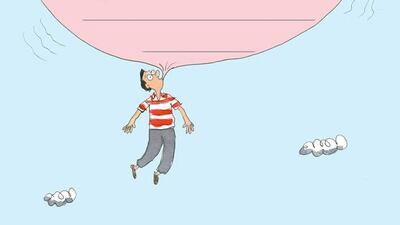

Has passive performance peaked? A debate is brewing. Over a bubble forming. No surprise there. There’s always some asset that’s overpriced, or cautioned to be. What’s interesting with this one is that it’s passive investing that is said to be ballooning.

It was but a matter of time that passive investing got it in the neck.

Since 2007, a huge amount of money has been flooding into it. The Financial Times estimates that, over the past decade, investors pulled US$747 billion out of actively managed equity funds – with significantly more than that, $1.65 trillion – put into passively managed equity index funds.

Which means that so-called active fund managers are losing out on fat fees. They’re not the only ones.

Bloomberg is also hurting. Its – very expensive – terminals, providing comprehensive fundamental data to support active trading – are running out of customers.

This is how serious things are: the first time Bloomberg registered a worrying decline in demand for its terminals was 2009, with 20,000 users pulling the plug. The second time was last year, when its number of terminals dropped by 3,145.

And things are bound to get worse if Moody’s is right.

Credit rating agency Moody’s believes that the passive market will become bigger than the active market in the US by 2024.

All this points to passive being a problem. For some. For former monopolies, and aspiring fat cats. So when Ned Davis, of Ned Davis Research, states that passive investment looks done to him (he came out with this just last month) I question the timing, as well as the detail.

One thing’s for sure. The scene is set. All you have to do is grab great seats and a bucket of popcorn then wait for the action. The passive-investing-bashing show is sure to run at a place near you.

But before getting swept up in the frenzy, let’s have a think. I go back to my opening paragraph. A way of investing – a technique, process, or technology, is said to be the overinflated bubble in the making.

But bubbles happen in asset classes, not investment techniques.

Think the dot-com bust of ‘90s. Or the US housing bubble of the past decade.

I don’t think it’s reasonable to say the passive process is done. But I do think there will be trouble at some point. Why? Because the choice of what to invest in passively is getting bigger. The niches are getting narrower. This is typical – when there’s appetite, supply comes online with all sorts of options, fads and trend-following offerings. Passive funds included.

The other thing to note is that anything that promises liquidity when the market doesn’t is a problem waiting to happen. Exchange Traded Funds (ETFs), cited repeatedly as a reason that passive is doomed, epitomise this. ETFs promise you can take your money out whenever you want. This is nigh on impossible when there’s a run on the market.

Cast your minds back to UK-based property funds – that had similar promises – except they barred investors from taking their money out post-Brexit.

Don’t expect money back when you want, at the price you’d like.

It’s certain funds that will go pop. Not the way of investing.

Last week I wrote about robo-advisers. One point made was that they cannot proffer critical thought or insight or figure out that a bubble is forming.

This is why something like ETFs will probably be part of an exploding bubble sooner or later. Not necessarily the reason for the bubble and it bursting, as being touted in the media, but involved nonetheless – as a channelling and multiplying mechanism of some sort, pumped up by the likes of robo-advisers pushing more money into them – precisely because they are doing well. A self-fulfilling prophecy mushrooming.

Yes, passive funds are expanding, yes there’ll be trouble at some point, but I think they’re here to stay.

But because we’re human, there will likely be a scenario where passive play is paused, giving way to a stock-picking renaissance, only to go full circle to passive once we’ve woken up to the insanity of paying overpriced fees for underperforming funds again.

Passive investment is dead – long live active management. As much as many former monopolies would like us to think so, don’t. Passive won’t go pop.

Nima Abu Wardeh describes herself using three words: Person. Parent. Pupil. Each day she works out which one gets priority, sharing her journey on finding-nima.com.

pf@thenational.ae

Follow us on Twitter @TheNationalPF