India's economy and equity markets are outperforming most of their global peers. Despite a slew of challenges including macroeconomic headwinds stemming from Russia's war in Ukraine, elevated crude oil prices and tightening liquidity globally, the growth story of Asia's third-largest economy remains intact.

“The Indian economy and equity markets proved to be resilient and outperformed most developed and emerging economies globally, as it [the economy] is still growing at one of the highest rates compared to most others,” says Mitul Shah, head of research at Mumbai-based Reliance Securities.

India is projected to be among the fastest-growing economies in the world this year and the pace of growth it has achieved so far is impressive. However, its resilience does not mean it is immune to the inflation-fed global economic slowdown.

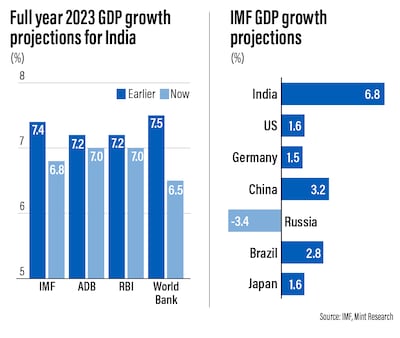

The International Monetary Fund this month cut India's gross domestic product growth forecast to 6.8 per cent for the current financial year to the end of March, from an earlier projection of 7.4 per cent.

The revised estimate is still significantly stronger than the IMF's growth estimates for the world's two largest economies — US at 1.6 per cent and China at 3.2 per cent.

The global economy is being battered by a multitude of factors and the world risks a recession in 2023 just as it tries to recover from the Covid-19 pandemic, IMF managing director Kristalina Georgieva said earlier this month.

In its latest outlook report this month, the fund kept its global economic estimate for this year at 3.2 per cent but downgraded next year's forecast by 0.2 percentage points to 2.7 per cent.

Inflation in particular has been damaging, soaring to its highest levels in four decades, forcing central banks around the world to aggressively raise policy rates to temper it, which could further slow down growth and stoke fears of a recession.

“Globally every major economy is battling inflation,” says Sumit Chanda, chief executive and founder of Jarvis Invest, an artificial intelligence-based equity portfolio advisory platform. “What works for India is the fact that since we are consumption driven — and that too with favourable demographics — domestic demand is never an issue.”

India is due to overtake China next year as the world's most populous country with more than 1.4 billion people, according to the UN.

There are external factors that are working to India's advantage, too.

“Commodity prices have eased off due to slowdown in global demand, which has worked in our favour,” says Mr Chanda. “We have also been witnessing the 'China-plus-one' trend that has augured well for our manufacturing sector.”

India's stock markets have also avoided falls in major equity indexes, with the benchmark BSE Sensex recording small gains since the beginning of the year. By contrast, the Dow Jones Industrial Average is down 15 per cent, while the Hang Seng index is down more than 30 per cent.

“The Indian economy, as well as the Indian equity markets, have so far ‘decoupled’ this year,” said a research note by Julius Baer, a Swiss private banking group. “This decoupling has happened despite all the possible global headwinds.”

“The key reasons for the outperformance is that India is one of the few large economies globally which are growing faster than peers, coupled with significant turnaround in the earnings of India Inc,” the report said.

Indian stocks have managed to avoid a slump, despite a record outflow of funds of foreign portfolio investors this year, triggered by a strong US dollar and the US Federal Reserve's aggressive interest rate increases that drive capital flows to the greenback.

Domestic investment into equities is what has largely saved the Indian benchmarks to avoid major declines.

“In the Indian markets, the domestic flow into equities is extremely high,” says Amit Jain, co-founder of Ashika Global Family Office Services. “If you observe the figures, foreign investors have sold about 2 trillion rupees ($2.42 billion) in the last year and this has been bought by Indian domestic investors.”

The surge in domestic investment is supported by a positive outlook for earnings, helped by a pickup in consumer demand in India after Covid-19 restrictions were eased, which has facilitated a recovery in the economy, analysts say.

“India is a domestic-orientated economy and consumption looks very strong”, at the moment, says Mr Jain.

Spending trends during the ongoing Diwali festival, typically a time when Indians loosen their purse strings, are very promising and bode well for earnings growth, he says.

“The festival season is likely to add further [momentum] to the economy after two years of disruption and lockdown-led restrictions,” says Mr Shah. “The market witnessed strong demand for various consumer products in the first half of this financial year despite higher prices.”

Julius Baer says the rise in earnings for Indian companies at about 15.5 per cent compound annual growth rate over the next two years, “pegs India as one of the strongest earnings growth stories globally”.

“Stock price increases are intricately linked to growth in corporate profits,” says Rajiv Shastri, director and chief executive of NJ Asset Management.

“In addition, as a larger cross section of our population gets included into the financial markets, flows into equities are also expected to remain robust.”

The robust Indian corporate earnings outlook has driven domestic flows from both retail and institutional over the past few quarters, however, there are risks that could disrupt the investment momentum, Sandeep Bagla, chief executive of Trust Mutual Fund, says.

“There could be headwinds in the future as rates would [likely] be hiked across countries and the inflation could persist”, longer than many anticipate, he says.

For Mr Shah “the biggest risk” is the depreciating Indian rupee against the US dollar which is exacerbating imported inflation, as imports from overseas become more costly with the unfavourable exchange rate. Indian rupees hit an all-time low of 83 against the dollar last week and some analysts expect it to slide further.

“This may stretch our dollar outflow and forex reserve getting impacted going forward,” says Mr Shah. “Sharp weakening of [the] domestic currency and high inflation … may prove to be [a] major drag on [the] economy and equity markets.”

This is a critical area for India given that the country imports crude to meet most of its energy needs.

co-founder of Ashika Global Family Office Services

“Access to cheap fuel is crucial for India's stability,” says Mr Shastri. “If that is disrupted, we may see a wrinkle in an otherwise smooth ride.”

Rising consumer prices continues to be an area of concern in India, particularly after the most recent government data showed retail inflation hitting 7.41 per cent in September, a five-month high.

Global supply and energy and food prices-driven inflation is also a threat to Indian corporate that may fail to “deliver earnings growth in lines with expectations,” as the economy slows, says Nitasha Shankar, head of premium research service at Yes Securities.

But the positives outweigh the negatives for now.

“We believe India continues to have good tailwinds including increasing credit growth, real GDP acceleration, goods and services tax collection, purchasing managers' index numbers, forex reserves, resilient agricultural sector, and a low external debt to GDP ratio,” says Ms Shankar.

Mr Jain also remains upbeat about the economic outlook, but says “export-orientated sectors may take a hit for some time until this global crisis and turmoil settles down”.

Barring any major upsets, he is also optimistic about the country's equities market.

“We are cautiously bullish with regard to the Indian stock markets keeping the next two to three-year horizon in mind,” says Mr Jain.

Globally, there is an increased stagflation risk for the world economy but “I believe that geopolitical risks are much higher than interest rate risks at the moment” he says.

“While the sentiment is positive, we should be careful that it doesn’t transform into euphoria,” Mr Chandra says.

“We haven’t completely decoupled from the challenges of the global macroeconomic front. Any setback here will have a material impact on our markets.”