US oil companies are planning to boost investments in Libya and expand operations despite troubled relations between the nations in the past as the North African country focuses on reviving its energy sector.

Companies including ConocoPhillips, Halliburton and SLB are aiming to increase their investment in the country. Chevron, a major US oil producer, also signed an initial agreement to return to Libya after a 15-year hiatus.

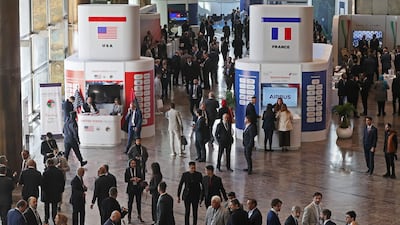

“2026 is going to be a turning point for Halliburton,” Chris Simonian, the company's area business development manager in Libya told The National on the sidelines of Libya Energy and Economic Summit in Tripoli.

“We are going to be expanding more, pumping more equipment and people into the country. We see the biggest opportunity, biggest growth segment within the region in Libya today.”

The comments come as Libya, an Opec member, this week announced investments worth $20 billion to increase oil production at Waha oilfield in partnership with France’s TotalEnergies and ConocoPhillips.

The deal, financed through external funding, is expected to help the country add 850,000 barrels per day of additional capacity, with net revenue generated estimated at about $376 billion.

Libya is also in the process of awarding new exploration licences to oil and gas companies next month. This is the first time in more than 17 years that Libya is undertaking such an exercise, with US companies including Chevron and ExxonMobil qualifying for the final round.

Oilfield services company Halliburton left Libya during the conflict and returned two years ago to resume operations, Mr Simonian said.

“We have alignment from our leadership to mobilise equipment and deploy equipment and resources to Libya. Libya is the place where we see growth in 2026 and beyond,” he said.

The participation of US companies in the development of Libya's energy sector comes despite frosty relationship between the two countries in the past.

Past tension

During Muammar Qaddafi's rule, the US imposed sanctions on the country, accusing Libya of supporting terrorist activities, affecting the relationship between the two countries. The US also bombed Tripoli and Benghazi in 1986, blaming Libya for a nightclub bombing that killed US servicemen.

After the fall of Qaddafi's regime in a 2011 protest, the US embassy in Benghazi was attacked by militants leading to the death of four people, including the US ambassador to Libya.

But things have changed since then. The country is run by two governments − the UN-backed administration in Tripoli led by Prime Minister Abdul Hamid Dbeibah and the eastern government supported by military commander Field Marshal Khalifa Haftar.

Texas-based ConocoPhillips had been operating in Libya since 1955, but left the country in 1980s because of sanctions. It returned in 2005 and stayed back even as many companies wound up their operations during the civil war, Glenn Hamrell, executive vice president at Waha Oil Company, that operates Waha oilfield, said.

ConocoPhillips has a 20.4 per cent stake in Waha, which is majority owned by state owned National Oil Corporation. TotalEnergies also has a 20.4 per cent in the company.

“In the last two years, we have been in renegotiations with the Libyan authorities and we finally now reached an agreement which is beneficial for both parties, for us to be able to invest more money now in Libya,” Mr Hamrell said.

The latest agreement “will improve the fiscal terms”, for the company and also extends the agreement till 2050, he said.

“Libyan authorities are struggling to fund the oil industry and if we see improvement in that one, there is a great potential for big growth there.”

Certainty on payments

US oilfield services company, SLB, is also bullish about opportunities in Libya as there is “good progress towards certainty on payments”, Jesus Lamas, president of Middle East and North Africa at SLB said during a panel discussion on Libya’s energy sector on Sunday.

“The environment is very positive, the increase of activity and the opportunities are extremely attractive and positive,” he said.

Oil and gas account for about 95 per cent of exports and government revenue. The sector’s expansion has helped push real gross domestic product growth to an estimated 13.3 per cent last year, according to the World Bank.

By attracting foreign investment, the country aims not only to boost production but also to reinforce its broader economic recovery.

However, security and the two governments in Tripoli and Benghazi continue to be an issue in attracting investments in the country.

This was highlighted by Massad Boulos, senior adviser to US President Donald Trump for Arab World and Middle East Affairs during his speech at the summit on Saturday.

“Our team at the US mission and I are committed to strengthening these partnerships and ensuring US firms are with you every step of the way, however, revitalising this industry isn't just about geology, it's about stability.”

Libya should create an environment where capital is “safe to stay for the long term”, Mr Boulos added.

“For Libya, this means unifying the country to ensure the kind of stability that investors demand.”