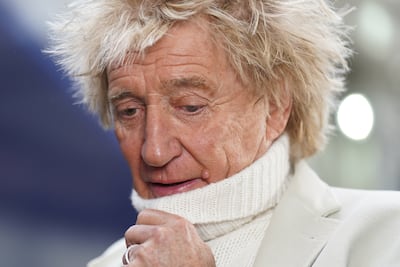

Rod Stewart will return to Abu Dhabi for his first UAE concert in eight years. The British singer, 80, will perform at the Etihad Arena on December 17.

The Rock and Roll Hall of Fame member will perform hits from his six-decade career, including Maggie May, Forever Young, and Have I Told You Lately That I Love You.

Stewart announced his retirement from major global tours in November, although he does not plan step away entirely.

“This will be the end of large-scale world tours for me, but I have no desire to retire. I love what I do, and I do what I love,” he said on X.

The singer will also perform in the legends slot at England’s Glastonbury Festival in June. His 33rd album, Swing Fever, hit number one on the UK charts in 2024.

Organised by Live Nation Middle East, the Department of Culture and Tourism Abu Dhabi and Miral, the concert will be Stewart’s second in Abu Dhabi after his performance in 2017.

The National’s Saeed Saeed wrote in his review at the time: “With Rockin’ Rod, it always comes down to that voice. That winning combination of full-throttled roar and raspy whisper served him well. It allowed his five-decade career to encompass various styles ranging from pop, rock and folk to his relatively recent foray into the great American songbook.”

Presale tickets will be available through Stewart’s website on Thursday, April 17 at 8am, with another presale starting at noon through Live Nation Middle East, before a general sale on Friday.