Gold prices surged past $5,000 an ounce on Monday to a record high, reinforcing bullion's status as a safe haven amid a weaker US dollar and simmering geopolitical tension.

Gold, which is widely viewed as a hedge against inflation, rose 1.67 per cent to $5,072.62 an ounce, data from GoldPrice.org showed.

This has extended a rally that drove up prices about 18 per cent this year as investors seek a safe haven in precious metals.

Gold has just recorded its best week since the financial crisis in 2008.

The surge in gold comes after a turbulent week in which tension over Greenland and Iran unsettled investors, while markets remained alert after major spikes in the Japanese yen.

Factors driving gold to its record peak on Monday are the same underlying reasons that have propelled bullion upwards over the past two years, said Michael Brown, senior research strategist at Pepperstone.

“These are the continued reserve demand from emerging markets' central banks, robust retail demand, plus inflows stemming from concerns over the fragile geopolitical environment and a pickup in momentum behind the ‘sell America’ trade accelerating outflows from the dollar,” Mr Brown said.

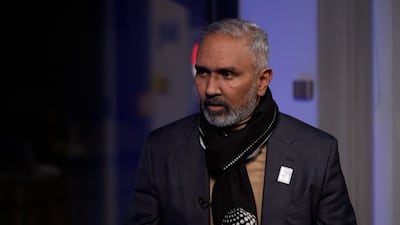

The intense safe-haven demand has been caused by the administration of US President Donald Trump’s erratic trade policies, notably tariff threats against Canada this weekend, as well as “unconventional” foreign policy moves in Greenland and Venezuela, said Samer Hasn, senior market analyst at XS.com.

Gold's historic rise is being driven by a “perfect storm of geopolitical volatility and fiscal anxiety”, he said.

A crisis of confidence in US assets is further exacerbated by persistent concerns over the US Federal Reserve's independence, while on the macroeconomic front, the gold rally is sustained by aggressive central bank accumulation led by China’s 14-month buying spree, Mr Hasn added.

Gold zooming past $5,000 an ounce reflects the “repricing of sovereign risk, not just geopolitical anxiety”, Jeffrey Sexton, chief executive and chief investment officer of Demeter Tactical Investments, told The National.

Central banks around the world are buying 60 tonnes of gold a month, up from 17 tonnes before 2022, while Brics nations are piloting a gold-backed mechanism to settle international transactions, he said.

“With the increase in central banks buying and the Brics pilot, we are witnessing the early stages of monetary system that's becoming less dollar-centric,” Mr Sexton said.

“For Gulf states facing Iranian instability … gold is the ultimate non-aligned reserve asset. That’s why gold is going up and will continue to go up.”

Gold is a “very solid, neutral reserve asset” because “it is not produced or printed by one country, there is no political theory behind it, no military and no economic or fiscal policy”, he added.

Record ETF inflows and a weakening dollar as the Fed shifts towards monetary easing also propelled the precious metal's ascent, analysts said.

Bullion added 64 per cent to its value last year, its biggest annual rise since 1979, driven by a mix of safe-haven demand and bets on US rate cuts.

What's next for gold?

Looking ahead, analysts expect further increases in gold prices.

“Next stop? We are likely to see $6,000 in 2026, though I expect the climb to be a lot more volatile from here,” Mohamed El Erian, finance and economic expert, said in a LinkedIn post.

Several major bank forecast prices at or above $5,000 this year, with UBS predicting $5,400 an ounce should political or financial risks intensify, particularly around the US midterm elections.

Mr Hasn said prices could reach $5,500 this year “given the significant uncertainty and geopolitical factors”.

“Additional factors could emerge if the US-China trade war is renewed or if the war with Iran escalates beyond control,” he said.

A record tends to generate several more, with gold currently a case in point, Mr Pepperstone said. “Round numbers are likely to provide some degree of psychological resistance, if little else, though we are of course now in truly uncharted territory.”

Analysts say several factors could trigger a correction in prices. “The extension of the rally naturally increases the likelihood of a sharp correction,” Mr Hasn said.

“A surprise breakthrough in Russia-Ukraine peace talks, a moderation in Trump’s hostile rhetoric towards Europe and Canada, or easing concerns about US public finances could also slow or even reverse gold’s gains.”

A dip in the price of gold price should be viewed as creating buying opportunities, as the factors underpinning demand are unlikely to change soon, Mr Pepperstone said.