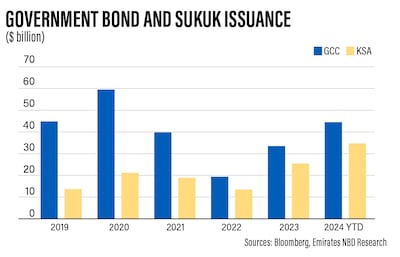

GCC governments have issued about $45 billion in bonds and sukuk so far this year, putting the region’s sovereigns on track for the most debt issuance since 2020. The volume has increased significantly this year, with the first half of 2024 alone reaching well above the $33 billion issued in the whole of last year.

Oil prices have averaged $83 per barrel so far this year, similar to the average for last year, and several countries that have issued bonds and sukuk this year are expected to run budget surpluses in 2024, including the UAE and Qatar.

For these issuers, the capital was raised not to finance regular budget spending but to build a benchmark yield curve against which corporates could more efficiently price their debt, and in the case of Qatar, to fund environmentally friendly projects specifically. The sums raised were relatively small: Abu Dhabi raised a total of $5 billion in three tranches of five, 10 and 30 years, while Qatar issued its first-ever green bond of $2.5 billion across five and 10-year tranches.

The bulk of sovereign debt issuance so far this year has been from Saudi Arabia, which has raised over $35 billion in bonds and sukuk year-to-date, more than three-quarters of total GCC sovereign issuance. About half of this was in dollar-denominated debt. Last year, Saudi Arabia also accounted for 77 per cent of total GCC government bond and sukuk issuance.

Separately, the secondary offering of Aramco shares raised another $11.2 billion in capital for the government last week. Emirates NBD expects the Saudi budget to run a deficit of about 4.2 per cent of gross domestic product this year or approximately $45 billion.

The funds raised through both debt and equity capital markets will be enough to cover this, but it is possible that the kingdom could tap capital markets again in H2. This suggests that the total capital raised this year is likely to exceed what is required just to finance the budget deficit.

Additionally, the Public Investment Fund has also been active in debt capital markets, raising about $8 billion so far this year through bonds and sukuk, including most recently a pound-denominated bond last week.

The capital raised by both the government of Saudi Arabia and PIF will be partly used to fund the ambitious infrastructure investment that is required to deliver the medium- and long-term goals of the kingdom, including economic diversification.

According to data from MEED Projects, over $100 billion worth of projects were awarded in Saudi Arabia last year, up 75 per cent from the value of contracts awarded in 2022. The bulk of these projects are in the construction, power and transport sectors. More than 80 per cent of projects currently in execution are government projects.

In addition to the value of projects that have been awarded and are currently in execution, there is a significant pipeline of planned projects in the kingdom. MEED data point to the value of projects in planning stages – both public and private – being in the region of $735 billion at the time of writing.

However, the bulk of these projects are in a design or study phase, with a significantly smaller share in more advanced stages, meaning that potentially not all these projects will make it to the execution phase. This figure doesn’t include the full budgets of all the giga-projects, as not all the funds have been allocated to specific subprojects yet.

While there is certainly room to scale back some of the planned spending, the government of Saudi Arabia has committed to hosting several major international events over the next decade, including the Asian Winter Games in Neom in 2029, the World Expo in Riyadh in 2030, and the FIFA World Cup in 2034.

These are fixed deadlines by which time the host cities must be able to accommodate and run these events, and for which the necessary infrastructure must be complete. The funding requirements are thus likely to be significant not just in 2024, but over the next few years as well. We expect Saudi Arabia, PIF and related entities to continue to drive GCC government bonds and sukuk issuance over the next three years at least.

Khatija Haque is chief economist and head of research at Emirates NBD