Opec+ has announced that it will extend its voluntary output cuts of 2.2 million barrels per day until the end of March next year, in an effort to rein in a possible supply glut.

Eight oil-producing nations, including Saudi Arabia and Russia, have agreed to prolong their voluntary oil production cuts, announced in November 2023, until the end of March 2025. After that, the 2.2 million bpd supply curbs will be gradually phased out on a monthly basis until the end of September 2026 to "support market stability", the group said in a statement after a ministerial meeting on Thursday.

"This monthly increase can be paused or reversed subject to market conditions," Opec+ said.

The producer alliance, which has implemented total supply cuts of 5.86 million bpd, had twice postponed the easing of voluntary production cuts before Thursday’s announcement.

These supply curbs were originally scheduled to be gradually phased out starting in October this year, but have been maintained amid a slump in oil prices, with Brent, the international benchmark, dropping nearly 19 per cent since reaching $91 a barrel in April. Brent was steady at $72.31 a barrel at 5.42pm UAE time on Thursday.

Opec+ also extended its oil production cuts of 2 million bpd and 1.65 million bpd by a year to the end of 2026.

The International Energy Agency said in November that current balances suggest global supply will exceed demand by more than 1 million bpd next year, even if the Opec+ cuts were to remain in place.

Oil markets anticipate a surplus in the first half of 2025 as substantial new production comes online from the US, Brazil, Canada, and Guyana, which are collectively expected to add more than one million barrels per day.

Driven by higher production from the oil-rich Permian Basin in Texas and New Mexico, along with operational efficiencies, US oil and gas output is projected to reach 13.5 million bpd next year – an increase of 300,000 bpd compared to the estimate for 2024, according to the US Energy Information Administration.

“The Permian is a prolific shale play that can ramp up and ramp down investment and consequently production quickly in response to oil prices, curbing risks,” BMI, a Fitch Solutions company, said in a research note.

“Other non-Opec growth leaders have longer investment cycles and would be unable to lower or raise output in response to prices. For the most part, they will be committed to bringing on new capacity regardless of oil prices,” BMI said.

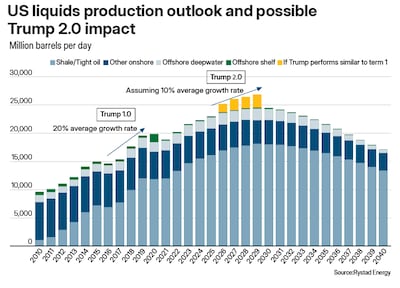

However, analysts say that US president-elect Donald Trump’s plan to boost domestic oil output contrasts with cautious growth signals from the shale industry.

American crude production surged by roughly 21 per cent during his first term, growing from 9.36 million bpd in 2017 to 11.32 million bpd in 2020.

Matching the growth achieved under Mr Trump’s first term now appears “unlikely”, and even a 10 per cent increase could be considered “ambitious”, Rystad Energy said in a research note last week.

The expected growth rate is less than five per cent currently, the Norway-based consultancy said.

The US rig count, an indicator of future output, fell to its lowest level since early September in the week that ended on November 27, data from oilfield services company Baker Hughes showed.

The country's rig count stood at 582 in the latest reported week, a decrease of 43 compared to the same period last year.

Fuel demand

Mr Trump’s policies may hamper economic growth next year, hurting demand for refined products such as petroleum and diesel, analysts said.

BMI expects global demand for refined fuels to increase by 1.4 per cent in 2025, slightly higher than the estimated 1.3 per cent growth for this year.

The forecast is supported by global economic growth, which is projected to be 2.6 per cent in 2025, according to BMI.

It is below the International Monetary Fund's estimated growth rate of 3.2 per cent for next year.

“A key determinant of 2025’s fuel outlook is the trade policies adopted by the incoming Trump administration, with significant import tariffs expected on major trade partners,” BMI said.

“These tariffs could see higher costs passed on to consumers, adding to inflation and raising the risk of tighter financial conditions than currently forecast.”

Last week, Mr Trump threatened to impose tariffs on Canada and Mexico, two of the US's largest energy suppliers – a move that could severely disrupt trade flows.

The president-elect also plans to increase tariffs on all Chinese imports to the US by an additional 10 per cent.

The global markets are closely watching China's economic situation, as it will significantly impact the country's energy demand.

China’s total refined fuel consumption growth is projected to slow down to 2 per cent in 2025, mainly on sustained weakness in diesel consumption, BMI said.

“Petrochemical feedstocks, liquefied petroleum gas, and naphtha will remain key drivers behind overall fuel demand growth as China’s focus on the domestic growth fuels greater demand from consumers,” it added.

China’s gasoline consumption could reach a peak of 3.66 million bpd this year and start to fall by 2.3 per cent in 2025 amid growing electric vehicle penetration, according to the IEA.