With the world gradually recovering from the effects of Covid-19, despite the onset of the Omicron variant, the New Year's holiday season will be characterised by shopping sprees. But it is important to guarantee that you make every penny count.

About 62 per cent of households in the Middle East reported a reduction in income and 49 per cent registered an increase in expenses during Covid-19, a study by PricewaterhouseCoopers found last year. The topic of saving, therefore, assumes even more importance during the festive season.

Life is unpredictable. With no indication of what lies in store for us, it is best to be prepared in every aspect possible.

We have imbibed an important life lesson from our parents: saving money. However, it becomes far more important in the latter phase of our lives as saving money is a necessity for every individual at a personal level.

Managing your money and finances is no rocket science. Neither is it the hegemony of professional financial advisers. Usually, people who struggle to save money are victims of bad spending habits.

We have all been there – an indulgent purchase, an impulsive vacation, an unforeseen emergency – these are inevitable situations in everyday life. But, you can easily adapt to these circumstances if you only spend after you save.

Putting money away in savings or investments in a systematic manner can help you avoid financial problems. It can help you in your hour of need and guarantee that your family has a cushion to fall back on in the event of an emergency.

Savings are essential for everyone, regardless of one’s income, expenditure or life stage. Here are some reasons why you should start saving:

- It provides peace of mind.

- It ensures a brighter future.

- It covers future expected liabilities such as children’s education.

- It protects your family in the event of financial turmoil.

But how does one save money? Here are a few tips:

Create a budget for savings

It is a good idea to create a monthly budget. You can plan at the beginning of each month to save and establish spending limits. This allows you to focus on what is essential, minimises the likelihood of overspending and put away some money as intended.

To stay on track with your budget, create a separate account for savings and transfer the planned amount on the salary date.

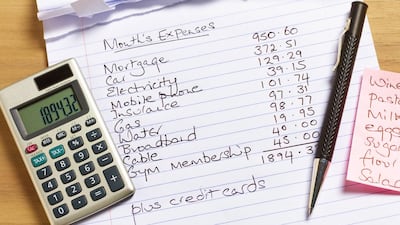

Record your expenses

If you find it difficult to save on a regular basis, consider keeping a record of your monthly expenditure. This will provide you with a clear picture of where your money is going. You may then identify non-essential items and strive to save more money by avoiding them.

Use your credit card smartly

Credit cards may give a momentary sense of comfort, but the hefty interest rates can quickly drain your funds.

They do offer rewards, cashback, miles or discount benefits. Prudent use of these cards will help you access easy credit and save a decent amount of money each month.

president, Hundred Offers

The cardinal rule for prudent use of credit cards is to pay the total outstanding bill in full every month before the due date. Otherwise, the card provider charges a hefty interest from the day of transaction.

Track discounts on your credit cards

It is difficult to be fully aware of relevant offers, especially with cards and loyalty programmes offering thousands of deals. Use aggregator apps to identify the best deals, which help you save money while purchasing everyday essentials.

Invest in long-term financial plans

It is essential to watch your money develop over time while you save. Investing in a long-term plan provides a decent rate of interest or return and allows your money to retain its value and outperform inflation.

Nitin Agarwal is the president of Hundred Offers.