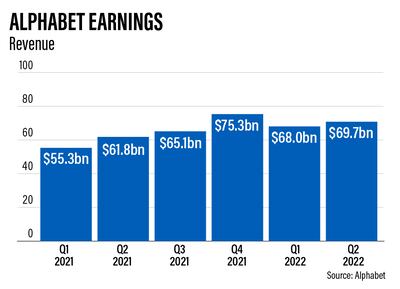

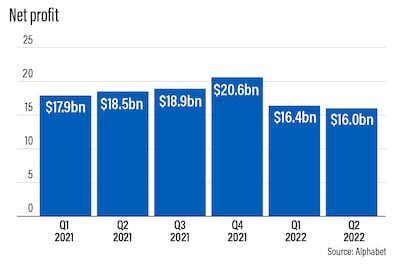

Alphabet, the world's largest provider of search and video ads, on Tuesday reported a 14 per cent drop in second-quarter net profit on an annual basis, as the company missed the analysts' sales expectations.

Net profit at Google's parent company dropped to about $16 billion in the three months to the end of June, more than $2.5bn less than the same period in 2021. Net profit on a quarterly basis fell about 2.6 per cent.

Revenue during the period rose 13 per cent annually to $69.7bn against expectations of about $70bn.

Alphabet’s chief executive

“In the second quarter, our performance was driven by search and cloud [businesses] … the investments we have made over the years in AI [artificial intelligence] and computing are helping to make our services particularly valuable for consumers and highly effective for businesses of all sizes” Alphabet’s chief executive Sundar Pichai said.

“As we sharpen our focus, we will continue to invest responsibly in deep computer science for the long term.”

Alphabet stock rose nearly 2.3 per cent to $107.4 a share in after-hours trading on Tuesday. Following the moves of Apple and Tesla in the past couple of years, the company carried out a 20-for-1 stock split on July 15.

Alphabet, which employs 174,014 people globally, earned nearly 47 per cent of its second-quarter revenue or more than $32.7bn from the US market. In Europe, the Middle East and Africa, the company earned $20.5bn, or 29.5 per cent of its total sales.

In the last quarter, Alphabet’s operating income remained flat at about $19.5bn. Its earnings per share dropped 11 per cent yearly to $1.21, missing analysts’ estimates of $1.28.

Google services business — which includes advertisements, Android, Chrome, hardware, Maps, Search, Google Play and YouTube — accounted for more than 90 per cent of the company’s total sales. It added $62.8bn to overall revenue, almost 10.1 per cent more than the second quarter of 2021.

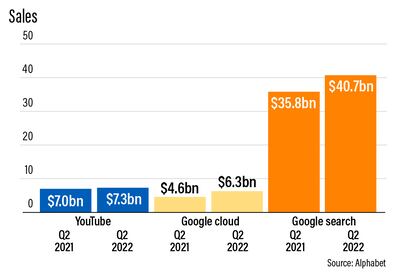

Google’s advertising revenue from Search, YouTube and other businesses increased 11.5 per cent yearly to nearly $56.3bn in the second quarter.

The total revenue from the cloud business grew an annual 35.6 per cent to about $6.3bn in the April-June period.

Google Cloud includes the company’s infrastructure and data analytics platforms, collaboration tools and other services for enterprise customers. It generates revenue mainly from fees received for cloud platform services and workspace collaboration tools.

Alphabet said its operating loss in the cloud segment reached $858 million during the quarter. It expanded from the second quarter of last year, when the division’s loss was $591m.

The California-based company’s operating loss from other bets, or subsidiaries, increased more than 20 per cent yearly to about $1.7bn.

Other bets are derived mainly through the sale of internet offerings, as well as licensing and research and development services. This includes Alphabet’s X lab, self-driving unit Waymo and other non-Google companies.

Alphabet spent more than $9.8bn on research and development, nearly 14.1 per cent of its total sales in the second quarter. This was 28.2 per cent more than the R&D expenditure of the same period in 2021.

“Our consistent investments to support long-term growth are reflected in our solid performance in the second quarter … we are focused on responsible capital allocation in support of our growth opportunities,” Alphabet’s chief financial officer Ruth Porat said.

YouTube added more than $7.3bn to Alphabet’s revenue, surging more than 4.8 per cent annually, almost matching streaming service company Netflix’s second-quarter revenue of $7.9bn.

Google’s TAC (total acquisition costs) stood at $12.2bn, up 11.8 per cent on an annual basis, against analysts’ expectations of $12.4bn.

TACs are payments that search companies make to affiliates and online companies for bringing traffic to their websites. It is a major source of expenses for companies such as Google and Yahoo.

Alphabet’s total cash, cash equivalents and marketable securities reached almost $125bn at the end of June, from $139.6bn at the end of last year.

Google will launch its new budget smartphone — Pixel 6a — this week as it seeks to increase its market share in a space currently ruled by rivals Apple and Samsung. First announced at the I/O developer conference in May, the new phone, priced at $449, will be available on shelves on Thursday.