Central bank digital currencies, or CBDCs, are gaining popularity, with 109 countries actively exploring or engaging with them across various phases of development as of last month, a new report has found.

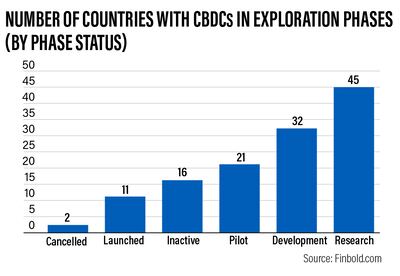

Forty-five countries are involved in research, 32 in development, while 21 are in the pilot stage of exploration, according to the study compiled by Finbold, a UK-based financial news platform. Eleven countries have already launched their CBDC projects, while two have cancelled their involvement.

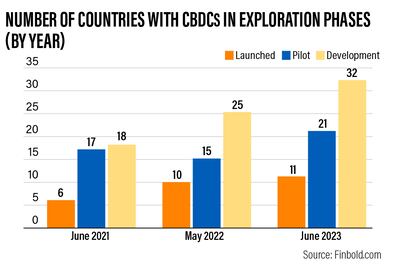

The number of countries in advanced exploration phases of CBDC development reached its highest level in June, with 64 countries – a 28 per cent increase from 50 countries in May last year, Finbold said. In June 2021, the total was 41 countries.

"The notion that the rise of cryptocurrencies and stablecoins poses a threat to national currencies has emerged as one of the key drivers behind CBDCs,” the report said.

“In this case, CBDCs respond to this challenge, ensuring central banks keep up with the digital revolution."

CBDCs are the digital form of a country’s money issued by its central bank. They are similar to cryptocurrencies but their value is fixed by the monetary authority and equal to the country's fiat currency.

CBDCs are expected to provide some middle ground for the highly volatile cryptocurrency market. They potentially reduce the risks associated with using cryptocurrency and provide a stable means of exchanging digital assets.

Blockchain, which is an expanding digital chain of transactions linked to each other using cryptography, is the key component of CBDCs. It is a mechanism for secure communications and creates an open ledger to record transactions in real time.

Up to $5 trillion could move to newer digital money formats such as CBDCs and stablecoins by 2030, of which about half could be linked to distributed ledger technology or blockchain, according to a report by Citi Global Perspectives and Solutions.

Governments are also positioning CBDCs to boost the efficiency and safety of retail and large-value payment systems, the Finbold report said. For example, CBDCs can improve cross-border payment efficiency and mitigate counterparty credit risk.

They are also seen as a catalyst for accelerating the shift to a cashless society.

“This transition can lead to reduced costs for central banks, improved traceability to combat vices such as tax evasion and illicit transactions, and enhanced security in fund transportation and payments,” the report said.

Several governments and central banks have taken steps to create frameworks for the implementation of CBDCs into their economies.

In March, the UAE Central Bank began enacting its digital currency strategy, Digital Dirham, as it prepares the country's infrastructure for the future of finance.

It signed an agreement with Abu Dhabi's G42 Cloud and digital finance services provider R3 to be the infrastructure and technology providers, respectively, for the implementation of the CBDC.

However, despite the rapid acceptance of CBDCs, there are some concerns, such as a threat to privacy and operational challenges, the Finbold report said.

Some of the operation challenges include infrastructure development, ensuring interoperability, and managing the transition from cash to digital currency, which could be intricate and expensive for governments and central banks.

“CBDCs could enable governments and central banks to monitor and track financial transactions, potentially compromising individuals’ privacy rights … cybersecurity vulnerabilities also pose a risk,” Finbold editor Justinas Baltrusaitis wrote in the report.

“The digital versions of fiat currency could also impact traditional monetary policy tools, reducing central banks’ control over the money supply and the effectiveness of monetary policy measures.”

While CBDCs offer potential for financial inclusion, there is a risk of exacerbating technological inequalities, as access to the necessary digital infrastructure is not evenly distributed, the report said.

Last month, the International Monetary Fund unveiled plans to create a global platform for the implementation of CBDCs. However, it also warned that if not designed well, they could cause considerable risks for the financial system and economies.

The Washington-based fund’s managing director Kristalina Georgieva said a standardised CBDC platform could help bridge the financial gap.