Oil prices are likely to experience a limited impact following the US's attack on Venezuela on Saturday, according to industry experts.

Giovanni Staunovo, a strategist at the Swiss bank UBS, said although it was a too early to make a call, exports and production from Venezuela came under downward pressure following the US oil tanker blockade and the risk is that this trend could continue.

Vandana Hari, chief executive of Singapore-based Vanda Insights, said the immediate implications for the oil market are minimal — "not much beyond another uptick in the Venezuela risk premium".

The US has struck Venezuela and captured its President Nicolas Maduro, who has been taken out of the country, President Donald Trump said on Saturday.

"The United States of America has successfully carried out a large scale strike against Venezuela and its leader, President Nicolas Maduro, who has been, along with his wife, captured and flown out of the country," Mr Trump said in a Truth Social post.

The Venezuela government in its statement said the goal of the attack is for the US to take possession of the country's oil and minerals. It added that the US "will not succeed" in taking the resources. The US has accused Venezuela of aiding in the trafficking of narcotics.

The Trump administration has stepped up a campaign against the country’s oil exports through a maritime blockade.

"The attacks in Venezuela are not targeting oil facilities directly. But the previous attacks on ships and latest sanctions/blockade were already causing production to fall by around 25 per cent," Amrita Sen, an analyst at market intelligence company Energy Aspects, told The National.

"The impact on oil prices won’t be severe due to the large expected stockbuilds but unplanned outages in Venezuela, Russia and Kazakhstan are mounting, which will chip away at these builds."

Mr Trump has announced a “blockade” of Venezuelan oil, expanded sanctions and staged more than two dozen strikes on vessels that the US alleges were involved in trafficking drugs in the Pacific Ocean and Caribbean Sea.

Oil prices edged lower on Friday, the first day of trading in 2026, after logging their worst annual performance in six years.

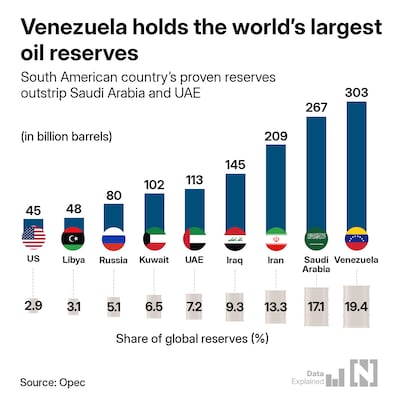

Venezuela, home to the world's biggest proven oil reserves, produces 1.1 million barrels of crude a day, with most of it going to China and India, Rystad Energy analysis shows. Although the volume is small in terms of global trade flows, representing about 1 per cent, but the quality is unique as more than 67 per cent of the output is heavy, it added.

Amena Bakr, head of Opec+ and Middle East research at Kpler, an independent global commodities trade intelligence company, said the market is underestimating the impact of geopolitical risk to some extent and that’s why there hasn't been a build of a large premium in the price.

But it’s important to note that this is happening at a time when the market is oversupplied, so there are a lot less concerns over the loss of some supply, she added.

“Oil prices over the past few days traded up slightly at $61 because of geopolitical risk in Venezuela and also the attacks from Ukraine on Russian facilities … so I do expect a small increase in the price when markets open if the geopolitical risk remains high,” Ms Bakr said.

“The issue with Venezuelan outages is rated to the quality of the crude. Heavy Venezuelan crude isn’t easily replaced by lighter grades, substitutes tend to cost more and could put upward pressure on refined product pricing. Overall, the impact on markets is muted for the time being.”

head of Opec+ and Middle East research, Kpler

Vijay Valecha, chief investment officer at Century Financial, said things are likely to turn more volatile for energy markets as traders would be eyeing the Sunday night open for WTI and Brent prices.

"Historically, oil prices have tended to show a gap during times of geopolitical uncertainty. As an instance during, the US strike on Iranian underground nuclear facilities last year, oil prices spiked by as much as 7 per cent during the initial market open session. Similar kinds of moves have happened during the past cycles as well," he added.

In terms of actual demand and supply, Venezuela’s current contribution to the global energy supply is miniscule, Mr Valecha pointed out. The worst-case disruption of 0.7 to 1 million barrels per day (mbpd) out of the total energy supply of 100 mbpd is small, he said.

However, for energy market participants, the biggest fear is further escalation in the crisis, which could see involvement of more players in the region. For Venezuela, it counts Iran as one of its main trading partners and natural allies.

In terms of specific numbers, during the past Middle Eastern geopolitical crisis, the average risk premium discounted by markets is in the range of $10+/barrel, Mr Valecha informed.

Robin Mills, chief executive of Qamar Energy and author of The Myth of the Oil Crisis, said there may be an initial bounce in oil prices on the news, but he sees the development as bearish for oil.

"A loss of some of Venezuela's exports wouldn't make much difference, but there is significant room for the country's exports to grow if a new leader negotiates a suspension of sanctions, and even more if they open to outside investment over a period of a few years," he added.