It’s bonus season on Wall Street, and a rich one at that, but people aren’t spending like they used to, says Andy, an anonymous financier turned Instagram financial influencer.

On hold, for many, are the usual bonus-time baubles: bespoke Brionis, Rolex Daytonas, Porsches 911s and so on.

Instead, in these days of pandemic, war and financial uncertainty, more Wall Streeters are temporarily banking their 2022 bonuses.

Some, alarmed by the surge in inflation, are seeking shelter in cryptocurrencies. Others are sniffing out real estate in work-from-home-friendly locales.

And some, burnt out by two years of Covid-19, just want to take the money and run: They’re talking about early retirement, financial advisers say.

“Three years ago, it was awesome to have a nice custom suit. That’s obviously changed,” says Arbitrage Andy, who has 249,000 Instagram followers. “Because of the way things have played out, priorities have shifted.”

The average Wall Street bonus increased 20 per cent to $257,500, according to an analysis by New York State’s comptroller.

Payouts at Goldman Sachs Group are up by an average of 23 per cent, with bonuses for top earners approaching $30 million. At Jefferies Financial Group, pay for some of the best performers has surpassed $25m.

At Bank of America, a vice president said he was splashing out on a family holiday in Vail after being cooped up together for two years.

At Houlihan Lokey, where payouts are due in May, one banker said he wanted to see if New York finance returns to the office and a traditional five-day workweek. If not, he said, he might consider moving somewhere cheaper. For now, he plans to sock away his new cash and keep an eye on anxious financial markets.

president at Summit Place Financial Advisers

“The way clients are thinking about their bonuses and talking about them is different from the past,” says Liz Miller, president at Summit Place Financial Advisers. “It’s an outcome of a couple of years of the pandemic and ongoing uncertainty in general.”

Ms Miller has been providing financial advice to Wall Street-types for years. When bonus money arrives, the first thing many want to talk about is how they’re going to spend it.

But 2022 is the first time she’s hearing people talk about not spending bonus money — or even about walking away from Wall Street careers after a single, lump-sum payout, Ms Miller says.

Early retirement is what one client mentioned to Ms Miller when the bonus conversation came up. “We haven’t really heard that before,” Ms Miller says.

Of course, real estate agents, private jet services and purveyors of luxury goods are still dreaming of the golden crumbs that might fall off the bonus cake.

Pamela Liebman, chief executive of the Corcoran Group, predicts that real estate will remain a favoured destination for bonus money. More people are thinking about ways to escape from city life. Perennial favourites like Aspen, Miami and New York’s Hudson Valley and Hamptons areas are always a draw.

“You will see plenty of money go into second and third homes,” Ms Liebman predicts.

For those with money to burn, other luxuries beckon.

Brent Moldowan, president of Mayo Aviation, a charter private-jet company in Denver that handles Wall Street clients, says he’s booking as much as two months in advance.

Arbitrage Andy says he often gets messages during bonus season about how Wall Streeters plan to spend their money.

Many young bankers, he said, are talking less about picking up luxe items like shoes, bags or coats when time spent at the office has decreased. Instead, they’re wondering about moving to Florida or Texas, or maybe taking a holiday to the Caribbean or somewhere like Montana. They are also eyeing investment markets.

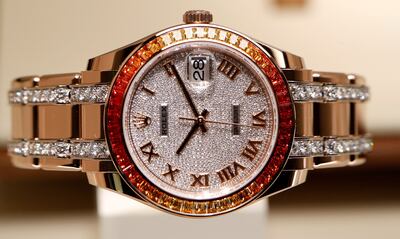

“With the rise of the retail investment phenomenon, a lot of people are just investing,” Arbitrage Andy said. “For the younger crowd, it’s redundant but watches is usually the biggest thing without a doubt.”

But Wall Street-types who are still hankering after a fancy Rolex might have a tough time finding one soon. Given demand and pandemic supply snags, the prices of second-hand Rollies are rising, according to João De Brito e Faro, watches supply manager at online retailer Farfetch.

The waiting list for Daytonas, Submariners and GMT Master IIs can run as long as six or seven years unless people have a long-standing relationship with a dealer.

“Right now, the big problem is that even if they want to get one of those watches, they are probably not going to be able to,” he said.