We have been previously impressed by Boston Dynamics' dancing robot and its ability to do parkour.

But can the robot, named Atlas, do something a little more useful in everyday life?

Judging by a video released by the US company, which is majority-owned by Hyundai Motor Group, the answer is a resounding “yes”.

In the video, called “Atlas gets a grip”, the robot can be seen interacting with objects and carrying out tasks which would be helpful to humans.

It can pick up items, climb, jump, throw and make deliveries across what can be described as an assault course.

The video ends with a flourish as Atlas performs a backflip that most of us could only dream of doing.

It was not clear if the robot is programmed to perform these skills in a set order, being moved around by remote control or, more improbably, is an artificial intelligence moving under its own decision-making power.

The National contacted Boston Dynamics for comment but did not immediately hear back.

Either way, the new moves represent a natural progression of continuing research, said Ben Stephens, Atlas controls lead, in a blog post.

“We are layering on new capabilities,” Mr Stephens said.

“Parkour and dancing were interesting examples of pretty extreme locomotion, and now we are trying to build upon that research to also do meaningful manipulation.

“It is important to us that the robot can perform these tasks with a certain amount of human speed. People are very good at these tasks, so that has required some pretty big upgrades to the control software.”

Boston Dynamics explained that the dance Atlas performed to the song Do You Love Me was done “blind” without the perception needed for it to respond to its environment.

“Parkour forces us to understand the physical limitations of the robot, and dance forces us to think about how precise and dexterous the whole-body motion can be,” said Robin Deits, a software engineer on the Atlas controls team.

“Now, manipulation is forcing us to take that information and interpret it in terms of how we can get the hands to do something specific. What’s important about the Atlas project is that we don’t let go of any of those other things we’ve learnt.”

Among the deceptively complex tasks in the video was pushing a box off a ledge, which meant Atlas had to get its weight transfer right so as not to topple forwards off the platform.

The company is now hoping to take this technology and adapt it to real-life physical work.

“Our hope is that if we can build the foundational technology that allows us to easily create and adapt dynamic behaviours like these, we should be able to leverage it down the road to perform real, physically demanding jobs with hustle,” said Scott Kuindersma, Atlas team lead at Boston Dynamics.

“There are many pieces required to deliver a complete solution in a domain like manufacturing or construction — this video highlights a narrow slice of what we’re working on.”

Boston Dynamics unveiled in 2021 a new robot called Stretch, designed to perform one very specific warehouse job: moving boxes.

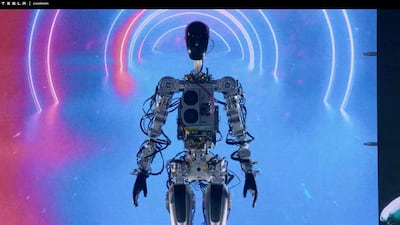

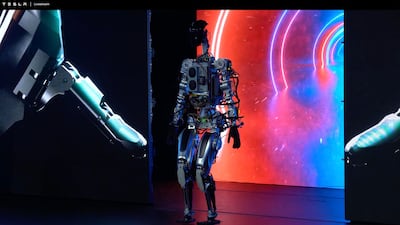

Humanoid robots are also under development by Elon Musk's Tesla.

In October, Mr Musk showed off a prototype of Tesla's Optimus robot, which waved to the crowd before a video showed it doing simple tasks such as watering plants, carrying boxes and lifting metal bars at a production station at the company's California plant.

He said Optimus would be an “extremely capable robot” that Tesla would aim to produce in the millions.

Mr Musk said he expected they would be about $20,000 each.