Bill Gates

Bill Gates says he has paid more than $10bn in taxes over a lifetime but billionaires like him should pay "significantly" more because they benefit more from the system.

The Microsoft co-founder, the world's second richest man after Amazon's Jeff Bezos, was critical of a recent US tax overhaul that slashed corporate taxes and lowered the top bracket for individual income.

"I've paid more taxes, over $10bn, than anyone else, but the government should require the people in my position to pay significantly higher taxes," he said in an interview with CNN.

He said the tax overhaul passed in December favours the rich despite Republican claims it will help the middle and working classes.

"People who are wealthier tended to get dramatically more benefits than the middle class or those who are poor, and so it runs counter to the general trend you'd like to see, where the safety net is getting stronger and those at the top are paying higher taxes," he said.

With a sixth of the US population living in what he called "disappointing" conditions, he said US policymakers need to think about rising inequality and ask, "Why aren't we doing a better job for those people?"

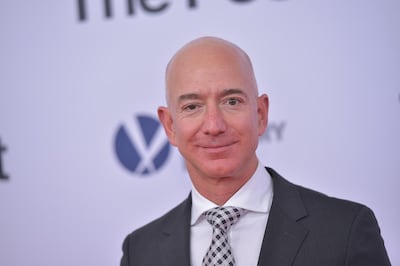

Jeff Bezos

Triumphant in online retail, cloud computing, organic groceries, and streaming television, Amazon founder and chief disruptor Jeff Bezos is turning his seemingly limitless ambition to health care.

Amazon, launched as an internet bookseller nearly 24 years ago, has branched into offerings including voice-commanded speakers infused with Alexa artificial intelligence and original TV shows streamed online at its Prime subscription service.

Health care now appears ripe for Mr Bezos, who has earned a reputation for attacking high costs and inefficiencies.

A possible step in that direction was taken last month, with Amazon announcing an alliance with billionaire Warren Buffett and JPMorgan Chase chief executive Jamie Dimon to provide a health care system for employees of the three companies.

According to the Wall Street Journal, Amazon would also like to become a supplier of medical equipment for hospitals.

"I think Bezos is methodical and thoughtful," eMarketer senior analyst Patricia Orsini told AFP.

"He has identified a market that is ready for disruption. The healthcare system in the US is ripe for reform."

Mr Bezos faces the challenge of taming skyrocketing costs throughout US health care from insurance and medicine to supplies and therapy.

"Just as with every other industry Amazon has entered, Bezos is envisioning lower-priced alternatives with frictionless services that could, over time, make a lot of money for Amazon," Ms Orsini said.

Barclays analysts said in a recent research note on Amazon's potential in health care, "We are never dismissive of anything disruptive that Amazon is involved in. Amazon arguable has the best technical abilities of any company we cover."

Amazon has been on a stunning growth streak of late, expanding its international retail operations as far as India and Australia, while devouring the US organic supermarket Whole Foods group.

With increased scale, it has been ramping up profits in recent quarters, helping Amazon leapfrog in market value to one of the top companies in the world and making Mr Bezos the world's richest individual with a net worth well over $100 billion.

Mr Bezos, whose personal investments have included buying the Washington Post, has been referred to as the "ultimate disruptor" with a long-term view that only recently has begun to yield hefty profits.

Amazon recently reported its profits had more than doubled in the past quarter to $1.9 billion as revenue grew 38 per cent to $60.5bn.

Aliko Dangote

Dangote Cement, owned by Africa’s richest man, has revived plans for a share sale in London that could raise about $1bn, according to people familiar with the matter.

The Nigerian company, controlled by Aliko Dangote, has approached investment bankers to discuss a potential UK listing, said the people, who asked not to be named. Once banks have been appointed, it will probably take at least five months to complete the process, one of the sources said. The cement maker is also considering issuing a debut Eurobond, according to two different people familiar with the matter.

Discussions are ongoing and a listing of Africa’s biggest cement maker may not go ahead.

“We have not, to the best of my knowledge, taken such a decision,” Anthony Chiejina, Dangote Cement’s spokesman in Lagos, said in an emailed response to questions, without commenting on the banker talks.

Fresh capital would enable Dangote Cement to fund expansion plans in sub-Saharan Africa and comply with a demand from the Lagos bourse that listed companies should have a free float of at least 20 per cent, regardless of where the shares are traded. The company sees London as a more favourable place to attract about $1bn than in its home base of Lagos, Nigeria’s commercial capital, where no company has raised more than Starcomms' $796 million in 2008.

Dangote Cement, which has a Lagos free float of 8.9 per cent and a market valuation of $12.2bn, mulled raising equity in London in 2010. At the time, Goldman Sachs Group, JPMorgan Chase and Morgan Stanley helped it prepare a sale that could have raised as much as $5bn, before the move was abandoned.

The revival of the plan comes as Dangote Cement shares climb to near records as the Nigerian economy recovers from a downturn caused by the 2014 slump in oil prices. The economy of Africa’s most populous nation went into recession in 2016 as government revenue plunged. Nigerian stocks are up 11 per cent this year in dollar terms, the sixth best performance globally according to data compiled by Bloomberg.

Aliko Dangote has a net worth of $13.5bn, according to the Bloomberg Billionaires Index. His Dangote Industries conglomerate has interests in sugar, flour and packaged food as well as controlling the cement company. The

60-year-old has repeatedly expressed a desire to bid for London’s Arsenal Football Club and is building a 650,000 barrel-a-day oil refinery near Lagos, which will cost more than $10bn.

Masayoshi Son

Billionaire Masayoshi Son’s plan to list his cash-cow Japanese telecom business is raising concern among observers that the company might stop guaranteeing the debt of its parent SoftBank Group, worsening the quality of its credit.

The mobile division SoftBank assures payments to investors on $33.4bn in bonds of its parent, which is rated junk by Moody’s Investors Service and S&P Global Ratings, according to Bloomberg-compiled data. The unit needs to prove its independence to get listed on the Tokyo Stock Exchange, meaning that it probably would have to cancel the guarantees to pass the test, according to Japan Credit Rating Agency and Asahi Life Asset Management.

“It’s the mobile company that’s generating cash flows, so its guarantees have been a source of a very strong sense of assurance” for bond investors, said Yoshihiro Nakatani, senior fund manager at Asahi Life Asset. “It would be a problem morally” if it cancelled them without negotiating with investors, he said.

The focus on SoftBank’s bond guarantees highlights how the market remains concerned about the broader company’s huge debt that it’s accumulated making investments around the globe. The firm’s total debt has climbed 28 per cent in two years to 15.8 trillion yen ($149bn) at the end of last year, and its bond-default risk is among the highest in Japan. SoftBank’s yield premiums would likely rise if it got rid of its guarantees without introducing any new form of assurance, according to Nomura Holdings.

In news conferences and analyst meetings, SoftBank hasn’t made clear its plans for the guarantees. SoftBank spokesman Mitsuhiro Kurano declined to comment.

Yield premiums on SoftBank’s 6 per cent dollar-denominated perceptual bonds have risen 27 basis points to 398 since Mr Son unveiled the IPO plan on February 7, according to Bloomberg-compiled data. Credit-default-swap protection costs against debt non-payment by the company have also increased 8 basis points to 168, based on CMA data.

SoftBank’s domestic telecom operations accounted for about 53 per cent of its 1.15 trillion yen in operating profit in the nine months ending December 31, according to company data. The firm’s market capitalisation has lagged below the value of its assets. Spinning off the mobile phone unit may help close that gap, while raising capital.

SoftBank’s bond prospectuses suggest that the company can cancel the guarantees without getting explicit approval from bondholders, according to Toshihiro Uomoto, the chief credit strategist at Nomura. For example, if lenders of a syndicated loan to the firm agree to get rid of their own guarantee from the mobile unit, the guarantee on yen notes will be cancelled too, he said.

Debt holders could still count on funds from more than 17 trillion yen in stock investments held by SoftBank if the guarantees are removed, so any gains in yield premiums may be limited, Mr Uomoto said.

If SoftBank opted instead to open talks with bond investors to gain their consent, the focus would be on what it could offer in return.

The firm could increase coupon payments on outstanding securities, said Akihisa Motonishi, a JCR analyst.

Or it could introduce a framework different from guarantees that would ensure debt payments, Asahi Life Asset’s Nakatani said. But many of SoftBank’s securities are likely held by individuals, rather than a limited number of institutional investors, so getting approval through negotiations could pose a challenge for SoftBank, Mr Nakatani said.