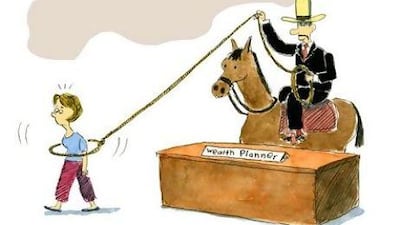

There's nothing worse than an unregulated, cold-calling cowboy, who rings you up out of nowhere and tries to talk you into meeting with one of their financial services agents, who will then proceed to put the hard sell on you.

I know I'm not the first person who's received these unsolicited calls - and I certainly won't be the last. But how many of you have been duped into signing up for an inappropriate savings plan that has been recommended by one of these supposed "wealth experts"?

The most common is the 25-year plan, sold to you not because it was the best way forward for your finances or your future, for that matter, but most probably because it offered a nice little earner in the form of a high commission for the salesman; sorry, financial planner.

If you are only here for a few years, how does it make sense to "sell" you something that locks you in for 25 years, not to mention the serious tax implications you will face when you are back home?

But here's what's interesting: the UAE Central Bank last year banned banks and other financial institutions that came under its jurisdiction from cold-calling potential customers.

At the time, Keren Bobker, The National's 'On Your Side' columnist, blogged about the ruling on her website.

"The unexpected ban, which took effect on 20th March, has surprised quite a few financial companies who work in this way, but does not apply to financial advisory firms that are licenced by the UAE's Insurance Authority," she said.

I see. So that's why we are still getting cold-calls; some financial services firms have an insurance licence and don't report to the Central Bank. Just one question, though: how does a financial services firm get an insurance licence?

What I also want to know is how the cold-calling cowboys get hold of our personal phone numbers. Is it through the promise of a free consultation to potential clients if they give up the numbers of 10 of their (soon to be ex) friends? Or is it by some other, unethical, means?

They certainly didn't get your number from the person they are calling: you. In my book, that's unethical and an invasion of privacy.

I've had a couple of cold-calls from these cowboys over the past month. I even registered a complaint against one company recently and copied in its chief executive for good measure, who has so far stayed silent, but is now copied in when his minion replies. And, of course, I also keep him in the loop.

The cold-call I received that prompted my complaint came, surprisingly, from the United Kingdom. Normally when I receive these calls, they are from the Emirates. But it turns out there was a good reason why this kid, at least he sounded wet behind the ears, was calling me from the UK. The London-based company he represents is expanding its network to the UAE and is trying to drum up business for its local agents, for which it has been advertising on the internet.

When I emailed my complaint to the company's compliance manager and chief executive, I demanded to know how they obtained my mobile phone number. I also requested that my details be deleted permanently from its database.

Unsurprisingly, he ignored my question about how they got my number. After all, if it was by deceptive means, he's not going to put that in writing. But here's what he said about the legality of cold-calling customers in the UAE:

"I have noted your comments on the legality of cold-calling, but thought I should clarify the position in the UAE and the UK. Cold-calling is illegal in the UAE only for companies with a banking licence." He went on to say that his company holds an insurance licence.

And added: "However, like you, we believe that cold-calling should be phased out."

But that doesn't explain the cold-call I received from his company last month. I also know other people received similar calls from the same company at the same time as me. In my book, that's a mass cold-call and in no way indicates that it is a practice this company will phase out any time soon.

But that's the nature of these types of companies that employ hard-sell tactics. They can't be trusted, despite what they say.

So here's what to do: if you receive a call from a financial services company looking to hard-sell you, ask them if they are regulated by the Central Bank. If they say yes, tell them you will register a complaint because their cold-call is illegal. If they say they have an insurance licence, tell them you will lodge a complaint with the UAE Insurance Authority. If it gets enough complaints from consumers, perhaps it, too, will outlaw cold-calls.

And if they persist, ask them which part of "no" they don't understand: the "n" or the "o"?

Then hang up.