Global carbon dioxide emissions rose by less than 1 per cent last year as the growth of renewable energy and electric vehicles helped offset a surge in crude oil and coal consumption, the International Energy Agency said.

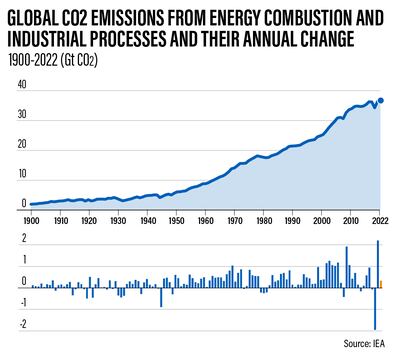

Carbon dioxide emissions grew by 0.9 per cent in 2022 to reach a new high of more than 36.8 billion tonnes, the agency said in its 'CO2 Emissions' report on Thursday.

The emissions, considerably lower than the 6 per cent surge in 2021, are still growing at an “unsustainable” rate, said the Paris-based agency, which called for stronger measures to speed up the transition to clean energy.

“The impacts of the energy crisis didn’t result in the major increase in global emissions that was initially feared — and this is thanks to the outstanding growth of renewables, EVs, heat pumps and energy efficient technologies,” said IEA executive director Fatih Birol.

“However, we still see emissions growing from fossil fuels, hindering efforts to meet the world’s climate targets.”

Emissions falling below last year’s global economic growth rate of 3.2 per cent signals a shift to a “decade-long” trend that was interrupted in 2021 due to a swift economic recovery from the Covid-19 crisis, the IEA said.

The deployment of clean energy technology helped offset emissions from extreme weather events, such as droughts and heatwaves, and the shutdown of a large number of nuclear power plants, it said.

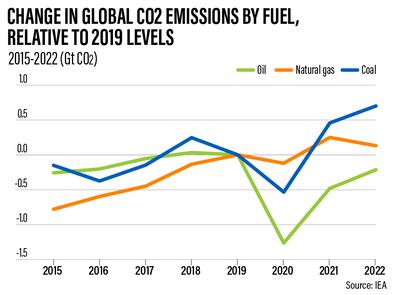

Carbon dioxide emissions from coal grew 1.6 per cent as the global energy crisis resulted in more switching from gas to coal, the agency said.

Meanwhile, crude oil emissions rose by 2.5 per cent but remained below pre-pandemic levels.

“International and national fossil-fuel companies are making record revenue and need to take their share of responsibility, in line with their public pledges to meet climate goals,” Mr Birol said.

“It’s critical that they review their strategies to make sure they’re aligned with meaningful emissions reductions.”

The global oil and gas industry's income jumped to almost $4 trillion last year, from its recent average of $1.5 trillion, the agency said last month.

China’s emissions were “broadly flat” last year as the country’s strict zero-Covid policy led to weaker economic growth.

The EU’s emissions fell by 2.5 per cent thanks to “record” deployment of renewables, a warm winter and energy conservation measures, the agency said.

Meanwhile, emissions grew by 0.8 per cent in the US as buildings increased their energy consumption to cope with extreme temperatures.

Excluding China, emissions from Asia’s emerging and developing economies increased by 4.2 per cent amid rapid economic and energy demand growth.

Global energy industry’s methane emissions surged to 135 million tonnes last year, slightly below 2019’s record highs, the agency said in a report last month.

Methane is responsible for about a third of global temperature increases since the Industrial Revolution. It dissipates faster than carbon dioxide but is a much more powerful greenhouse gas during its short lifespan.

The energy sector accounts for about 40 per cent of total methane emissions attributable to human activity, second only to agriculture.