KUWAIT CITY // A crisis in Kuwait's banking system and an uproar from disgruntled investors entered a fourth day today, sowing political and economic turmoil as the tentacles of the global financial crisis reach further into the Gulf. Bassam al Ghanim, the chairman of Gulf Bank, Kuwait's fourth-largest lender by market value, resigned today, two days after it was revealed that losses of up to 200 million Kuwaiti dinars (Dh2.7 billion) had been incurred due to bad bets on currency derivatives. The news spurred depositors to throng around the bank's main branch on Ahmad Al Jaber street on Sunday to withdraw money.

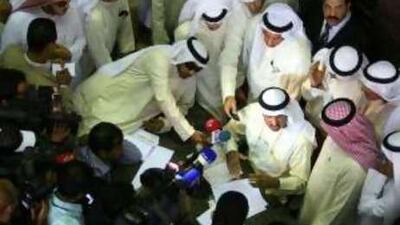

Fitch Ratings downgraded Gulf Bank's credit rating to 'D' from 'B/C' and simultaneously placed it on rating watch negative. Mr Ghanim was replaced by his brother Kutayba al-Ghanim. The new chairman said Gulf Bank, which is only active in Kuwait, might increase its capital or seek support from its major shareholders, according to Reuters. Traders on the Kuwaiti stock exchange, meanwhile, continued to protest today and repeated demands for a halt in all trading after the index declined for a fifth straight session, shedding 2.06 per cent to 9,685 points, down 22.8 per cent since the beginning of the year. The traders planned to bring their grievances before legislators at Kuwait's National Assembly this morning.

"They will be fighting there, because everybody is afraid," Faisal al Bader, a trader at the exchange who has participated in the protests, said today. "I don't know what is causing the declines, but I think they must put 5bn [Kuwaiti dinars] in." The government has already been acting as a participant in the market by buying shares when no other buyer can be found, sources say. The market is too large, however, for the government to prop up indefinitely.

And with oil prices on the decline, inflation on the rise and the financial crisis spreading, Kuwait's power brokers and market authorities find themselves in an increasingly difficult position, tugged on all sides by pressures that are being felt throughout the region. Just when revenues are decreasing because of sagging oil prices, investors and banks are demanding - and in some cases desperately needing - massive cash infusions.

"Even the government cannot help if oil prices keep dropping," Abdullah bin al Eissa, a retired businessman, said at the exchange today. Gulf Bank's troubles only add to the pain felt by Kuwaiti businessmen and investors in recent days. Trading in Gulf Bank shares was suspended when the bank's losses were revealed on Sunday, and the stock is not expected to trade again until a task force set up by the Central Bank of Kuwait investigates what happened. But the central bank has stopped short of halting all activity on the exchange, which many traders view as essential to prevent further declines as the government formulates its response.

Gulf Bank's losses stemmed from derivative contracts in which clients were betting that the dollar would weaken against the euro. When the dollar strengthened by more than eight per cent in 10 days, they incurred losses that they were either unable or unwilling to cover, leaving the bank to foot the bill. Ibrahim Dabdoub, the chief executive of the National Bank of Kuwait, the country's largest lender, estimated on Sunday that losses could be up to 200m dinars, leaving depositors clamouring to withdraw their money.

The central bank said on Sunday it would rush through legislation to guarantee all deposits at Kuwaiti banks, reversing a position it had taken just a week before. Bank officials also scrambled to reassure depositors, describing the Gulf Bank losses as an isolated incident that did not portend systemic trouble. Gulf Bank was dealt yet another blow when the ratings service Moody's announced the bank was being placed on watch for a possible downgrade.

Ratings are important because they govern how cheaply financial institutions can borrow money. Higher ratings generally translate into better profit margins. Analysts said the bank's problems did not directly threaten to undermine the banking system in Kuwait, or elsewhere. But many banks in the Gulf have similar contracts on their books, and volatility in global markets due to the financial crisis increases the risk of more large losses in derivative contracts gone bad.

@Email:afitch@thenational.ae