India is bracing for the economic fallout of Russia's military attacks in Ukraine, which pushed already bullish crude prices above $105 a barrel last week.

While oil prices dropped below $100 a barrel on Friday, India stands to be the hardest hit country in Asia by the latest surge, which will hamper economic growth and push inflation higher, says investment bank Nomura.

“India would be adversely affected by rising oil prices, given its status as a net oil importer,” says Sonal Varma, managing director and chief economist for India at Nomura. “Rising crude oil prices are a shock for consumers and businesses.”

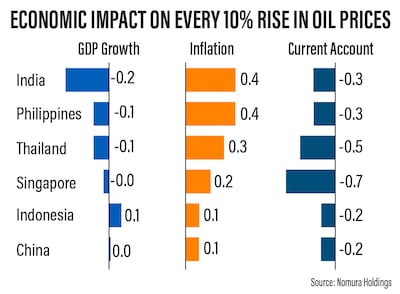

Nomura estimates that each 10 per cent increase in oil prices will shave off 0.20 percentage points from India's gross domestic product growth — the biggest loss of any country in the region.

India imports about 85 per cent of its crude oil requirements and is the world's third-largest consumer of oil. Higher prices would increase the country's import bill at a time when it is facing a steep budget deficit.

Although Russia is not a major supplier of fuel to India, it is the second-biggest exporter of oil in the world and the conflict in Ukraine is stoking fears that there will be global supply shocks, which could further inflate prices.

Indian companies are already grappling with high inflation, while the country's economic recovery has been hampered by the Omicron wave of infections. Steeper crude costs would only add to their expenses.

“At the sector level, the impact of increased global crude oil prices is most marked for the transportation and oil and gas sector,” says Sujan Hajra, chief economist and executive director at Mumbai-based Anand Rathi Shares and Stock Brokers.

But rising fuel costs would weigh in on the economy and reduce "disposable income of consumers and thereby lower consumer demand”, he says.

Demand for petroleum in the coming financial year, which begins in April, is projected to hit a record high of 214.5 million tonnes as pandemic restrictions ease and the economy reopens, according to a forecast by the Indian oil ministry's Petroleum Planning and Analysis Cell.

“India remains the fastest-growing major economy of the world and according to the estimates of the International Monetary Fund, the country is likely to maintain this position even in 2022,” says Mr Hajra.

“While this is a positive development, the resultant high oil import demand also increases India's vulnerability to an oil price shock.”

Businesses are already questioning how they will cope with another economic hurdle after India was plunged into a historic recession in 2020 due to the pandemic and lockdown curbs.

Many sectors have been bouncing back, but it has been very challenging for some industries to recover as the pandemic continues.

“The impact of oil prices on the aviation sector will have long-lasting consequences,” says Kanika Tekriwal, chief executive and founder of JetSetGo Aviation, a private jets company.

“The limited opening up of the markets had already made our business suffer a lot in the past due to Covid. We are just wishing for a cushion for our industry from the government.”

But New Delhi's ability to help sectors with measures such as tax cuts on fuel will be limited given its plans for large expenditure aimed at propelling the country out of the Covid-19 economic crisis and keeping its fiscal deficit within its already-high target of 6.4 per cent of GDP for the current financial year.

The government's excise duties on petrol and diesel reached 3.72 trillion Indian rupees ($49.5 billion) in the financial year to March 2021, official figures show.

In recent years, the government has been able to increase duties on fuel on lower oil prices, helping to boost its coffers. However, any cuts to duties on oil would hit its finances.

Aside from tax cuts, “the government may not have too many options in the face of the rising oil prices”, says Mr Hajra.

“Further diversification of sourcing, bilateral arrangements to augment supply, temporary release of stock from strategic reserves are the kind of options which the government can think of.”

Ambrish Kumar, founder of digital logistics company Zipaworld and group chief executive of AAA 2 Innovate Private, says: “The increasing price of Brent crude oil will impact India big time.”

“This will, in turn, impact the logistics sector with the expected increase in retail prices of petrol and diesel. Transportation costs will surge, which will affect input costs. Container and shipping costs are already skyrocketing.”

There is a limit to the extent that companies can pass on the costs to their customers and, ultimately, the bottom line will take a hit, Mr Kumar says.

“Such a hike will also impact our long-term rate agreements with clients, hence we will have to take hits on margin levels to stand up to the commitments.”

Another major concern for India is the impact that higher oil prices will have on inflation. In January, the country's retail inflation jumped to 6.01 per cent — breaching the Reserve Bank of India's target of between 2 and 6 per cent.

“Oil at $100 is certainly destabilising for the Indian economy given the adverse inflationary impact,” says Hitesh Jain, lead analyst for institutional equities at Yes Securities.

“Every $10 rise in oil is tantamount to a 25 to 30 basis point rise in [retail] inflation. The pinch will also be evident in profit margins of India Inc given the pervasive effect of oil on the manufacturing value chain.”

Should oil prices remain elevated, he says New Delhi will have no option but to cut fuel taxes.

lead analyst for institutional equities at Yes Securities

“We see states and the central government lowering taxes to ensure that fuel prices do not aggravate inflation,” says Mr Jain.

A rise in oil prices can also lead to a depreciation in the rupee, which would also weigh on many businesses that buy goods priced in dollars.

“The government needs to absorb certain levels of the hike through excise cuts,” says Mr Kumar.

For the longer term, the issue highlights the need for India to boost its energy security and move towards alternative sources of power.

“There should be more focus on promoting electric vehicles at a fast pace and other alternates to the highly expensive crude oil,” says Mr Kumar.

India is working on scaling up its use of renewable energy to meet growing demand, lower its import bill and reduce its carbon emissions, having set a net-zero target for 2070.

However, for now, fossil fuels still dominate the country's energy sector, with rising coal and oil demand making these goals more difficult to achieve.

“India's coal imports have indeed increased substantially not only compared to the pandemic-induced lows but also from the averages in the pre-Covid era,” says Mr Hajra.

“Once again, increased economic activity in the country and a marked increase in electricity demand and supply are factors behind this.”

To manage global oil price shocks, India has been increasing its strategic reserves by diversifying its sources of crude oil, which could help to cushion the impact, Mr Hajra says.

There are also a few beneficiaries of elevated crude rates.

“The fuel price rise is positive for upstream oil companies like [state-run oil company] ONGC and even downstream companies can extract some transient benefit to the extent of inventories they hold,” says Piyush Nagda, head of investments products at stockbroker Prabhudas Lilladher.

Nevertheless, the consensus among analysts is that the shocks posed by increasing oil prices for India will far outweigh any benefits.

Even if the government absorbs part of the crude surge through excise cuts, a portion of the increase will have to be passed on to consumers, says Arafat Saiyed, a senior research analyst at Reliance Securities.

“High inflation is a key concern amid strong growth witnessed in the past couple of quarters, which affected margins,” he says.

“If crude oil prices remain elevated, then it may hurt the sentiment further going ahead as well.”