A former fish feed mill and ice storage facility that lies in the town of Kalba, on the Gulf of Oman, has been transformed into an art space in time for the Sharjah Biennial 15.

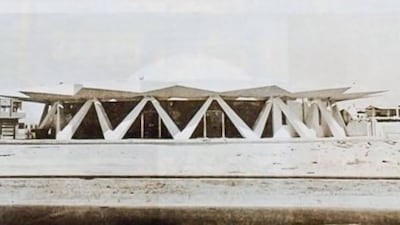

The Kalba Ice Factory has been renovated by the Sharjah Art Foundation and designed by Peru studio 51-1 arquitectos, and turned into an art space with social amenities, retaining its distinctive saw-tooth-shaped roof.

The 20,000-square-metre building was bought by Sharjah Art Foundation in 2015 and has since served as a site for the organisation's activities, including a performance by South African film director Mohau Modisakeng during Sharjah Biennial 14 in 2019 and for Argentinian sculptor Adrian Villar Rojas's Planetarium during Sharjah Biennial 12 (2015).

The transformed building will now reopen to the public on Wednesday as one of several venues playing host to Sharjah Biennial 15, featuring work by artists such as Rebecca Belmore, Ibrahim Mahama and Abdul Raheem Salem. In particular, the vast industrial space has been deemed suitable for performance art and large-scale installations.

This industrial look is offset by its natural surroundings, as it sits adjacent to the Kalba creek and Al Qurm mangrove reserve. Species such as the endangered Arabian collared kingfisher are known to reside here, as well as Blandford's lizard and hawksbill and green turtles, which nest on the nearby beach.

A new adjoining structure that models the look of the ice factory will also house six apartments and other social spaces, while another existing building is being repurposed into a 200-square-metre workshop space for artists.

Behind the factory, a restaurant with views of the shoreline will also open, alongside a garden that will feature areas for dining, cooking, playing and prayer.

“Kalba is a critically important part of Sharjah’s cultural and ecological makeup, and we are enlivening this abandoned site by turning it into a multifaceted gathering space for residents of this region as well as visitors from across the emirate and around the world,” said Sheikha Hoor Al Qasimi, director of Sharjah Art Foundation.

“By preserving the industrial rawness of the factory space and protecting the unique ecosystem of the surrounding landscape, this project extends the foundation’s critical work preserving sites of historic, cultural and environmental significance for future generations through adaptive reuse, and engaging communities across the emirate with contemporary arts programming.”

This is just one of a number of conservation projects that Sharjah Art Foundation is undertaking to preserve the emirate's heritage and built environment, as well as to create spaces to meet the needs of established and up-and-coming artists.

Another such high-profile project has included The Flying Saucer, a Brutalist landmark transformed into an exhibition space and community venue that had its original architectural character restored, and which was shortlisted for the 2022 Aga Khan Award for Architecture. It also won Best Cultural Project at the 2021 Architectural Digest Design Award.