Oil and gas sector payments to governments are expected to reach an all-time high of $2.5 trillion in 2022, smashing the previous record of $2.1tn in 2011, amid higher prices and increasing production, according to a new report from Rystad Energy.

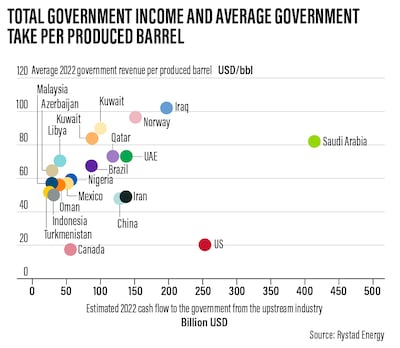

Saudi Arabia, Opec’s biggest producer, is set to top the table in terms of total cash flow to the government from the upstream sector — related to exploration and production — this year, followed by the US and Iraq, the Oslo-based energy consultancy said. The top 10 list is dominated by Middle Eastern producers.

Total tax income from the oil and gas sector plummeted to $600 billion in 2020 amid lower commodity prices after the coronavirus pandemic. However, it rose to $1.4tn last year as oil and gas prices recovered on improved demand.

“A year ago, it looked like the era of trillion-dollar revenues might have been behind us,” said Espen Erlingsen, head of upstream research at Rystad Energy.

“Today it is clear that we are heading into a supercycle that will benefit petrostates. These record revenues present an unparalleled opportunity to diversify economies.”

Oil prices, which rose more than 67 per cent in 2021, continue to trade higher this year amid supply concerns due to Russia’s military offensive in Ukraine. Brent, the global benchmark for two thirds of the world's oil, is up more than 30 per cent since the start of this year, after falling from a 14-year high of almost $140 per barrel in March.

Opec+ producers, led by Saudi Arabia and Russia, are also gradually boosting production as they unwind record output cuts of 9.7 million barrels per day implemented between May 2020 and July last year. The group is adding 400,000 bpd to the market every month, which is set to increase to 432,000 bpd in May.

Earlier this month, Moody's Investors Service revised its outlook for the global energy industry to positive from stable as higher commodity prices are expected to boost the earnings of oil and gas companies. Earnings of energy companies active in exploration and production, refining and marketing, as well as oilfield services, will rise due to higher oil prices, the rating agency said.

Saudi Arabia, the Arab world’s biggest economy, will be the “largest beneficiary” of higher commodity prices, according to Rystad. The kingdom is expected to receive more than $400bn from its cornerstone industry in 2022, up roughly 166 per cent from the previous year.

The US, the world’s largest economy, “when including royalties paid to private landowners”, takes the second spot with around $250bn in payments to the government, an increase of $100bn compared with 2021.

Iraq’s total income from the upstream oil and gas sector is also expected to double to about $200bn this year amid higher commodity prices and increased production, according to Rystad.

The country’s March exports of crude oil reached more than 3.24 million bpd, with revenue amounting to $11.7bn, the highest since 1972, according to the Ministry of Oil. Iraq, Opec's second-biggest producer, relies heavily on oil revenue to rebuild its economy after decades of conflict.

On average, Iraq has the highest government take per barrel — for each barrel the country produces, about $100 goes to the government due to a low level of costs and service agreements, Rystad said.

Norway, which is the 10th largest oil and gas producer globally, will receive about $150bn this year due to higher European gas prices, low costs and large government ownership of the oil and gas sector.

The country also has a very high government take per produced barrel, at just below $100, while the US is on the other side of the scale, with an average government take per produced barrel of about $20 due to high investment rates, low domestic gas prices and low corporate tax rates.