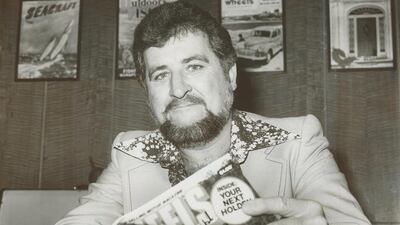

A man called Bill Tuckey passed away earlier this month. Mean anything to you? Perhaps not, but his legacy will forever shape me, and certain others who also write about cars for a living.

Tuckey was an Australian who was, between 1963 and 1968, editor of the car magazine Wheels. Now that Tuckey has shuffled off this mortal coil, it has become obvious, from reading the tributes that have been flowing in from all corners, that he was the one who started a wave of Aussie-led alterations to motoring journalism's trajectory.

When I look back on the chain of events that culminated in me becoming a motoring writer, it all began with three things: my father deciding a Triumph TR6 was an ideal family runabout, him taking me to my first motor show in 1980, and buying an issue of Car in that same year.

Car was, for many years, the pinnacle of motoring publications, standing proudly above all others before the market became saturated. The writing was fearless, often poetic and always thoroughly descriptive, and put me, even as a pre-teen, in the driver's seat. I didn't know what a clutch pedal was for, but I knew that I wanted to drive and explore the world while piloting exciting cars.

The road-trip stories, always in glorious long-form journalism, were nothing short of epic, and fired my imagination like little else. I can still remember, word for word, entire paragraphs that I haven't read again for 35 years – that's the power that Car wielded at its zenith.

This British publication – feared by manufacturers and loved by its readership – was the product of Australians who relocated to Britain after working on Wheels under the stewardship of Tuckey.

In the past few days, I have been reading his material, and have to admit that some of it is quite indigestible. His use of terminology often turned long features into material that students of J R R Tolkien would revel in, but is too much for my less-flowery palate. But here’s the thing: he actively encouraged his writers to embrace creative freedom, to go further than anyone else in describing the most mundane things, always with complete honesty.

This was what Car was famous for long before the modern-day likes of Jeremy Clarkson ditched their short trousers and picked up a typewriter. Car was the great leveller, and Tuckey, it turned out, formed the template.

Car has had at its helm no fewer than seven Australian editors, including Angus MacKenzie, who I met for the first time a few weeks ago. MacKenzie took the Tuckey effect with him to the United States when he became the editor of Motor Trend.

“Bill succinctly communicated a car’s strengths and weaknesses,” he said in tribute to Tuckey, “often to the discomfort of car companies when they failed to live up to his high standards. But he was also a consummate storyteller. He delighted in capturing those ephemeral moments that distilled the essence of our love affair with the car. He put his readers behind the wheel, in the moment, and revealed the soul in the machine.”

The journalism within the pages of Car is what inspired me to do what I do, and for that, I owe Tuckey a debt of gratitude.

When it comes to writing honestly about cars, Tuckey set the bar. I’m glad he did – his influence has helped make cars better, improving the lives of pretty much every driver out there. Rest in peace, Bill.

motoring@thenational.ae

Follow us @LifeNationalUAE

Follow us on Facebook for discussions, entertainment, reviews, wellness and news.