The Diet Myth by Tim Spector

‘Unpasteurised cheese is one of the richest sources of healthy microbes. A third of people have genes which prevent them from getting fat.’ Just some of the myth-busting facts from a book that shows why people should abandon faddy diets to get healthy. (Weidenfeld, May 14)

Adventures in Human Being by Gavin Francis

A journey around the human body, from the ribbed surface of the brain to the pulse of life at the wrist. Francis is a doctor and he blends his own experiences with the history of how the body has been portrayed over the millennia. (Profile, May 7)

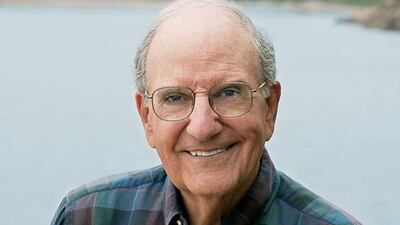

The Negotiator: A Memoir by George J Mitchell

Mitchell won acclaim for his role chairing the successful peace negotiations in Northern Ireland. In this compelling and honest memoir, he talks about those fraught days along with his role as Senate majority leader. (Simon and Schuster, May 21)

Tightrope by Simon Mawer

Marian Sutro has survived the horrors of Ravensbrook, Hitler’s concentration camp for women, and is now struggling to adjust to life in 1950s England. When a Russian diplomat emerges from the shadows to draw her into the uncertainties of the world of Cold War, a double life beckons. (Little Brown, June 4)

A General Theory of Oblivion by José Eduardo Agualusa

On the eve of Angolan independence, Ludo bricks herself into her apartment. She will remain there for 30 years, her only contact with the world her radio and neighbours’ voices. But life changes when she meets Sabalu, who climbs up to her terrace. She won the Independent Foreign Fiction Prize in 2007. (Harvill Secker, June 25)

The Book of Numbers by Joshua Cohen

An enigmatic tech billionaire hires a failed novelist, Josh Cohen, to ghostwrite his memoirs. The mogul, known as The Principal, takes Josh on a journey from Palo Alto to Dubai as the life or death stakes behind the book are revealed. A novel about what it means to be human in the internet age. (Harvill Secker, June 4)