Back in December we ran three excerpt from Richard Thaler's book Misbehaving, which describes the halting start and eventual rise of behavioural economics, a field in which the University of Chicago professor is among the pioneers.

Now, as the book is about to launch its paperback edition tomorrow, we present a fourth excerpt in which the author uses a game to illustrate the inefficiency of markets.

THE EXCERPT

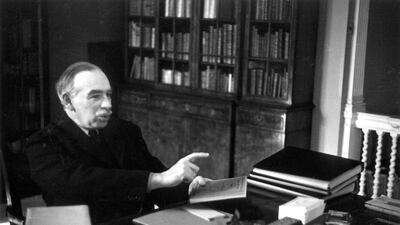

By the time he was writing The General Theory of Employment, Interest and Money in the mid-1930s, John Maynard Keynes had concluded that markets had gone a little crazy. "Day-to-day fluctuations in the profits of existing investments, which are obviously of an ephemeral and non-significant character, tend to have an altogether excessive, and even an absurd, influence on the market." To buttress his point, he noted the fact that shares of ice companies were higher in summer months when sales are higher. This fact is surprising because in an efficient market, stock prices reflect the long-run value of a company, a value that should not reflect the fact that it is warm in the summer and cold in the winter. A predictable seasonal pattern in stock prices like this is strictly verboten by the efficient market hypothesis (EMH).

Keynes was also sceptical that professional money managers would serve the role of the “smart money” that EMH defenders rely upon to keep markets efficient. Rather, he thought that the pros were more likely to ride a wave of irrational exuberance than to fight it. One reason is that it is risky to be a contrarian. “Worldly wisdom teaches that is it is better for reputation to fail conventionally than to succeed unconventionally.” Instead, Keynes thought that professional money managers were playing an intricate guessing game. He likened picking the best stocks to a common competition in the male-dominated London financial scene in the 1930s: picking out the prettiest faces from a set of photographs:

“Professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole: so that each competitor has to pick, not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view. It is not a case of choosing those which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice, the fourth, fifth, and higher degrees.”

I believe that Keynes’s beauty contest analogy remains an apt description of how financial markets work, as well as of the key role played by behavioural factors, though it may be bit hard to get your head around. To understand the gist of his analogy, and appreciate its subtlety, try out this puzzle.

Guess a number from 0 to 100 with the goal of making your guess as close as possible to two-thirds of the average guess of all those participating in the contest.

To help you think about this puzzle, suppose there are three players who guessed 20, 30 and 40 respectively. The average guess would be 30, two-thirds of which is 20, so the person who guessed 20 would win.

Now, let’s ponder how someone might think about how to play this game.

Consider what I will call a zero-level thinker. He says: “I don’t know. This seems like a maths problem and I don’t like maths problems, especially word problems. I guess I will pick a number at random.” Lots of people guessing a number between 0 and 100 at random will produce an average guess of 50.

How about a first-level thinker? She says: “The rest of these players don’t like to think much, they will probably pick a number at random, averaging 50, so I should guess 33, two-thirds of 50.”

A second-level thinker will say something like: “Most players will be first-level thinkers and think that other players are a bit dim, so they will guess 33. Therefore I will guess 22.”

A third-level thinker: “Most players will discern how the game works and will figure that most people will guess 33. As a result they will guess 22, so I will guess 15.”

Of course, there is no convenient place to get off this train of thinking.

Now let’s see how this game is related to Keynes’s beauty contest. Formally, the set-ups are identical. In the guess-the-number game, you have to guess what other people are thinking that other people are thinking, just as in Keynes’s game. In fact, in economics, the “number guessing game” is commonly referred to as the “beauty contest”.

This delightful game was first studied experimentally by the German economist Rosemarie Nagel, who teaches at Pompeu Fabra University in Barcelona. Thanks to the Financial Times newspaper, in 1997 I had the opportunity to replicate her findings in a large-scale experiment. The FT had asked me to write a short article about behavioural finance and I wanted to use the guess-the-number game to illustrate Keynes's beauty contest.

Based on what you know now, what would be your guess playing with this crowd?

The winning guess was 13. The distribution of guesses was as shown in the table on this page.

We asked participants to write a short explanation of their logic, which we would use as a tiebreaker. Their explanations provided an unexpected bonus. Several were quite clever.

There was a poet who guessed zero: "So behaviourists observe a bod, an FT reader, ergo clever sod, he knows the competition and will fight 'em, so reduces the number ad infinitum."

Here is a Tory who, having decided the world cannot be counted on to be rational, guessed 1: “The answer should be naught [0] … but Labour won.”

A student who guessed seven justified his choice: “because my dad knows an average amount about numbers and markets and he bottled out at 10.”

Finally, another poet who guessed 10: “Over 67 only interests fools; so over 45 implies innumeracy rules. 1 to 45 random averages 23. So logic indicates 15, leaving 10 to me.”

As illustrated by all these FT guessers, at various levels of sophistication, we see that Keynes's beauty contest analogy is still an apt description of what money managers try to do. Many investors call themselves "value managers", meaning they try to buy stocks that are cheap. Others call themselves "growth managers", meaning they try to buy stocks that will grow quickly. But of course no one is seeking to buy stocks that are expensive or stocks of companies that will shrink.

So what are all these managers really trying to do? They are trying to buy stocks that will go up in value – or, in other words, stocks that they think other investors will later decide should be worth more. And buying a stock that the market does not fully appreciate today is fine, as long as the rest of the market comes around to your point of view sooner rather than later! Remember another of Keynes’s famous lines. “In the long run, we are all dead.” And the typical long run for a portfolio manager is no more than a few years – maybe even just a few months.

Reprinted from Misbehaving: The Making of Behavioral Economics by Richard H Thaler. Copyright 2015 by Richard H Thaler. With permission of the publisher, WW Norton & Co, Inc. All rights reserved.

This selection may not be reproduced, storied in a retrieval system, or transmitted in any form by any means without the prior written permission of the publisher.

business@thenational.ae

Follow The National's Business section on Twitter