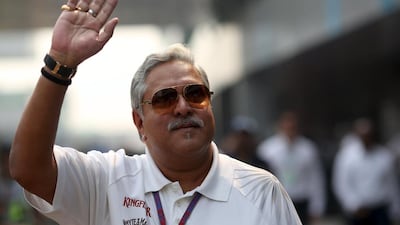

MUMBAI // Vijay Mallya, once known as “the king of good times”, is going through the worst times of his business career as banks close in on the Kingfisher tycoon in an effort to recover debts.

Mr Mallya, 60, was widely considered to be India’s answer to Richard Branson. The flamboyant Indian entrepreneur built up his inherited empire, United Breweries Group, the prized assets of which were its beverages division and Kingfisher Airlines, and lived a lavish lifestyle, buying Formula One and cricket teams, islands and vintage cars.

But the collapse of Kingfisher Airlines, which stopped flying in 2012 and had amassed US$1 billion in debt, has resulted in Mr Mallya losing much of his empire. State Bank of India has called for him to be jailed as the country’s largest lender tries to recover money it is owed. Creditors on Tuesday asked India’s supreme court to prevent Mr Mallya from leaving the country. They are too late, since Mr Mallya had already left India last week.

On Friday, the enforcement directorate summoned Mr Mallya to appear before March 18 for questioning in a money laundering investigation, the Press Trust of India reported. Mr Mallya took to Twitter the same day to say that it was “rubbish” he had fled the country and that he travelled frequently as an international businessman.

The debt recovery tribunal in Bangalore on Monday blocked the $75 million settlement that the global drinks giant Diageo had agreed to pay Mr Mallya after he exited his role as chairman of United Spirits last month. Creditors argue that they are entitled to those funds as repayment. United Spirits, India’s largest spirits company, used to be part of United Breweries, but Mr Mallya sold most of its interests and Diageo took control following Kingfisher Airlines’ financial troubles.

Experts say that Mr Mallya’s extravagance and ambition resulted in his downfall, as he overspent on Kingfisher Airlines, launched in 2005, in an effort to try to create a superior carrier.

“He had that aspiration to be the Branson of India,” says Vijayaraghavan Pisharody, whose background is in strategy development and human resources leadership and is the general manager of Stempeutics Research. “But his experience is a different thing. Mallya is a man who built a liquor empire. There was that element of flamboyance that he wanted to create in the sky. Would that have been the right thing to do? Perhaps not. Oil prices were at a peak. Would you really want to have other overheads, such as high salary costs? He picked up pilots, technicians, almost paying double the salary to get them on board Kingfisher Airlines. He had created that unmanageable proportion of costs. It could have been avoided.”

Mr Mallya, who is also a member of the Rajya Sabha, the upper house of India’s parliament, in a statement issued on Sunday tried to defend his reputation and argued that the media “was indulging in sensationalism”

He said: “Kingfisher was launched on the basis of a viable business plan vetted by SBI Capital Markets and renowned international aviation consultants, but despite every effort, it was an unfortunate commercial failure caused by macroeconomic factors and then government policies.”

He claimed that “a successful disinformation campaign” had resulted in him “becoming the poster boy of all bank NPAs [non-performing assets]”, adding that other companies that owed much more than Kingfisher had escaped scrutiny.

“I have been making efforts to reach a one-time settlement with the banks,” Mr Mallya said. “My group directly invested over [40 billion rupees (Dh2.19bn)] into Kingfisher Airlines itself which stands fully impaired – it is not as though it is only the bank debt that has suffered. The banks will recover a substantial part of their debt – my group’s loss is permanent.”

Sanjay Chakraborty, a marketing communication adviser at EssKsee Consultancy, based in Ahmedabad, Gujarat, explains how Mr Mallya built up his brand to become synonymous with Kingfisher, which put him in the limelight as things went wrong.

“Due to the restrictions on advertising in the category of liquor he very strategically created a personal brand of himself, or in other words it is an excellent example of CEO as a brand,” he says.

Mr Mallya moved to try to capitalise on India’s growing economy and rising middle class spending.

“With an intention of extending the brand from beverages to aviation, this was a move to leverage the brand personality to another category catering to similar segment of consumers,” says Mr Chakraborty. “But as a brand one needs to envisage the future and market stability of the category one is entering into, namely aviation. If not profitable, one must gracefully exit rather than continuing with controversies. A personal brand is a high-risk game.”

Former employees of Kingfisher Airlines this month wrote an open letter to Mr Mallya over non-payment of salaries, accusing him of damaging India’s image and that of its aviation industry. They took objection to comments that Mr Mallya made recently, when he told the Press Trust of India news agency that he had “no regrets as such” and that “perhaps the only regret is that Kingfisher Airlines is not flying today when the oil price is so low”.

Analysts say that Mr Mallya’s case could harm India’s image as an investment destination and raises questions about India’s regulations.

“The worrying trend among some of the companies openly flouting their debt commitments as well as diversion of company’s funds has to be blocked at any cost,” says Mahesh Singhi, the founder and managing director of Singhi Advisors, a Mumbai-based investment banking firm.

“Wider autonomy and sweeping powers need to be given to banks and other financial institutions to deal in a time- bound manner with such [alleged] wilful defaulters and initiate their loan recovery process through sale of assets or forced change of management before it gets too late and quality of assets and the business deteriorates.”

Abhimanyu Sofat, the co-founder of AdviseSure, an investment advisory company, says that “the banks were not doing proper due diligence”, which allowed Kingfisher Airlines’ debt problems to escalate.

“The legal system in India is not that strong in the case of bankruptcy and that is the reason for this mess. In the US, the bankruptcy [law] makes it very easy for banks to take a hold of your assets, which is not there in India. The positive thing out of this is that the RBI [Reserve Bank of India] is very serious about it and some good would happen structurally in how banks give lending. But whether we’ll be able to catch hold of Vijay Mallya and people will recover their money, I have big reservations.”

Rajesh Gupta, the managing partner of SNG & Partners, a law firm in Mumbai says that “Vijay Mallya is in the news for right reasons now”.

“It’s high time that large corporate defaulters who have means to lead a most luxurious life are questioned on financial impropriety,” he says. “The financial defaults by large corporates is squeezing and killing the banking system.”

Mr Mallya has said that he wants to spend more time in the United Kingdom, which has raised concerns that he will flee the system. I have been most pained as being painted as an absconder,” Mr Mallya said. “I have been a non-resident for almost 28 years and the Reserve Bank of India has acknowledged this in writing. That I want to spend more time in England closer to my children – has been grossly distorted and mis-portrayed. I wish to reduce my business commitments gradually and devote more time to my family.”

As Mr Mallya was ousted from the board of United Spirits, he agreed on a five-year non-compete clause. He remains chairman of United Breweries.

“In effect, I have given up my interests in the spirits business globally at considerable cost,” he said. “I have always lived an honourable life and the calumny notwithstanding shall continue to do so.”

business@thenational.ae

Follow The National's Business section on Twitter