Digital economies require digital currencies. Technological developments and innovation have transformed the payment system landscape in the past decade, with an additional boost from the pandemic.

Personal, government and business payments shifted away from mainly cash to online and digital payments, embraced FinTech (eg, for financial market transactions, lending, wealth management), with tech companies such as Apple and Alibaba disintermediating banks.

Retail, wholesale, cross-border and financial payment systems now enable e-commerce and digital finance including digital assets and cryptocurrencies such as Bitcoin and Ethereum.

Data suggests there is substantial appetite for cryptocurrencies in the Middle East and North Africa: the region had the sixth largest crypto economy globally, with an estimated $389.8 billion in on-chain value received, in the year ending June 2023 (about 7.2 per cent of global transaction volumes).

Saudi Arabia reported the highest growth globally in the volume of cryptocurrency transactions during this period.

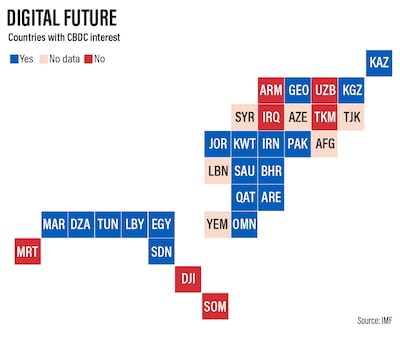

As the use of cash declines, central banks have been exploring the feasibility of establishing their own peer-to-peer payment systems through Central Bank Digital Currencies (CBDCs). Currently, about 134 countries and currency unions (representing 98 per cent of global gross domestic product) are exploring CBDCs, including 13 in the Arab world.

While many are in pilot stages, Bahrain, Saudi Arabia and the UAE have moved to the more advanced “proof-of-concept” stage.

Globally, three countries have launched a retail CBDC – the Bahamas, Jamaica and Nigeria – and a 2022 BIS survey forecasts there could be 15 retail and nine wholesale CBDCs publicly circulating in 2030.

A retail CBDC is used by the general public, while a wholesale CBDC is accessible only by financial and certain non-bank institutions.

In contrast to cryptocurrencies, which are mainly decentralised, CBDCs are digital cash, legal tender, issued by and a liability of the central bank. They are basic payment infrastructure for increasingly digital economies, enabling secure, efficient, monetary, financial and digital transactions.

The International Monetary Fund highlights the need to build trust in CBDCs through robust institutional, legal and technological safeguards to protect user privacy while ensuring compliance with anti-money laundering and combatting the financing of terrorism (AML/CFT) standards.

The successful implementation and adoption of CBDCs requires secure and inclusive public digital infrastructure to facilitate integration and competition between public and private payment providers.

The adoption requirements pose challenges for developing countries. There are large digital and financial divides across the Mena region, with only about two thirds of the population in the Arab states using the internet (in line with the global average). The wide disparities within the region reflect the economic and digitalisation divide between the oil-rich GCC and the non-oil countries.

Benefits for Mena region

The roll-out and use of CBDCs offer multiple macro and socio-economic benefits in the Mena region as the digital economy expands.

Firstly, for the developing nations subset, a retail CBDC could lead to greater financial inclusion. As per the Global Findex Database 2021, only 48 per cent of adults in the region (excluding high-income nations) have a financial account, about 23 percentage points lower compared to the developing economy average.

Secondly, CBDCs can be used for social transfers, for targeting subsidies as well as for payment of fees and taxes in an efficient and cost-effective manner.

Thirdly, for the more advanced nations such as the UAE and Saudi Arabia that aspire to be international financial centres, wholesale CBDCs would facilitate cross-border payments and settlement. Interoperability would enable greater adoption and usage of the CBDC, but this requires ongoing co-operation between central banks. This will ensure that differences in legislation and national standards for data handling or cyber security provisions can be aligned.

Fourthly, leveraging data derived from CBDC usage can be used to establish credit profiles to reduce lending gaps.

What needs to be done?

CBDCs need to be complemented by secure and inclusive digital public infrastructure, a cohesive, integrated digital network including digital ID, payments and data exchange.

This could be along the lines of a national digital ID (eg, India’s success with the Aadhar card), real time payment systems (eg, Thailand’s PromptPay, Brazil’s Pix or Egypt’s InstaPay) or integrated payment systems (eg, digital Yuan e-CNY pilot programme and integration with Hong Kong) among others.

Digital inclusion needs to be one of the pillars of a CBDC rollout, along with financial literacy and data protection integrated into the process. Effectively, CBDCs are public goods and require swifter action and implementation.

Will CBDCs accelerate de-dollarisation?

Following the visit of President Sheikh Mohamed to China, a joint statement by the Chinese and UAE central banks highlighted the role of CBDCs in enhancing cross-border trade and investment. The UAE had completed in late January its first cross-border payment using the digital dirham – a payment of Dh50 million to China using the BIS mBridge cross-border CBDC platform where both countries are participants.

Saudi Arabia joined the mBridge project on June 6.

These moves could result in an alternative to conducting cross-border transactions without depending on the dollar.

The UAE and Saudi Arabia’s successful Project Aber in 2020 to settle cross-border payments, and their co-operation under the mBridge project, can be seen as a stepping stone towards greater economic and financial integration in the wider GCC region.

Globally, the dollar’s dominance in transactions has been long-standing: according to SWIFT, it accounted for 47.37 per cent of total transaction value as of March. However, oil sales are also being transacted in non-dollar currencies including the Chinese yuan and the UAE dirham.

Weaponisation of the dollar (eg, via financial sanctions or freezing of assets and using the income on sanctioned assets) renders “risk-free” US assets risky, encouraging countries to reduce the share of dollar assets, including in international reserves.

The dollar in allocated reserves globally stood at 58.4 per cent as of end-2023, from around 70 per cent at the turn of the century, with central banks raising the share of non-traditional reserve currencies (including the yuan, Australian dollar, and the Nordic currencies among others) as opposed to euro, yen or pound.

There has also been a distinct shift to holding gold as a hedge instead, helping boost gold prices. A successful implementation of CBDCs could boost de-dollarisation – reduce the dependence on SWIFT and the use of dollars, thereby changing and challenging the current geopolitical financial topography.

Given the role of China as the world’s biggest trading nation, it is the yuan and the petro-yuan that will become the de facto Brics+ trade finance and payments currency.

Nasser Saidi is the president of Nasser Saidi and Associates. He was formerly Lebanon's economy minister and a vice-governor of the Central Bank of Lebanon