Salman Beg, who runs a small factory making crockery and cutlery on the outskirts of Mumbai, is feeling the heat from higher oil prices.

Steep fuel prices are adding to his expenses during a time when he is trying to get his business back on its feet, after it was battered by the impact of Covid-19 lockdowns, he says.

“Oil prices have gone up, transportation and raw materials have become more expensive,” he says. “We've been hit from all sides.”

head of strategy, Reliance Securities

Brent, the international benchmark under which two thirds of the world’s oil trades, has risen more than 60 per cent this year to trade above $85 per barrel, as an economic recovery globally has increased demand and has triggered an energy crunch. This is bad news for India, which depends on imports to meet 85 per cent of its crude oil requirements and is the world’s third largest importer of the fossil fuel.

“Higher oil prices ... have a ripple effect on all sectors of the economy,” says Amit Jain, the chief strategist, global asset class, and co-founder of Mumbai-based Ashika Wealth, a financial services company. “That too in times when the Indian economy is trying to recover from the Covid-19 shock.”

India's economy was plunged into a historic recession last year due to the pandemic and Covid-19 lockdown restrictions. But economic activity has been picking up of late amid a dip in infections and easing of curbs. The World Bank forecasts the country to grow 8.3 per cent in the current financial year until the end of March. This revival is also part of the problem, as it’s increasing the demand for fuel.

As well as eating into businesses' profitability, rising crude prices will weigh on the country's trade deficit.

According to analysis from the Reserve Bank of India, each $10 per barrel rise in crude oil prices results in an additional deficit of $12.5 billion.

An increase in oil prices feeds into transportation and manufacturing costs, which in turn, affects businesses across the board. Ultimately, they may have to pass the costs on to consumers.

All this poses a risk to inflation, which in September eased to 4.35 per cent from 5.30 per cent the previous month, according to official data. Inflationary pressures create a headache for policymakers at a time when the central bank is focused on trying to boost liquidity to get the economy back on track.

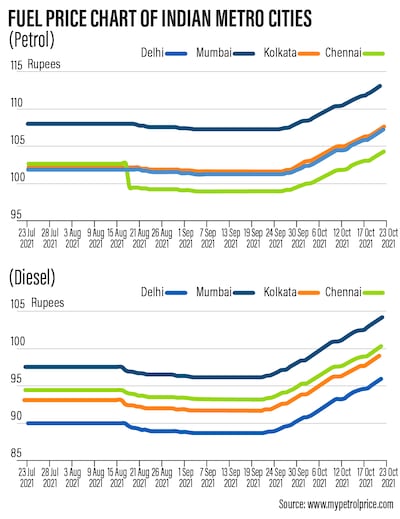

“A sharp increase in crude prices is certainly detrimental to the Indian economy given India’s over-dependence upon imports,” says Binod Modi, the head of strategy at Mumbai’s Reliance Securities. “Given the sharp rise in diesel and gas prices recently, we believe inflationary concerns may come to the fore once again in coming months.”

On Friday, petrol and diesel prices hit record highs, with steep taxes on fuel only adding to the rates.

“Since the prices of fuels have risen so much, people are refraining from buying new cars,” says Aditi Bhosale Walunj, the co-founder and chief visionary officer at Repos Energy, an energy distribution company.

Other sectors and the population will also feel the pinch, since crude oil is used to manufacture a range of products, including plastics.

“From securing raw material to packaging of finished products, high oil prices impact fast-moving consumer goods at every level,” says Ms Walunj.

“When the burden of this high input cost is passed on to consumers in terms of increased prices, the sales decline.”

She points out that there are also implications for the Indian rupee, which weakens as oil prices rise.

India's current woes are only compounded by coal shortages, which the country depends on to generate 70 per cent of its electricity.

India is striving to reduce its dependence on fossil fuels and boost its use of clean energy for two reasons – to become more self-reliant and to bring down carbon emissions.

To achieve this, it has mapped out plans to grow the electric vehicles sector and ramp up its renewable energy capacity to 450 gigawatts by 2030.

It is yet to be seen if renewable sources could help feed India’s appetite for energy, which is only going to increase in the coming years due to a rapidly expanding economy and urbanisation.

As a result of burgeoning economic activity, India's oil demand, which is expected to stand at 4.9 million barrels per day this year is projected to more than double to 11 million bpd by 2045, according to a report by the Organisation of the Petroleum Exporting Countries. It forecasts that diesel and petrol will make up 58 per cent of India's oil demand in the next 25 years, up from 51 per cent currently.

Given India's dependence on oil imports and the current strain on the country, New Delhi is pushing Opec to increase oil output to control prices.

On Friday, Hardeep Singh Puri, India's minister of petroleum and natural gas, warned that the rise in crude prices poses a threat to an economic recovery.

“High energy prices will certainly, if not checked, have a likely effect on the global economic recovery,” he said, speaking at the CeraWeek India Energy Forum, organised by IHS Markit.

“That's true for us and that's true for other parts of the world.”

Mr Puri, however, remains hopeful that the situation will be resolved.

“If you look at the supply and demand curve, today the supply is shorter than demand and that is a recipe for higher prices,” he said.

“I'm hoping that people all over the world will realise that it is a win-win only if the price matrix is responsive both to the requirements of the producing and consuming countries.”

An increase in output by major oil producers is likely to be India's best hope of a near-term solution, analysts say, as some economists are warning of a risk that crude prices could move towards $100 a barrel by the end of this year.

“In the short term, it's only continuous dialogue with oil producing nations to increase output which can help,” says Mr Jain.

In the medium to longer term, there are several steps that India is working on to try to reduce the effects of volatile oil prices and to ensure energy security.

“Some of the key issues, which we know, are growing the domestic supply of hydrocarbons, implementing the national hydrogen mission, which was announced in August, exponentially growing the bio energy supplies, particularly biofuels, and making gas a [bigger] part of India's energy mix,” said Atul Arya, the senior vice president and chief energy strategist at IHS Markit, speaking at the CeraWeek India Energy Forum on Wednesday.

Mr Puri on Friday said that there was scope for India to ramp up its own exploration and production efforts in the hydrocarbons sector, alongside developing renewable energy solutions, to meet the country's energy demands.

He said that India “will do whatever is required” to increase domestic hydrocarbons production. The country has 26 sedimentary basins but only eight are under exploration, he added.

“Somehow there has been an underinvestment in this area and I can say from the Indian point of view, certainly we can do much more in exploration and production.”

While such measures could help in the long term, there have been some calls for a reduction in taxes on fuel to reduce the immediate pressures on individuals and businesses.

“In the event of further increase in prices of crude oil, the government could cut its levies moderately and maintain the rates at the current range itself to ensure that the prices of fuel do not contribute further to inflation, especially food inflation,” says Divakar Vijayasarathy, the founder and managing partner of DVS Advisors, an international professional services company.

And that could bring some relief to struggling small business owners, including Mr Beg.