WASHINGTON // US budget talks remained deadlocked yesterday, even as Republican and Democrat leaders began presenting their own plans to secure at least a temporary debt ceiling increase before the US begins to default on its obligations next week.

John Boehner, the Republican speaker of the House of Representatives, yesterday said he thought his plan could pass both houses of Congress.

"We are going to have some work to do to get it passed, but I think we can," Mr Boehner told reporters after a meeting of House Republicans yesterday.

Legislators will vote on Mr Boehner's plan today.

Even if it passed, however, Gene Sperling, the director of the White House National Economic Council, indicated that Barack Obama, the US president, would veto the Republican plan with its short-term six-month increase.

"The president has been pretty clear that he does not find that acceptable," Mr Sperling said in an interview on MSNBC on Monday.

Mr Boehner is pushing a two-step plan, a short-term bill to cut spending by about US$1.2bn (Dh4.4bn) and extend the debt ceiling for about six months, conditioning further increases on further spending cuts.

In the Senate yesterday, Democratic Senate Majority Leader Harry Reid challenged Republicans to back his competing plan, a spending-cuts proposal to trim $2.7 trillion over a decade in return for a similar increase in the debt ceiling.

Neither plan includes any tax increases and fall far short of the grand plan envisioned by Mr Obama to see the country through the next decade. But they may be the only options as the deadline for raising the ceiling creeps ever closer.

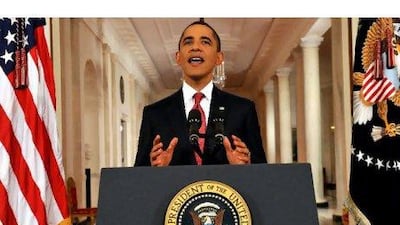

The president, in a televised address late on Monday aimed at rallying public support for a package proposed by Senate Democrats, said failure to increase the $14.3 trillion US borrowing limit would severely hurt the nation.

"For the first time in history, our country's Triple-A credit rating would be downgraded, leaving investors around the world to wonder whether the United States is still a good bet," he said in remarks at the White House.

The US government runs a budget deficit that topped $1.5 trillion this year, and has amassed a national debt of $14.3 trillion.

If the debt impasse is not broken by early next week, Mr Obama will be forced to make decisions about how he will manage the crisis.

Timothy Geithner, the US treasury secretary, and a small team of his aides have been working on contingency plans should Congress fail to raise the US borrowing limit by an August 2 deadline.

The administration has said little in public about its plans and there is disagreement among private-sector experts on the feasibility of some of the options. A number of them are complicated and could provoke a political backlash.

Even if the administration were to implement some of the options, the debt deadlock could still trigger turmoil in financial markets, sending the dollar lower and US interest rates higher and putting the economy at risk.

There are several measures Mr Obama could consider. Treasury could sell off some of the government's assets, including holdings of gold and mortgage-backed securities. US officials say this option has major drawbacks because it would show the world the United States is having difficulty honouring its obligations. These officials say the government might also have to accept fire-sale prices for the assets and that the sales likely would not buy much time.

Some legal scholars see a possible trump card for Mr Obama in a provision of the Constitution that says US public debt "shall not be questioned".

Those scholars contend the 14th Amendment clause would give Mr Obama the right to bypass Congress and raise the debt limit on his own.

Other legal experts believe the president does not have the authority to ignore the cap on borrowing set by Congress. Administration officials have said they do not see the 14th Amendment clause as a solution to the impasse.

If the Treasury decides that neither an asset sale nor the use of the 14th Amendment is workable, it could look at delaying some payments to recipients of government benefits, government employees, outside contractors or other parties to ensure it has enough cash on hand to keep paying interest on its debts.

The Treasury will collect US$172 billion in revenue in August. Without new borrowing, that would cover only 45 per cent of the $306bn in payments the government is scheduled to make next month, according to the Bipartisan Policy Center think tank.

Some conservative Republicans have suggested the Treasury could manage a default by shutting down many government services and putting a priority on debt payments. Mr Geithner has dismissed this as unworkable.

If talks with congressional leaders on the debt ceiling fail, one big decision Mr Obama would face would be what to do about a $49bn Social Security payment scheduled to go out on August 3.

In a sign that financial authorities were coordinating closely on the unfolding debt drama, Mr Geithner met on Friday with the Federal Reserve chairman, Ben Bernanke, and the New York Federal Reserve Bank president, William Dudley.

Charles Plosser, the Philadelphia Federal Reserve Bank president, said the US central bank, which acts as the Treasury's broker in financial markets, could not step in and borrow money on the Treasury's behalf. He said that would amount to conducting fiscal policy, which is not part of the Federal Reserve's mandate.

But the Federal Reserve might need to become involved in some operational issues since it clears cheques for the government for everyone from Social Security recipients to federal workers.

Mr Plosser said the issues that would need to be looked at include how the Fed is going to go about clearing government cheques, which ones are going to be good, and which ones are not going to be good.

Because the New York Federal Reserve is regularly in close contact with financial market participants, the central bank would also play a crucial role in monitoring the market reaction if a default or US credit downgrade were to spark a panic among investors.

* Additional reporting by Reuters