The UAE is doubling down on its comprehensive economic partnership agreements (Cepas) to shield its economy from potential trade wars and ensure uninterrupted access to global markets.

With deals already signed and ratified, granting market access to more than three billion people, the Emirates aims to boost its position as a global trade and investment hub, Mohammed Alhawi, undersecretary at the UAE’s Ministry of Investment, said.

“Whatever happens in the world will affect us if we want to be a global logistics hub … [but] the name of the game is diversification … we are diversifying in terms of partners as well as sectors [to minimise disruption],” Mr Alhawi told The National in an interview at the World Economic Forum in Davos.

“Working in this direction, we are signing more Cepa deals and expanding market access ... this trend will continue in 2025 and 2026.”

The ministry has launched a white paper that sets out the recent strong growth in the Emirates - and the path forward.

This includes ambitions to attract more financial services businesses, family offices, hedge funds, and private equity firms to Abu Dhabi, Dubai and the rest of the country, and ensures the right eco-system is in place to make it as attractive as possible.

The UAE has been strengthening its trade ties with countries around the world to boost non-oil foreign trade.

Earlier this month, it signed Cepa deals with New Zealand and Malaysia to deepen trade ties with economies in different geographies.

The UAE aims to sign 26 Cepas, with deals already reached with India, Turkey, Indonesia, Cambodia, Georgia, South Korea, Chile and Mauritius. Talks are under way with other countries, including the Philippines. Cepas are expected to add about 2.6 per cent to the UAE's economy by 2030, Dr Thani Al Zeyoudi, Minister of State for Foreign Trade, said previously.

“By continuing to sign bilateral agreements, we offer opportunities to global companies to manufacture in the UAE and export globally, leveraging our strategic location and connectivity,” Mr Alhawi said.

Overall, the UAE's economy grew by 3.6 per cent yearly in the first half of last year, driven by the non-oil sector.

The country's real gross domestic product at constant prices rose to Dh879.6 billion ($239.5 billion) for the January-June period, while non-oil GDP increased by 4.4 per cent annually to reach Dh660 billion, contributing 75 per cent to the total, the Ministry of Economy said in December.

Diversification as a buffer against disruption

As the world grapples with protectionist tendencies and shifting trade routes, the UAE is banking on its diversified economy and robust logistics network to weather uncertainties.

“Our ports in Dubai and Abu Dhabi, coupled with extensive airline connectivity, position us to remain resilient amid global disruptions,” Mr Alhawi said.

“We want more market access for companies that choose UAE to be their home.”

The UAE is also capitalising on trends such as micro-manufacturing, which emphasises production closer to consumers, he added.

Ease of doing business, quality of life, and world-class infrastructure are among the factors drawing global talent and companies to the UAE.

“We act fast on regulations that need to be changed for the better,” Mr Alhawi said. “Whether it’s healthcare, transportation, or education, we are investing in all areas to create an environment where businesses and families can thrive.”

With more than 40 freezones offering sector-specific advantages and streamlined processes, the UAE intends to lower operational costs for companies while ensuring access to top-tier financial and legal services, Mr Alhawi said.

Freezones tailored to specific industries, stable regulations, and fast decision-making further bolster the UAE’s attractiveness, he added.

Focus on financial services and manufacturing

Looking ahead, financial services and manufacturing are poised to be key growth drivers for the UAE.

“Those are the areas where we are hoping to see a big jump … companies want to come to the UAE, manufacture and then send products back to the world.”

“Both Abu Dhabi and Dubai are investing heavily in financial services, attracting family offices, hedge funds, and private equity firms,” Mr Alhawi said.

This dual focus aligns with the country’s broader ambition to become a nexus for innovation, talent, and investment, he explained

In 2021, the UAE launched Operation 300bn, an overarching strategy to position the country as an industrial hub by 2031. The 10-year plan focuses on increasing the industrial sector's contribution to the country's gross domestic product from Dh133 billion ($36.21bn) in 2021 to Dh300bn in 2031.

The strategy focuses on boosting production in various priority sectors, supporting the growth of national industries, attracting foreign investment and ensuring availability of dedicated financing for local industrial companies.

Surging FDI

The UAE, the second-largest economy in the Arab world, is actively working to attract foreign direct investment as part of its broader strategy to diversify its economy beyond oil dependence.

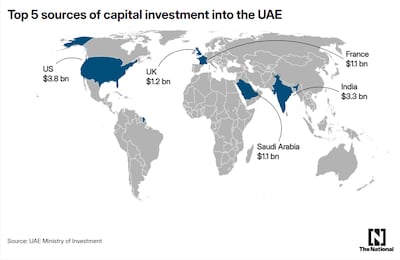

In 2023, it attracted $30.68 billion of FDI inflows, compared with $22.73 billion in 2022, an annual growth of 35 per cent, the UN Conference on Trade and Development stated in its 2024 World Investment Report in June. FDI outflows from the country stood at $22.3 billion, compared with $24.8 billion in 2022.

In terms of cumulative FDI balance, the UAE has “significantly outpaced global growth rates” over the past decade, according to the UAE's Ministry of Investment. From 2013 to 2023, the UAE’s FDI balance increased by 150 per cent, compared with the global average growth rate of 97 per cent.

“We are targeting all big economies that have great companies that can export or move into the UAE. There are also [smaller] nations that are growing in terms of exporting FDI … for example, Portugal.”

“We have list of those, looking at them, contacting them, approaching private sector in those nations to see how they can utilise UAE as a platform for faster international growth,” said Mr Alhawi.

In November, the UAE launched a new strategy to double cumulative FDI to Dh1.3 trillion ($354 billion) by 2031 amid its economic diversification push.

The country had previously set a target to attract Dh550 billion in foreign investment by 2031 and to eventually reach Dh1 trillion by 2051. It also aims to rank among the top 10 countries globally in terms of attracting FDI.

To boost FDI, the UAE has unveiled initiatives including 100 per cent foreign ownership of companies, reduced visa restrictions and incentives for small and medium enterprises.

Risks and opportunities

Mr Alhawi highlighted protectionism as a “significant risk” on the horizon.

“The biggest threat is illogical barriers that disrupt global trade and harm economies rather than support them,” he said.

However, the UAE’s proactive policies and focus on bilateral agreements are designed to mitigate such risks, he added.

He further noted the significance of maintaining resilience in the face of global challenges.

“Anything that happens in major nations like China or the US affects us. But are we worried? No. We take precautions,” he said.

“China is still an important market, and Asia, in general, continues to be a priority for investment and attracting investors. Nothing changes there.”