Such is the clout the megastar Shah Rukh Khan wields that his every gesture reverberates throughout India, and the latest is no different. Khan recently said that all his films would henceforth show the name of his female lead before his own in the credits.

It’s an attempt to strike a blow for gender equality in Bollywood – where even the most popular female star does not command anywhere near the same salary as her male counterpart.

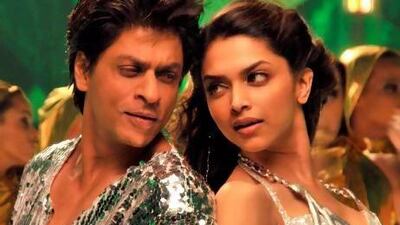

"King Khan", who reportedly demands US$9 million (Dh33m) per movie, told journalists that women in Bollywood deserve more -recognition. "They work harder, they look better, they keep the film industry together. I honestly think that they do not get the credit they deserve," he said. Khan plans to introduce the practice in his forthcoming film Chennai Express, in which he stars opposite Deepika Padukone.

Reactions have been varied, with some saying he should lobby for equal pay instead of “token gestures”. But for many in the industry, Khan’s announcement is worthy of appreciation.

The filmmaker Raja Menon says it would take time to change deep-seated attitudes but Khan had done the right thing by making a start. “At least it shows that someone is thinking about this inequality,” says Rao. “His decision has set the ball rolling.”

“It’s not only Bollywood that is guilty of such inequalities,” points out the television host Anupama Chopra. “You find this disparity in other spheres all over the country. I truly welcome Shah Rukh Khan’s move because it’s a beginning – the big change can come later.”

Women in Hindi cinema get smaller pay cheques and have a lesser influence, too. Their roles are rarely meaningful, they are limited to providing glamour to the films they are cast in and are regularly made to star opposite actors old enough to be their father.

But there have been recent exceptions, such as Vidya Balan in the bold and much appreciated film The Dirty Picture (2011); Sridevi with her sensitive portrayal of a middle-aged mum struggling with her limited knowledge of English in English Vinglish (2012); and Kareena Kapoor in Heroine (2012), a story about a top actress whose star is on the wane.

Kapoor is now the highest--earning female star in Bollywood but she still makes far less than the boys. According to estimates by industry experts, Kapoor earned around $1.5 million for Heroine, about a tenth of the $11 million cheque Salman Khan got for the film Ek Tha Tiger.

Other top stars such as Aamir Khan and Akshay Kumar charge $10 million and $8.3 million per movie, respectively. Even the ageing warhorse Amitabh Bachchan takes home more money than the average 20-something, A-list -actress.

At a conference in New Delhi last year titled "How does a heroine become the hero?", Kapoor boldly spoke her mind on gender inequality. Kapoor said: "It's always between three or four Khans and a few other male actors. Female actors are there just to dance with them. We have to stand behind Shah Rukh and Salman and say: 'Hey! I'm here, too, give me something to do.' And the pay cheques, what Salman gets and what I get, well, let's not even go there."

Kapoor also referred to Balan as the woman who would smash the salary ceiling. “I don’t get as much as they get [the Khans]. I am not on the same platform as them. But I am going to fight for it. Hopefully, we will get there one day. I am glad that there has been a stellar performance by Vidya Balan [for The Dirty Picture]. She proved to be the ‘hero’ of 2011.”

“Balan’s success has marked a paradigm shift,” agrees the trade analyst Taran Adarsh. “Writers are no longer scared to come up with screenplays for strong female characters. Once you’ve proved yourself at the box office, nothing else counts.”

artslife@thenational.ae

Follow us

Follow us on Facebook for discussions, entertainment, reviews, wellness and news.