Fame can often be a double-edged sword, as Faith No More discovered during the course of a career that helped to shape the 1990s alternative-rock movement. The San Francisco quintet produced some of the most uncategorisable yet commercially successful sounds to emerge from that loose scene, but they were also credited with inspiring a stack of the worst bands of perhaps all time, in the shape of the lowlights of the late-1990s nu-metal scene.

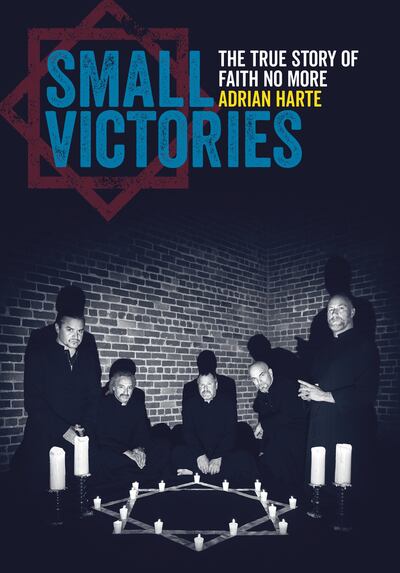

That Small Victories: The True Story of Faith No More tackles the link to that blight on the musical landscape as early as its introduction seems apt for a biography of a band who have spent the past 35 years stirring up trouble, rowing in public and thumbing their noses at rock-music conventions.

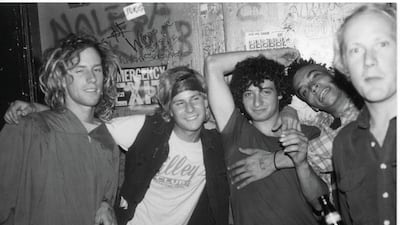

It is 35 years this month since their first gig, but the FNM of 1983 that grew up as misfits in San Fran's squats and punk-rock dive bars are almost unrecognisable from today's besuited incarnation. This year is also the three-decade anniversary of the most important change in the band's extensive line-ups: the introduction of singer Mike Patton, who would become their handsome figurehead, veering from death-metal screaming to rap and bossa nova vocals en route. He would go on to accrue an almost cult-like following for his myriad musical adventures post-FNM.

The book also arrives less than a year after the death of the man who Patton replaced, Chuck Mosley, an erratic yet talented mixed-race singer who was the very epitome of FNM’s early genre-crossing breakthroughs. His addictions cost him his place in the band and, ultimately, his life.

Small Victories certainly has all the ingredients of any good rockography, then: drugs, death, despair, fame, (not so much) fortune, hotel-room trashings and a whole heap of amusing anecdotes that even bassist and FNM founder member Bill Gould suggested has provided him with "more than a few revelations… and I'm in the band".

Tackling the history in chronological order, the story is told by Adrian Harte, a man behind a long-running unofficial FNM website who in his day job works for European football governing body Uefa. He uses a mix of original interviews with the majority of the band and related artists (sadly, minus Patton), stitched-together quotes through the years from local papers to Rolling Stone – and slightly incongruously, a handful of academic insights.

There is enough detail and previously unheard angles to pique the interest of hard-core fans, almost always maintaining an eye on explaining FNM in a wider context for those less familiar with the band.

Along the way, colour is painted into the spell where Kurt Cobain’s future wife Courtney Love assumed the role of frontwoman in the mid-1980s, as the band solidified from various previous outfits that had featured future members of, among others, Bay Area thrash-metal titans Metallica.

A revolving door operated for their various vocalists during those early days, yet they ended up in double figures with guitarists, getting through six-stringers on a rate comparable with Spinal Tap’s infamous drummers, including sacking their most recognisable axeman, Jim Martin, via fax.

The intra-band frictions and fights are recounted with unflinching detail, as is FNM’s reformation, more than a decade after they grumblingly originally called it quits in 1998. As Patton explained of their initial averseness to reunions: “There’s a lineage of bands that maybe did some nice things, and then needed the cash and got back together, and basically just sprayed diarrhoea over their entire body of work.”

Thankfully, after 11 million album sales and more than 900 concerts, FNM v2.0 did little to soil their body of work, which hit a unit-shifting high with 1989's The Real Thing, an album that spawned hit single Epic and part-catalysed a new era of rock that washed away the late-1980s hair-metal scene. They even managed to navigate the legacy-tainting minefield that is the comeback record, with 2015's Sol Invictus receiving far more critical acclaim than previous parting shot, 1997's mock-cocky Album of the Year.

But while those latter-day episodes are recounted as much in the name of completeness, readers will revel most in moments where FNM cross swords with rock royalty. Such as when the band are summoned before Guns N' Roses' erratic frontman Axl Rose during a tour that openers FNM chiefly spent bad-mouthing the headliners to anybody who would listen.

“I only like you guys, Nirvana, Jane’s Addiction, and two other bands, and all of you hate me. Why do you hate me?” Rose reportedly griped. Not for the first time in the book, FNM have no qualms about painting themselves in a less-than-rock ’n’ roll way, recalling their subsequent sheepish apologies.

Rose also features in one of the silliest – and possibly fictional – passages, centring on a 1990 interview in which the band joked how their newfound fame had yet to translate into filthy lucre.

"Hey, Axl Rose likes your record," Patton says. "Yeah," drummer Mike "Puffy" Bordin retorts. "It's like: can Axl loan me 20 bucks?" A few months later, Gould told another interviewer: "Axl Rose sent us a letter with a note and a 20 saying: 'Sorry you feel this way. Here's 20 bucks.'"

Small Victories, in keeping with its modest title and such small change, is not a bombastic or boorish rock tome in the style of, say, Led Zeppelin's Stairway to Heaven. It simply gets on with the task of fleshing out a band who did things rather differently, eye-jabbing the establishment while skipping across styles with abandon. And in that context, its success is rather sizeable.

___________________________

Read more:

Two Emirati authors search for success at the Frankfurt Book Fair

Two new books investigate the rhythm in Emirati Arabic

472 guests and 1,800 events – Sharjah International Book Fair announces 2018 line-up

Twelve leading Brazilian Arab authors to have their works translated and published in Arabic

___________________________