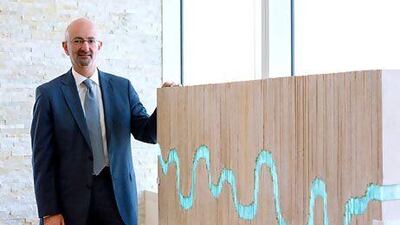

Khaled Sifri says he is not an expert on art but he does realise the importance of investing in good pieces.

As chief executive of Emirates Investment Bank, a Dubai-based boutique bank that mainly serves the high net worth sector, the 52-year-old stresses the need for diversification of one's portfolio.

And, in his opinion, art should play a part.

"Art is a unique physical asset," he says. "It has an aesthetic value, but also a marketable value."

Not only does the bank encourage its clients to invest in art, however, it has spent money itself on the asset class to diversify its own portfolio. Its recently acquired investment pieces are to be were unveiled for the first time today at a private function in its head office at Festival City, Dubai.

The exhibition includes work by established artists from across the region, such as Emirati artists Mohammed Kazem, Hassan Sharif and the Kurdish artist Walid Siti. "We consider art an asset class which any person with an investment portfolio should consider. Why? Because the nature of investment is to get the best possible return at the lowest possible risk," says Mr Sifri.

"To reduce risk you need to expand the scope of your investments. Art as an asset class is not linked to other assets, which makes it low risk and therefore a good choice for diversification."

It's certainly true that art, and Middle Eastern art at that, has become an increasingly popular form of investment during these turbulent economic times.

In 2011, 8 per cent of Christie's global turnover - US$456 million - came from Middle Eastern buyers and at last year's sale of Modern and Contemporary Arab, Iranian and Turkish art in Dubai, the 1941 piece Pêcheurs à Rashid (Rosette) by the modern Egyptian artist Mahmoud Said sold for $818,500 over an estimate of $400,000-$600,000.

"Arab art in general is just beginning to prove itself as an asset class that's recognised globally. It's a safe investment if you choose the right pieces from the right artists," says Mr Sifri,

The notion of bank's tying up with art is not new either. Corporate art collections have a long history and according to Forbes, banks such as UBS, with more than 35,000 pieces, and JP Morgan, with 300,000 pieces plus, have made their collections central to their corporate identity.

While Emirates Investment Bank won't disclose how much it has invested in its artwork, Mr Sifri says part of the reason for hosting the exhibition is to raise the profile of regional art. "Of course, we also want to support the growing art community here," explains the Palestinian banker, who was born in Beirut and grew up in Kuwait.

After studying law in Washington, he returned to live and work in Kuwait, only leaving when the Iraqi invasion took place in 1990. Moving back to the United States with his wife, whom he met at university, he hankered after his Arab roots, eventually returning to the Arabian Gulf in 1996 to settle and raise a family in Dubai.

"I began my career as a lawyer in Kuwait, but I had to make an abrupt business decision once I moved to America. I had an opportunity to join the family business - a manufacturing company that supplied small automotive parts to the big chains," he says.

He took up law again on his return to the Gulf, working mainly for banks. Then came an opportunity to work as head of investment banking at Shuaa, the regional investment bank, before joining Emirates Investment Bank as chief executive five years ago.

"I enjoy being in a position to lead a bank of this nature and help it to grow." says Mr Sifri who stresses the importance of staying focused on business.

"A lot of people get side tracked and caught up in dealing with personalities," he explains, adding that he also maintains a healthy work-life balance.

A father of four, with three girls and one boy between the ages of 17 and 24, he enjoys spending time with his family, reading about the history of religion or politics and playing golf

But like many successful businessmen, he says discipline is key. "I have to be disciplined to run a bank successfully because we are responsible for other people's money," he says. "Part of that responsibility is investing in quality assets like art."