Sterling volatility is getting a shake-up as the risk of the UK crashing out of the European Union grows.

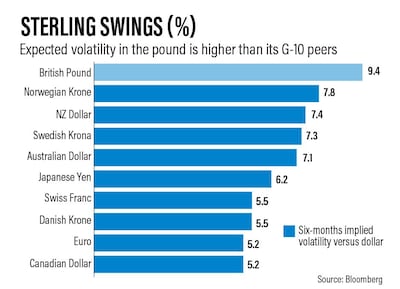

Measures of expected pound swings over the next three and six months, covering the run-up to and the aftermath of the October 31 Brexit deadline, have surged to the highest among Group-of-10 currencies. The gauges may still climb, being well short of the levels ahead of the original March deadline. UK Brexit Secretary Steve Barclay says no-deal risks are "underpriced".

The pound is bucking a trend of almost unprecedentedly low volatility in the multi-trillion-dollar-a-day market for foreign exchange, as it mirrors the twists and turns of the Brexit saga. Bets on swings are more in line with emerging-market currencies such as the Mexican peso and Brazilian real, given the myriad of political risks that could drive a sharp move.

"With the October 31 deadline about to enter the three-month expiry window, the options market is pricing in the expectation of higher and higher volatility ahead of that expected cliff-edge," said Ned Rumpeltin, the European head of currency research at Toronto Dominion Bank.

The pound's latest slide and volatility have coincided with the contest to replace Prime Minister Theresa May after she stepped down following failure to get her deal with Brussels through Parliament. Both contenders Boris Johnson and Jeremy Hunt have said they would take the UK out of the bloc if no deal could be reached, and this week toughened their rhetoric.

Three-month implied sterling-dollar volatility touched 8.72 per cent Wednesday while the six-month gauge hit 9.49 per cent, both the highest since April. By contrast JPMorgan's Global FX Volatility Index is hovering near record lows.

Given what's at stake if Britain broke away without a deal, sterling volatility ought to be much higher according to Esther Reichelt, a currency strategist at Commerzbank. Reichelt pointed to the surge in volatility in the run up to the Brexit deadline of March 29 when a similar gauge jumped to an 18-month high.

"That shows that the majority of market participants is speculating on a further extension — and most likely further negotiations, which could push the actual decision on what kind of Brexit to expect further into the future," Ms Reichelt said. "The market does still see predominant pound-idiosyncratic risks but in my opinion might still be too optimistic about how these risks will eventually play out."