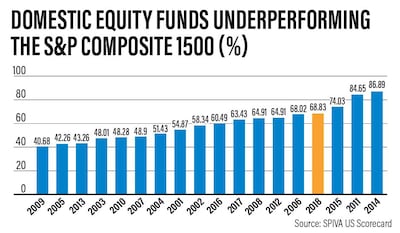

It got worse for active managers, as research repeatedly showed the vast majority underperform their benchmark index, to an embarrassing degree.

In the 15 years to December 29 2017, 92.33 per cent of actively managed large cap US funds failed to beat the S&P 500, according to the Spiva US Scorecard. The failure rate rose to 94.81 per cent for active funds covering the S&P Mid-Cap 400 Index, and 95.73 per cent for the S&P Small Cap 600 Index.

In March this year, Spiva's report examining performance to the end of 2018 stated that "over the long-term investment horizon, such as 10 or 15 years, 80 per cent or more of active managers across all categories underperformed their respective benchmarks".

Offshore investment guru Andrew Hallam, author of Millionaire Expat: How to Build Wealth Overseas, says the message is stark: trackers aren't just cheaper, they perform better too.

Although a small proportion of active managers do beat the market, it is impossible to work out who they are in advance. “Funds that win during one time period usually disappoint the next,” he says.

The message has sunk in, and at the end of July, the sums invested in US ETFs topped $4 trillion for the first time, according to ETF.com.

Mr Burry fears the flood of money looks remarkably like the bubble in collateralised debt obligations, recently telling Bloomberg that the flows will reverse at some point and when they do “it will be ugly”. “Like most bubbles, the longer it goes on, the worse the crash will be," he said.

However, Mr Hallam cautions against putting too much faith in experts calling the market, even those who have been right once, because few analysts successfully manage to repeat the trick.

Rather than rushing to sell your ETFs, he recommends staying invested, something billionaire investor Warren Buffett preaches, famously stating that: “Stock market forecasters exist to make fortune tellers look good.”

However, Adrian Lowcock, head of personal investing at UK-regulated adviser Willis Owen, says that although passive funds do have their place in portfolios, he believes active funds have the edge. “Passives will buy the good, the bad and the ugly companies, whereas active managers can identify opportunities that are missed and undervalued by the market," he says.

He quotes UK fund performance figures showing that passives made up just two of the top 50 performing funds over the last five years.

Rebecca O’Keeffe, head of investment at online platform Interactive Investor, said by adopting a passive only strategy you are sacrificing the opportunity to invest in star fund managers with a track record of outperformance. “There are undoubtedly huge positives to low-cost trackers and in the US, most new money now flows into passives. However, managers can invest wherever they choose, which may increase the risks but the rewards are often worth paying extra fees for.”

Jahangir Aka, managing director for the Middle East & Africa at fund manager Neuberger Berman, echoes this by saying investors may find passive exposure to an index much less attractive in a falling market, which is when “active managers can employ risk management techniques to protect portfolios”.

ETFs have thrived in a period when central bankers have pumped up stock markets with monetary easing, Mr Aka says. “When the bull market runs out of steam the downside mitigation which only active managers can give may be an increasingly important consideration.”

Passive advocates point out that trackers will never outperform, nor will they underperform either. There will always be some active funds that beat the market, by the simple law of averages, but they will struggle to repeat their success, year after year.

Mr Hallam dismisses claims that active managers can protect investors when stocks fall, noting that in 2008, the S&P 500 dropped 37 per cent, but that year nearly two thirds of actively managed US stock market funds actually fared worse than their index, with a near identical pattern in 2001 and 2002.

Actively managed funds don’t reduce risk, diversification does, he says. "That’s why investors should stick to a diversified portfolio of low-cost index funds. No matter what your broker says, there’s no room in your portfolio for an actively managed fund.”

Steve Cronin of UAE financial community DeadSimpleSaving.com, is also a big fan of ETFs and dismisses another of Mr Burry's arguments that the flood of passive money into main indices such as the S&P 500 is distorting stock market pricing mechanisms. "Stock prices are still being determined by active traders and managers buying and selling stocks," says Mr Cronin. "This would still be the same even if 90 per cent of investments were passive."

Theoretically, actively managed funds could become such a small part of the market that they can start to beat the index regularly. "If that happens then people would start crowding into them again," he adds.

Mr Cronin acknowledges that ETFs have not been tested by a global crisis on the scale of 2008, but in all the subsequent mini-crises and flash crashes they have held up well and done what they are supposed to do.

Investors need to choose their ETFs carefully, though. While many buy the actual “physical” shares on an index, others merely copy them “synthetically”, using complex financial instruments such as derivatives and swaps to replicate performance. Mr Cronin says stick to physical ETFs: “In a major downturn, corner-cutting synthetic ETFs could be much more vulnerable to imploding.”

He also advises against putting all your money into the major indices such as the S&P 500, something too many ETF investors do. “Diversify by investing in smaller companies as well, for example the iShares USA Small Cap UCITS ETF," he says. "Be warned, though, small cap funds are more volatile.”

Mr Cronin also rejects the "completely false” notion that active managers can predict market movements and position to avoid downturns. “If that was true, they would consistently outperform during downturns, but very few do.”