Mark Zuckerberg passed Elon Musk on Friday to become the third-richest person in the world, the first time since 2020 the arch-rival billionaires have held those positions.

Mr Musk, who ranked first on the Bloomberg Billionaires Index as recently as early March, fell to fourth after Reuters reported Tesla had cancelled plans for a less-expensive car, sending shares tumbling. Mr Musk denied the report.

That followed news earlier in the week that Tesla’s vehicle deliveries fell in the three months through to March, their first year-over-year decline since the early days of the Covid pandemic.

Mr Musk’s wealth has shrunk by $48.4 billion this year, while Mr Zuckerberg has added $58.9 billion to his fortune as Meta Platforms climbs to fresh highs, including a record on Friday.

It’s the first time Mr Zuckerberg has broken into the top three on Bloomberg’s ranking of the richest people since November 16, 2020, when he was worth $105.6 billion and Mr Musk’s fortune was $102.1 billion.

Top 10 richest people in the world 2024 – in pictures

Mr Musk now has a net worth of $180.6 billion; Mr Zuckerberg’s is $186.9 billion.

The reversal of the wealth gap between the two billionaires, which was as big as $215 billion in November 2021, illustrates how once-hot electric vehicle stocks have been usurped by Big Tech, and particularly anything involving artificial intelligence.

Tesla shares have fallen 34 per cent this year, making it the worst performer on the S&P 500 Index.

It’s been battered by a global slowdown in EV demand, growing competition in China and production problems in Germany. Meta, meanwhile, has surged 49 per cent thanks to strong quarterly earnings and excitement about the company’s AI initiatives. It’s the fifth-best performer on the S&P 500.

The two billionaires’ rivalry extends beyond their wealth: Mr Musk and Mr Zuckerberg have been engaged in an continuing public spat that intensified when Meta launched Threads, a social-media platform that competes with X, formerly known as Twitter.

The two even traded barbs last year about a possible cage fight. Mr Musk, 52, recently revived the idea on X, saying he would fight Mr Zuckerberg, 39, “anywhere, anytime”.

Mr Musk’s net worth could take a further hit after his $55 billion Tesla pay package was struck down by a Delaware judge.

The Bloomberg Billionaires Index continues to use the options from that pay package, which are one of Mr Musk’s largest assets, in its calculations of his wealth.

Bernard Arnault, chairman of luxury giant LVMH Moet Hennessy Louis Vuitton, and Amazon founder Jeff Bezos hold the first two spots on Bloomberg’s wealth ranking with fortunes of $223 billion and $207 billion, respectively.

Donald Trump

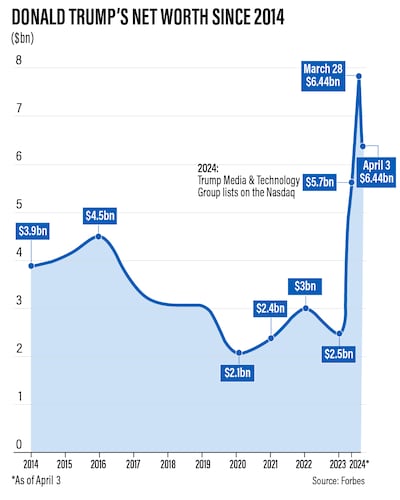

The value of Donald Trump’s stake in his social media business has tumbled by nearly $2 billion since the company disclosed that it lost more than $58 million in 2023, as revenue for the former president’s Truth Social platform trickled in.

Trump Media & Technology Group’s stock fell 21 per cent last Monday to $48.66 per share, below the $49.95 level where the blank-check vehicle it merged with was trading a week ago.

On Friday, the company, which listed on the Nasdaq on March 26, fell another 12 per cent to close out the trading week at $40.59.

Mr Trump’s current net worth is estimated at $5.1 billion, down from a peak of $7.81 billion on March 28, according to the Bloomberg Billionaires Index.

The former US president owns 57 per cent of the company, according to the filings with the US Securities and Exchange Commission, with his stake now worth about $3.2 billion on paper.

The company generated $4.1 million in revenue for the full year, results reported in a filing on April 1 show, underscoring how richly valued Trump Media is relative to its peers.

The company doesn’t report active user numbers, disclosing in its prospectus in February that Truth Social has about nine million sign-ups across its platforms.

Trump Media has still delivered a meteoric gain of 132.6 per cent this year to date, with its market value sitting at about $5.55 billion after it became a meme stock and captivated retail traders.

Reddit – which went public last month and has a similar valuation – had 267.5 million weekly active users in the last quarter and delivered $804 million in revenue last year.

Meanwhile, Snap, which has a market value of $19 billion, had a net loss of $1.3 billion on $4.6 billion in sales last year. Snap estimated daily active users for the first quarter of about 420 million.

The discrepancy between where Trump Media’s shares trade and how the underlying business performs indicates that some investors use it to signal they support Mr Trump’s push for re-election.

The stock, which has been trading since 2021 under the Spac’s ticker, has more than tripled this year as the retail-trading crowd pumps it with posts across Stocktwits and Reddit’s WallStreetBets forum.

In the filing, Trump Media’s revenue inched higher from $1.47 million in 2022 as it swung to an annual loss. The company recorded a $50.5 million profit in 2022 after receiving a boost from a change in the value related to its convertible notes.

Mr Trump can’t sell the stake immediately due to a six-month lock-up agreement, hindering his ability to monetise the shares and ease his present cash crunch.

His media company debuted on the Nasdaq after the closing of the merger with Digital World Acquisition brought in more than $275 million of much-needed cash. The media start-up had warned that without the deal there were concerns it could go bankrupt.

The heightened valuation has made it costly and risky to bet against, with short sellers facing annual financing costs of 500 per cent to borrow, according to brokers.

That makes it the most expensive US company to bet against with more than $100 million of short interest by a large margin, data from financial analytics firm S3 Partners show.

Companies that go public via Spac have historically been volatile in the days around the merger completion despite little fundamental change.

Prices of some stocks, including VinFast Auto, surged as the small amount available for trading made it easy for traders to drive share prices to extremes, before ultimately cratering.

More than one fifth of the nearly 500 Spac deals that have closed since 2019 are trading below $1 each, a greater than 90 per cent decline.

Steve Cohen

Billionaire Steve Cohen said he expects more businesses will move to a four-day work week – one of the reasons he’s made investments in golf.

“My belief is that a four-day work week is coming,” Mr Cohen, the founder of Point72 Asset Management and owner of the New York Mets, said in an interview with CNBC. “That fits into a theme of more leisure for people.”

Mr Cohen, an avid golfer, said several forces were pushing the world towards fewer work days, including the rise of artificial intelligence. More companies allowing hybrid working means “people are not as productive on Fridays”, he said.

Mr Cohen is part of a consortium that recently agreed to invest up to $3 billion in an entity controlled by golf's PGA Tour.

The deal, with a string of investors including the billionaire Marc Lasry and the Milwaukee Brewers owner Mark Attanasio, is a new commercial venture that will give some players an equity stake. Saudi Arabia’s Public Investment Fund is in continuing discussions over potential investment.

Mr Cohen is also a team owner in a new simulator-based golf league funded by Tiger Woods and Rory McIlroy.

However, Mr Cohen said he’d keep his own traders and portfolio managers working five days a week. “Taking off Friday when you have a portfolio – that would be a problem,” he said.

Jeff Bezos

Jeff Bezos is expanding his property empire with a third mansion on South Florida’s exclusive Indian Creek Island.

The Amazon founder agreed to pay about $90 million in an off-market transaction for a six-bedroom home in the Miami-area enclave, according to sources with knowledge of the matter.

Mr Bezos plans to live there while he tears down the other houses he bought on the island, said one of the sources.

A representative for Mr Bezos declined to comment. Property records show the house was last sold in 1998 for $2.5 million.

Mr Bezos, the world’s second-richest person with a net worth of $207 billion, according to the Bloomberg Billionaires Index, in November said he was moving to Miami from the Seattle region.

He shelled out $147 million for two mansions in Indian Creek, a man-made barrier island so renowned for its wealth that it’s dubbed “Billionaire Bunker”. Residents include Jared Kushner and Ivanka Trump, Tom Brady and Carl Icahn.

Since February, Mr Bezos has sold Amazon shares worth about $8.5 billion after having not disposed from the company stock since 2021. Mr Bezos, 60, hasn’t disclosed plans for the proceeds.

His property holdings include homes in Washington, a Maui estate and a Beverly Hills mansion he bought for $165 million in 2020.