Financial troubles at Indian airline Go First, previously called Go Air, are the latest in a series of challenges to hit the country's aviation sector.

The industry is now bracing itself to deal with the fallout of the bankruptcy of the airline controlled by Indian billionaire Nusli Wadia.

“Airline insolvencies and their resolutions have been extremely complex in India where [the country] has not yet witnessed much success,” says Nadiya Sarguroh, principal associate at Mumbai-based law firm MZM Legal.

As uncertainty hangs over Go First's future, analysts say the airline's woes have already driven up fares, while aircraft leasing costs may rise as a result.

The jolt to the sector comes as India's airline industry has been enjoying record growth in passenger demand following the easing of Covid-19 restrictions.

It therefore came as a shock when Go First this month filed for insolvency and grounded flights, blaming the US engine maker Pratt & Whitney for the debacle.

The company said its financial troubles were “due to the ever-increasing number of failing engines supplied by Pratt & Whitney”. It accused the manufacturer of refusing to supply usable engines under an emergency arbitration award that resulted in cash flow issues.

The airline this month said the “grounding of close to 50 per cent of its A320neo fleet due to the serial failure of Pratt & Whitney's engines, while it continued to incur 100 per cent of its operational costs, has set Go First back by 108 billion rupees ($1.3 billion) in lost revenue and additional expenses”.

Pratt & Whitney has rejected the claims.

In a filing on Thursday, International Aero Engines (IAE), in which Pratt is a shareholder, said the “risks for IAE, which were high to begin with, have increased significantly since Go First’s bankruptcy”.

It accused the carrier of not paying maintenance charges, describing it as an “insolvent airline that materially breached its contractual obligations”.

Go First is majority owned by Wadia Group, which is also known in India for its cookie brand Britannia and its textile company Bombay Dyeing.

The National Company Law Tribunal (NCLT) admitted Go First's bankruptcy plea on Thursday, granting protection to its assets.

But this means that lessors will be unable to repossess planes and this could have implications for the cost of leasing aircraft for India carriers due to the increasing risks associated with the market, analysts say.

“Unlike the normal practice of the financial creditors using the insolvency and bankruptcy code route in case of default by the borrower, in this case the company itself has gone in for the voluntary filing to seek protection available under law to escape sudden total closure”, says Jyoti Prakash Gadia, managing director at investment bank Resurgent India.

Because the case has been admitted by the tribunal, this means “the companies who have leased out the planes will not be able to take them back immediately”, he adds.

The UK-based global aviation leasing watchdog Aviation Working Group has already put India on a negative watch list, Reuters has reported.

The watchdog said this will “have a direct and material impact on future financing and leases to Indian airlines”.

Before the tribunal ordered the freeze on Go First's assets, some lessors had already ended their leases and asked India's aviation regulator to repossess more than 40 planes.

“From an airplanes point of view, we do see impact coming in and it's primarily from the leasing point of view, where we are seeing the cost of capital going up because lessors are going to increasingly look at this as a risk on the lending they do, and somewhere in the models they will have to start building it into their scenarios,” says Shravan Shetty, managing partner at Primus Partners India.

The other impact is on airfares, which have increased by about 25 per cent on some routes as Go First's flights have been cancelled, he says.

The latest issues in the aviation sector could also derail its recovery after it was battered by the fallout of the pandemic.

Amid a surge in demand for travel following the pandemic, India's aviation industry handled about 200 million passengers in the financial year ended March 2023, with that figure set to rise to more than 1.3 billion passengers in the next 20 years, according to the Centre for Asia Pacific Aviation.

Factors including increasing middle class incomes in a country of more than 1.4 billion people and the growth of budget airlines have been driving demand.

India's domestic air travel hit a record daily high of 456,082 passengers travelling on April 30, according to a post on Twitter by India's Civil Aviation Minister Jyotiraditya Scindia.

However, even before the pandemic hamstrung the sector severely, Indian aviation has had a chequered history. Several airlines have struggled to stay afloat and a few went under in what has become an increasingly cut-throat market. Carriers have been competing for passengers for years at prices that severely crimp margins.

In 2019, Jet Airways suddenly collapsed and it has faced a prolonged insolvency process. That followed Kingfisher Airlines' demise in 2012.

"The margins that can be looked at are very low” in India, while costs for airlines in the country are disproportionately high, Mr Shetty says.

“It's a very competitive market since India is a net importer when it comes to fuel, which [accounts for] a large portion of airline costs,” he says.

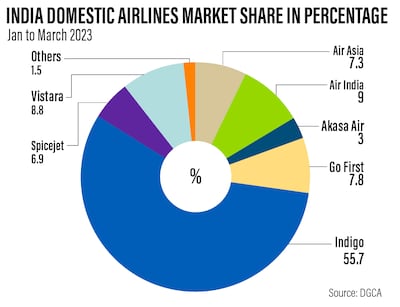

With newer airlines coming into the market such as Akasa Air, it can become more difficult for older companies to keep up.

“There are a lot of new players who come in and how this impacts is the fact that over the years the quality of aircraft has improved,” says Mr Shetty. "And as new players come in with new operating models, they are able to run at a far lower cost than legacy airlines would have been able to.

“Go First is one of those airlines which have been there for a long time, have been trying to innovate but have not been able to reach the kind of scale where they could justify being part of this competitive market.

Go First “would eventually either go away and merge with one of the entities which are there, or one of the new airlines which are coming up might just acquire them considering that they do have certain slots which are very lucrative”, he adds.

Along with engine problems, Go First in its bankruptcy filing said the had pandemic affected its finances.

Mr Gadia says “despite the fresh opportunities for a bounce back in airlines' business, Go First had to go in for a voluntary insolvency resolution process”.

On Friday, Go First extended the cancellation of flights until May 23, citing “operational reasons”.

It said as “it has filed an application for immediate resolution and revival of operations ... we will be able to resume booking shortly”.

MZM Legal's Ms Sarguroh says “the bid for resolving the liabilities of the airline and the actual implementation shall take several twists and turns and the direction of this insolvency shall be uncovered in the near future”.

Some, however, say the airline still has a chance to take off again.

“The fact that the existing planes on lease will continue to be available to Go First as per the orders of NCLT implies that the operations can resume shortly — provided the company is able to arrange short-term funds and requisite approvals from aviation authorities,” says Mr Gadia.