Global tokenised payment transactions are expected to increase 47 per cent to more than one trillion by 2026 from this year, as the e-commerce industry's adoption of secure “one-click” transactions and Internet of Things (IoT) solutions continues to grow, according to Juniper Research.

About 680 billion transactions are expected in 2022, as quick transaction solutions such as click-to-pay and auto-filling of checkout details, continue to grow, a study by the UK-based company said.

Tokenisation is the process of replacing things with high value, such as bank cards and account details, with alternative codes called “tokens” that have low or no intrinsic value.

This boosts security by removing the most valuable data that cyber criminals can steal during the transaction process.

“Protecting payment data is integral to the security of the payments ecosystem. In an increasingly interconnected world, with a growing number of payment options, the need for strong security solutions is clear,” Juniper said.

Card networks are encouraging the mass adoption of tokenisation to also improve payment approval rates, it said.

“With so many payment methods now in use, the need to ensure that consumer data is protected across all channels is only growing.”

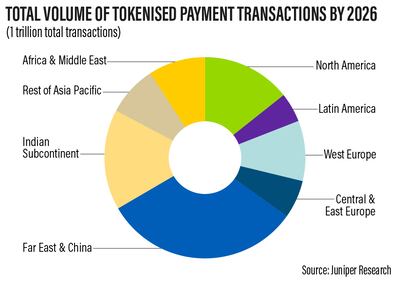

The Far East and China region will account for about a third of the tokenised transaction market by 2026, with IoT solutions expected to lead the growth.

IoT-driven payments — transactions made using connected devices beyond smartphones and computers, including wearables, cars and home appliances — are expected to record the largest growth in the tokenisation market over the next five years.

Tokenised IoT transactions are set to hit about 19 billion by 2027, a fivefold increase from 3.8 billion in 2022, the study showed.

“Tokenisation is critical in facilitating IoT payments, enabling transactions to be made via new use cases and form factors, and unlocking new revenue opportunities for payment providers,” the report said.

The volume of tokenised online and mobile e-commerce transactions is expected to grow by 74 per cent by 2026, driven by the increasing customer expectation of a faster and frictionless checkout experience, which one-click solutions offer.

The market's growth will also be driven by benefits such as time savings for the end-user through the elimination of the need for customers to re-enter payment credentials when shopping online.

However, many organisations are yet to adopt tokenisation, given the long development cycle.

“Tokenisation vendors, other than the already advanced card networks, must begin scaling their own IoT tokenisation solutions or risk missing this lucrative opportunity,” the report said.