Rob Lloyd, the chief executive of Hyperloop Technologies, has said that he hopes the UAE will be one of the early adopters to embrace its ultra-fast transport system.

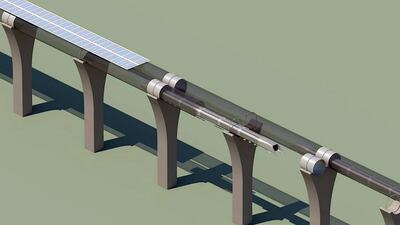

Hyperloop is a tube-based transportation system currently under development that can move containers or up to 40 people in a single capsule at speeds of up to 1,100 kilometres per hour, which could potentially cut journey times between Abu Dhabi and Dubai to 15 minutes.

Although he declined to discuss conversations with individual customers, Mr Lloyd said on the sidelines of Middle East Rail that he “would expect the history of innovation in this region could make Dubai and the UAE one of the first places where the Hyperloop comes into production”.

“Our goal in the next few years is to select the top three projects in the world where we can build the Hyperloop, where we can demonstrate its capabilities and we will be working with innovative companies, regulators and governments to try to make that a reality,” Mr Lloyd said. “Our dream would be that it happens here and we will see if we can make that dream come true.”

Mr Lloyd described Hyperloop as “the new broadband for transportation”. It can be used to shuttle people across cities – from one airport to another, say – within minutes. It could also be deployed at existing ports to quickly shift containers enclosed within tubes from shoreline to a “dry port” for customs clearance 80 kilometres inland, freeing up shoreline real estate for more valuable uses.

“None of what I have described requires any new science. It can all be built today,” argued Mr Lloyd.

US-based Hyperloop Technologies has already raised $100 million in venture funding, which it has used to acquire a 50-acre site in north Las Vegas, where a 3km-long test facility is under construction using 11.5ft-diameter steel tubes. Mr Lloyd said it has received interest from around the world, but would focus on an initial three projects – all of which would be freight-based. He expects contracts for the first of these to be agreed either this year or next, with civil and construction work starting in 2017 for delivery by 2020-21.

“Typically, it takes more than a decade to do high-speed rail. This can be done much more quickly,” he said.

The senior executive vice president of Siemens’ Middle East mobility division, Joerg Scheifler, said that more forms of public transport are needed given the massive predicted rise in urbanisation and travel both within and between cities. He said that transport use is forecast to grow from 22.8 trillion person kilometres in 2010 to 49 trillion by 2050, with the biggest growth expected in individual car transportation. He added that Dubai already has considerably higher commute times than average at 105 minutes per person per day, compared with just 45 minutes in London and 36 minutes in Singapore.

“Something needs to be done. [We need to] move away from individual transport to public transport. Make public transport as attractive as possible.”

mfahy@thenational.ae

Follow The National's Business section on Twitter