The Central Bank of the UAE has signed preliminary agreements with Jordan and Egypt's banking regulators to enhance financial and banking co-operation, after the recent industrial partnership between the three countries to boost sustainable growth.

The deals cover collaboration in the areas of financial supervision, FinTech and technical expertise, a statement said.

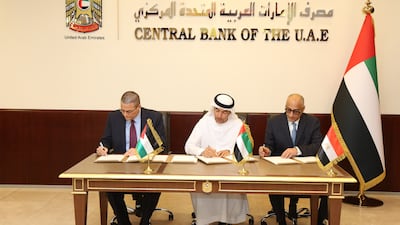

Governors from the three banking regulators signed the deals in Abu Dhabi on Tuesday and discussed ways to expand collaboration in the supervision of licensed financial institutions as well as technical assistance in the financial sector.

“We are keen to strengthen co-operation with our partners in Egypt and Jordan in the financial sector to achieve sustainable growth and prosperity for all of us, and promote investments, trade relations, economic partnership and to meet the mutual interests of the three countries," said Khaled Balama, governor of the CBUAE.

"The MoU with the Central Bank of Jordan, and the supplementary MoU with the Central Bank of Egypt constitute a framework for exploring opportunities for future co-operation with the two countries, building on the strong relationship between our financial systems and the economies of our countries."

The industrial partnership between the three countries has identified five sectors of mutual interest: petrochemicals; metal, minerals and downstream products; textiles; pharmaceuticals and agriculture; and food and fertiliser.

The new initiative will establish large joint industrial projects, create job opportunities, contribute to increasing economic output, diversify the economies of the three countries, support industrial production and increase exports.

A $10 billion investment fund has been allocated and will be managed by Abu Dhabi's holding company ADQ.

The preliminary agreement between the central banks of the UAE and Jordan covers co-operative mechanisms of supervision and the exchange of information, the statement said.

It also specifies joint collaboration in the areas of payment systems, FinTech, training and building professional capabilities, and sharing technical knowledge and experience.

“We seek through the MoU with the Central Bank of the UAE to create a comprehensive supervisory and monitoring framework on the financial and banking services in both countries," said Dr Adel Al-Sharkas, governor of the Central Bank of Jordan.

"This will enhance financial stability, efficiency and integrity requirements in the provision of financial and banking services, as part of digital transformation initiatives which facilitated intra-financial transactions.”

With Egypt, the UAE Central Bank signed a supplement to an earlier agreement made in 2021, which includes new articles related to the objectives and scope of co-operation and FinTech collaboration.

Under the deal, the two regulators will develop projects, initiatives and strategies to enhance competitiveness and digital transformation in the financial sector.

An additional article covers training and technical co-operation to enhance the professional skills of both parties’ staff, the statement said.