One of the great things about the dawning of a new year is that for a brief moment all things seem possible, which is why we make solemn resolutions that most of us will not be able to even remember, much less stick to faithfully, by the time spring rolls around.

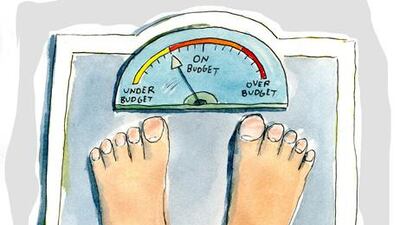

The most common pledges have to do with making our waistlines thinner or our wallets fatter, but conjure images of a commitment to an ascetic lifestyle of bread and water, followed the next day by leftover bread and water, and so on and so on until we end up either skinny or rich. These quests are so joyless that it is little wonder so few of us cross the finish line.

There are certainly similarities to dieting and creating a lean budget, but the latter is actually a much more effective tool.

One thing they do share in common is that gimmicks do not work.

Numerous studies have shown that fad diets - only eat radishes in the morning, or drink six smoothies a day - do not work in the long run and usually only result in a small weight loss at the outset, which is quickly regained along with a few extra pounds. Some researchers argue that the evidence indicates people would have been better off not dieting at all because of the stress that gets put on the body.

There is an abundance of research that shows the most effective way to lose weight is to exercise more and eat generally in moderation, usually in smaller portions and with a few vegetables thrown in the mix. That's not to say it is easy - just that there is no previously undiscovered secret that will be revealed anytime soon to an obscure nutritionist with a publishing contract.

Similarly, for the financial-minded, it is unlikely that goals will be achieved through novel means, such as one that arrives in the form of an e-mail suggesting a new business opportunity.

The key to saving money is spending less than we earn. If we want to improve that ratio, we need to find ways to earn more or spend less.

Most resolutions focus on the latter, with too much focus on the sacrifice and not enough on the fun for my tastes. Many people sit down and create elaborate spreadsheets finding ways to carve a few dirhams here and there out of the budget through behavioural changes. "Drink coffee at home each morning instead of paying Dh15 for a cup at Starbucks or Gloria Jean's" or "bring lunch to work" are two common techniques.

Those are two admirable strategies and I hope to employ them on at least an occasional basis this year. But I also know myself fairly well after all these years, and I recognise that I'm unlikely to change my habits so drastically - good news for shareholders of Gloria Jean's and Subway.

What's easier for me, and for a lot of other people, is to make an extra effort to earn more money by working extra hours or taking on outside jobs that could bring in a few extra dirhams each month.

Further, it is easier for me to put in that extra effort if I know I will be rewarded with something fun. My wife and I are hoping to visit some friends in Tanzania later this year, so any extra money I can earn this year will be earmarked for that trip.

But that works for me because I make a steady monthly salary with a good handle on my income versus my expenses. When I worked as a freelancer for seven years, the biggest mistake I consistently made was not being realistic about what I could expect to collect each month.

My budget was always based on a best-case scenario that rarely materialised because of payments that were delayed and assignments that fell through.

Particularly for those who freelance or are paid largely through commission, the newest generation of budgeting software can be quite effective. But again, it does not work unless the user is realistic about what is coming in and going out.

Another trick I prefer to crunching numbers is to take advantage of automatic withdrawals. Our increasingly cashless society often works against well-intentioned savers because paying for goods and services only requires a swipe of the card rather than handing over paper currency. It does not seem real.

However, this technology can be turned in our favour.

Automatic bill-pay and transfers to investment accounts can overcome the common human impulse to delay expenditures or make purchases simply based on the current account balance.

Finally, I find that an annual or semi-annual audit of spending patterns produces more savings than depending on changes to your daily habits. A couple of years back, the US magazine Consumer Reports looked at the spending of average American families and found that each could save around US$500 (Dh1,835) by analysing six different areas for savings: car insurance, life insurance, bank fees, credit-card fees, internet and phone plans and grocery shopping.

This is not about sacrifice, but simple efficiency. A quick check of the bills at least once a year can easily produce a few hundred extra bucks, or enough to cover dinner at Hakkasan in Emirates Palace.

That's a diet I can get behind.