As a Palestinian woman living in the West Bank, Sondos Mleitat says she realised the difficulty of finding reliable and affordable mental health services after a long search for suitable and consistent support.

Once she experienced the life-changing benefits of counselling, she began to see the glaring gap in the market for services that are easy to access, culturally sensitive and budget-friendly. So the architectural engineer quit her corporate job and, together with Majd Manadre and Mohannad Amarneh, co-founded tele-health start-up Hakini.

The Ramallah start-up is seeking to provide mental health services online in Arabic to users in Palestine and the wider Middle East as people deal with the devastating impact of Covid-19, the realities of living under occupation and the social stigma of accessing counseling – particularly for women.

Hakini, which means "tell me" or "talk to me" in Arabic, remotely connects users to therapists based on their needs and offers guidance for self-help intervention.

"We started to realise the pain with finding mental health services in Palestine and the Mena region, the [current] solutions are inefficient in the short-term and expensive in the long-term," Ms Mleitat says. "Many people are not getting the mental health support they need, so we see a huge opportunity for Hakini to provide a solution."

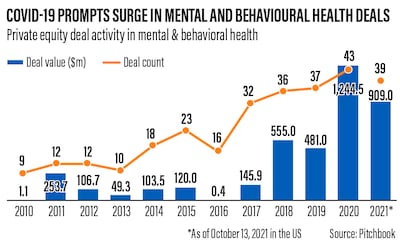

The Covid-19 pandemic has cast a spotlight on mental health tech start-ups globally, with 2020 marking a record year for venture capital investment in the sector, according to data firm PitchBook. Its data showed 146 deals raked in nearly $1.6 billion in venture capital investments as of December 2020. In 2019, the total was $893 million from 111 deals. A decade ago there were only three deals, worth $6.6m.

Investments are pouring in as demand for mental health services increased during the pandemic when disruptions to daily life and work, coupled with lockdown measures, triggered and accentuated mental health issues. Social distancing rules and health concerns pushed that demand online, making tele-health essential for care providers.

Hakini, which began operations in March 2020, recorded increasing demand for online therapy services during the global health crisis.

"It was our time during Covid-19. The number of people suffering from anxiety and depression increased and they started to seek solutions online due to the lockdowns," Ms Mleitat says. "We see more interest from governments and the private sector in mental health."

The pandemic revealed weaknesses in healthcare systems around the world that prompted governments to increase investment in mental health services, a typically under-funded segment, and companies to invest more in employees' well-being.

"After Covid-19 our business was impacted positively: the stigma around mental health has reduced and people are more comfortable using technology," she says.

The difficulty of finding mental health services is further amplified in parts of Palestine, where many people are living in worsening economic conditions and ongoing political crises, according to Hakini.

"In the West Bank where we started, less than 10 per cent of people seeking mental health services were able to find it," Ms Mleitat says, citing data from the Ministry of Health in Palestine and Hakini's own calculations. "There's a huge need and people are not satisfied with the current solution."

Following the recent air strikes on the Gaza Strip in May, Hakini received an influx of inquiries from people seeking counselling. The platform provided 6,000 minutes of therapy for people in the blockaded strip based on a sponsorship model, where people can pay on behalf of those who cannot afford sessions. For Gaza, which has been under an Israeli blockade since 2007, the pandemic made life worse for people whose mobility was already restricted, a UN report shows.

"We need mental health solutions that are adapted to the Arab culture and experience, because not just any western concept is immediately applicable to the Arab region," Ms Mleitat says.

The social stigma around seeking mental health support and the attitudes towards mental illness have meant that women in particular get inadequate access to the required help.

Hakini says about 75 per cent of its clients are women seeking online therapy as they face more acute stigma than men for in-person counselling.

"Some are not allowed by their brother or husband or family," Ms Mleitat says.

Hakini serves clients mainly in Palestine but also has Arabic-speaking users from the UAE, Jordan, Germany, Netherlands and the US. Ranging in age from 18 to 45 years old, and mostly women, the users are can opt for online therapy individual sessions or packages with an average price of $60 per session. Another option is paying $15 for a monthly subscription of guided self-help tools on a range of topics "to help them be their own therapist."

The content and online sessions are in Arabic, to address the gaps in mental health support in the language and to offer culturally-nuanced insights, Ms Mleitat says.

Hakini has so far provided a total of 40,000 minutes of online therapy in the 12 months from November 1, 2020 to October 30, 2021. It also served 1,000 people with self-help tools and published 300 articles in Arabic on its platform that reached one million readers, it says.

The start-up is eyeing expansion into the Middle East and North Africa region, starting with Saudi Arabia and the Arab world's most populous country Egypt, the co-founder says.

Hakini, which previously raised $35,000 of pre-seed funding from investors in Dubai and Paris, is now seeking another $750,000 in seed investment, Ms Mleitat says.

The start-up will use the funds to invest in technology, build a mobile application, hire more talent and start marketing.

co-founder of Hakini

Running a start-up in Palestine is not without its challenges, the co-founder says.

"In my experience as a Palestinian entrepreneur, we don't have strong infrastructure for entrepreneurship, there's no independent ecosystem," she says. "I see change coming from entrepreneurs because they can transform the economy."

More investment is also required into start-ups in Palestine, separate from the donations for international aid, to help entrepreneurs solving local problems, she says.

"There is a lot of funding coming into conflict zones, but we need to enhance the mindset of investment into start-ups," she says. "We are not looking for a donation, we are looking for investment into a business that will expand and grow and build sustainable solutions."

Q&A with Hakini co-founder Sondos Mleitat:

1. Which other successful start-up do you wish you had started?

Clubhouse is one of the startups that inspires me and affected my way of thinking about how we can convert our start-up from an idea to a real business with exponential growth. Specifically, I liked their model that focused on growth of the platform in terms of increasing their user base, by providing a user-friendly platform with a freemium model and an innovative approach of communication between people from all over the world.

The way in which Clubhouse founders thought about their business is impressive, where they focused on building trust with their targeted customers and later potentially be able to monetize their services and generate revenues in the future. I think that this approach is important for startup founders that especially work in B2C model.

2. What is your next big dream to make happen?

My dream is to make therapy and mental health services accessible and affordable for every single person in the Mena region. I hope that therapy becomes a way of life and is not affected by social stigma. There are positive indicators that the region is on the right track to make this happen.

3. What new skills have you learnt in the process of launching your start-up?

Running a start-up is not an easy process and you need to really invest in yourself in a way that contributes to your management, communication, and leadership skills and understand how to collaborate with potential partners that could be an important part for the success of your business. I learned that building trust is a key of success. At first this trust should be created with your team, your mentors, advisors, customers and eventually with potential investors.

I also learnt about business modeling, storytelling, pitching, how to apply design thinking processes and use the lean start-up method to understand our customers’ needs.

4. How has the Covid-19 pandemic affected your business?

It was the time to launch Hakini and start providing support to help people from Palestine and other countries around the world, as the need for mental health services increased worldwide. Many people were looking for help to overcome the depressive and stressful situation. During Covid19 we started to see big interest from individuals, businesses and governmental institutions in mental health and well=being services. These institutions started to understand the importance of investing in this sector and how it can positively contribute to the educational system, economy, and society.

5. What is the importance of mental health services during the pandemic?

The Covid-19 pandemic negatively affected many people’s mental health and created new barriers for people already facing mental health and substance use issues. There was a huge increase in symptoms of anxiety and depression because of the pandemic. For example, in the US about four in 10 adults have reported these symptoms, up about 400 per cent from 2019. This indicates the importance of taking mental health more seriously by governments, schools, universities, businesses and other stakeholders.

6. Where do you see your business in the next five years?

I see Hakini the leading therapy platform in the Mena region. Today, we provide our services to people from Palestine, Jordan, Holland, Germany, UAE, and the US. In five years, we want to see Hakini operate in other countries in Mena, starting with Saudi Arabia and Egypt.

Company Profile:

Company: Hakini, Inc

Founders: Sondos Mleitat, Majd Manadre, Mohannad Amarneh

Founding date: October, 2019 and commenced its operations in March, 2020

Based: Delaware, US and Ramallah, Palestine

Sector: mental health, well-being and telehealth

Size (employees and revenue): 11 employees

Investment stage: Seed funding required

Investors: angel investors, accelerators, grants