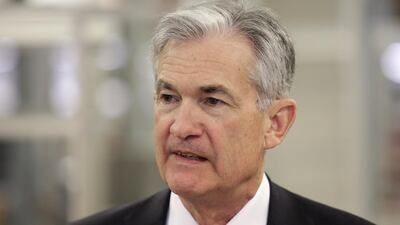

Federal Reserve Chairman Jerome Powell backed further gradual interest-rate increases amid strong US economic momentum, in remarks that avoided the turbulent US stock market and sought to steer clear of the simmering US-China trade dispute.

“We will continue to aim for 2 per cent inflation and for a sustained economic expansion with a strong labour market,” Mr Powell said Friday in his first speech since becoming chairman in February. “As long as the economy continues broadly on its current path, further gradual increases in the federal funds rate will best promote these goals.”

US stocks extended losses after his remarks, with the S&P 500 Index ending 2.2 per cent lower Friday as investors took note of Mr Powell’s reluctance to be swayed from raising rates. His remarks were reinforced by comments several hours later by incoming New York Fed chief John Williams.

“I guarantee you they are thinking about it,” Roberto Perli, a partner at Cornerstone Macro said. “It is hard to think that any more bad news on tariffs doesn’t reduce the odds of faster tightening down the road.”

Mr Powell’s prepared comments, which included no reference to China or financial markets, hewed closely to his March 21 press conference that emphasised the stronger US economic outlook after the Fed raised interest rates and signaled at least two more moves in 2018.

Asked subsequently about the tariff debate, he said it’s “really too early” to estimate how tariffs will impact the US economy. President Donald Trump on Thursday said he was weighing tariffs on an additional $100 billion in Chinese imports, bringing to $150bn the range of Chinese goods under consideration. China says it will respond proportionately.

Mr Williams, who is currently head of the Fed’s San Francisco branch, backed projections for three or four rate hikes this year and called his outlook “very positive” with “low and falling unemployment, and inflation that is closing in on our 2 per cent long-run goal.”

_______________

Read more:

Fed easing policy just a pointer for ECB's approach

Who's next to take the top spot at the European Central Bank?

_______________

“The economy continues to steam ahead,” Mr Williams told an audience in Santa Rosa, California. “I am confident that we can carry on the process of gradually moving interest rates up over the next two years while seeing solid growth and historically low rates of unemployment.” He takes the helm of the New York Fed on June 18. The new job makes him vice chairman of the rate-setting Federal Open Market Committee.

Asked about trade, Mr Williams said “so far, the kind of things that have been happening about specific actions -- they don’t add up to a huge effect on the economy.”

Laura Rosner, a senior economist at Macropolicy Perspectives, said the inflation and growth affects from tariffs right now have a “small impact” on her forecast. “We are saying it is small and the Fed is saying it is too early” to say anything about the impact, Ms Rosner said.

The S&P 500 Index is down almost 10 per cent from its January peak. Still, policy makers forecast solid growth this year aided by Republican tax cuts, and job growth remains steady.

Mr Powell said reports from the labor market were mixed, with some indicators showing tightness and others showing slack.

“The absence of a sharper acceleration in wages suggests that the labor market is not excessively tight,” Mr Powell said. “I will be looking for an additional pickup in wage growth as the labor market strengthens further.”

Employers added 103,000 new workers in March, Labour Department data earlier on Friday showed, while unemployment held at 4.1 per cent. Inflation, measured by the central bank’s preferred gauge, rose 1.8 per cent in the 12 months through February and has been below the Fed’s 2 per cent target for most of the last six years.

“Given that the current pace of growth is above trend, my view is that we need to continue on the path of raising interest rates,” Mr Williams said.